|

S3 |

S2 |

S1 |

R1 |

R2 |

R3 |

|

1.3200 |

1.3290 |

1.3383 |

1.3445 |

1.3552 |

1.3662 |

USD/CAD is flat in the Monday session. In the North American session, the pair is trading at 1.3437, down 0.01% on the day. It’s a quiet start to the week, as U.S. markets are closed for Memorial Day. There are no Canadian or U.S. events on the schedule. On Tuesday, the U.S. releases CB Consumer Confidence. Investors are looking ahead to later in the week, as the Bank of Canada releases its monthly rate statement on Wednesday and the U.S. releases first-quarter GDP on Thursday.

Canadian releases have been lukewarm, but consumer spending was unexpectedly strong in March. Retail sales climbed 1.1%, up from 0.8% in February. The core release was even sharper, jumping from 0.6% to 1.7%. Both indicators easily beat their estimates. Consumer spending is a key driver of economic growth, and if upcoming numbers also point upward, the Canadian dollar could gain some ground on its U.S. counterpart. The Canadian currency remains under pressure, and flirted with the 1.35 line on Thursday.

U.S. indicators ended the week on a disappointing note, as April durable goods orders were softer than expected. Durable goods orders slumped 2.1%, just below the estimate of -2.0%. This marked the sharpest decline since January 2018. The core reading slowed to 0.0%, down from 0.4% a month earlier. The U.S. economy has been performing well, and the economy will receive a report card on Thursday, with the release of Preliminary GDP for the first quarter, which is expected to post a strong gain of 3.1%. The initial GDP reading showed a gain of 3.2%, crushing the estimate of 2.2%. Will the revised release also beat expectations? If so, traders can expect the U.S. dollar to post broad gains.

Markets in holiday mood

MEU elections not so bad for EUR or GBP

USD/CAD Fundamentals

Monday (May 27)

-

There are no events on the schedule

Tuesday (May 28)

-

10:00 US CB Consumer Confidence. Estimate 130.1

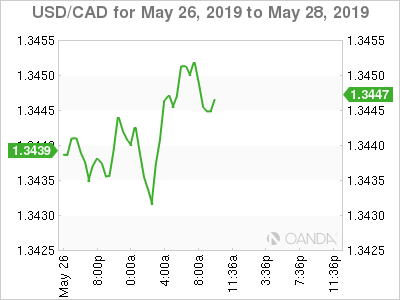

Open: 1.3439 High: 1.3453 Low: 1.3430 Close: 1.3437

USD/CAD Technical

USD/CAD posted small gains in the Asian and European sessions. The pair is steady early in North American trade

-

1.3383 is providing support

-

1.3445 is fluid. Currently, it is under pressure in resistance

-

Current range: 1.3383 to 1.3445

Further levels in both directions:

-

Below: 1.3383, 1.3290, 1.3200 and 1.3125

-

Above: 1.3445, 1.3552 and 1.3662

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.