- USD/CAD rejected heavily by the bears at 200-DMA.

- CAD supported on the price of oil.

This was the week:

The Federal Reserve was a let down for the US Dollar bears in the week and the Canadian Dollar picked up a welcomed bid due to a huge spike in the price of global oil prices. While the Federal Reserve was the expected focal point for the pair, weekend attacks on Saudi oil facilities took the spotlight from the get-go and sent the price of oil in the furthest spike since the Global Financial Crisis. WTI rallied over 15% on the open and funds gapped lower. However, the Dollar picked up a safe-haven bid and the Fed' delivered a hawkish cut which leant support to Dollar crosses, including funds.

Key CAD events:

As for Canadian events, the week ahead is a blank spot, but the prior week delivered Retail Sales and Consumer Price Index. Canadian Retail Sales have been soft this year to date, although headline sales this time around edged up 0.4% which is the first rise in three months. Excluding price impacts, volume sales were unchanged, both from a month earlier and from year-ago levels. As for headline CPI, this ticked lower to 1.9% year-over-year and Core inflation remained steady at 2%. However, with oil set to rise, the inputs from gasoline prices are likely to be a factor for the Bank of Canada to consider.

Key U.S. events:

The Federal Reserve delivered a hawkish 25 basis point rate cut, with the market discounting the probability of another rate cut as soon as next month or even this year. Fed's Chair Powell's non-committal guidance at the press conference enabled the US Dollar to climb higher in a risk-off environment on the week. Looking ahead, we will have a slew of Fed Officials which will be of particular interest for next week.

"NY Fed President Williams is likely to appear open to further accommodation, while voters Evans and Bullard will make the case for the doves at the FOMC. We also look for remarks by voters George (hawkish dissent) and Quarles," analysts at TD Securities noted. Also, we will have Producer Price Index and CPI data that should suggest a notable pick-up in August core inflation to 1.8% from 1.6% before, as temporarily-weak components continued to rebound during the month, according to analysts at TDS:

"Headline CPI likely rose a tenth to 1.5% y/y. Separately, personal spending data should support the view that the US consumer remains resilient. We expect a firm increase in services spending to lead the upside."12.5K

USD/CAD Technical Analysis

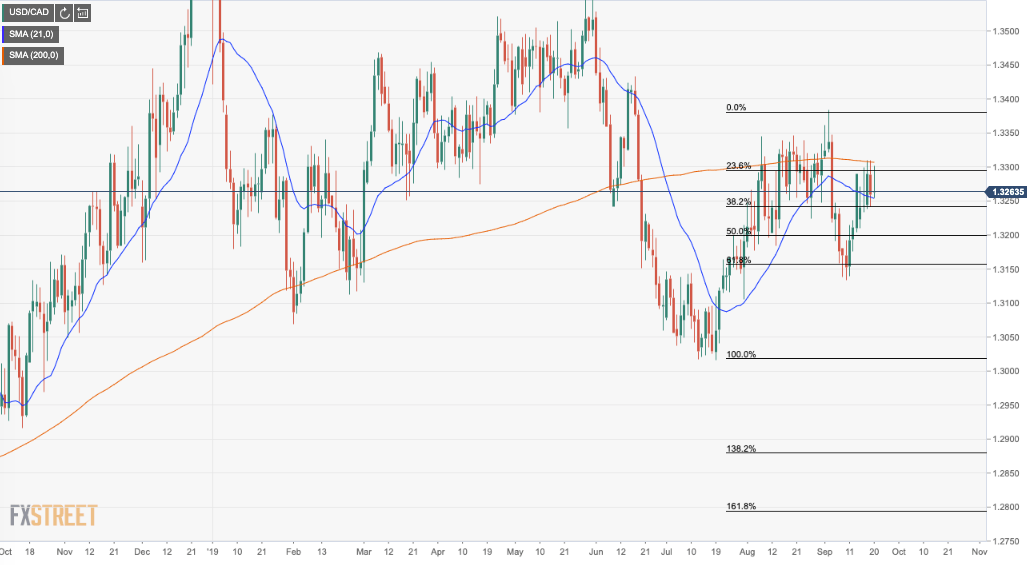

USD/CAD has tested on multiple occasions throughout the week the 200-day moving average and a confluence of the 50% Fibonacci mean reversion of the July rally to September highs, accumulated around 1.33 the figure which guards the 1.34 handle and mid-June highs. On a break below the 21-DMA, bears will look to the July lows just ahead of 1.30 the figure which guard a run to the 1.28 handle and a 161.80% Fibo extension.

USD/CAD daily chart

USD/CAD Forecast Poll

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.