|

S3 |

S2 |

S1 |

R1 |

R2 |

R3 |

|

1.2969 |

1.3049 |

1.3125 |

1.3200 |

1.3290 |

1.3383 |

The Canadian dollar continues to improve this week. Currently, the pair is trading at 1.3169, down 0.06% on the day. Canada will release ADP nonfarm payrolls and wholesale sales. In the U.S., the markets are expecting positive news. Durable goods orders is projected to post a strong gain of 1.6%, while unemployment claims is forecast to fall to 228 thousand.

The Federal Reserve has presented a dovish stance in 2019, and this position was underscored in the minutes from the January 2019 policy meeting. Participants reiterated that the Fed will remain cautious, stating that a “patient approach to monetary policy” was appropriate. However, members added that if economic projections improved, the Fed could revise the “patient approach”. The minutes noted that the employment market had strengthened and economic activity was rising, but expected GDP in 2019 to slow down compared to 2018.

Is a breakthrough around the corner in the U.S-China trade talks? The sides are holding a fourth round of talks in Washington this week. Talks are reportedly making substantial progress, as negotiators are preparing memorandums of understanding on key issues such as cyber theft and intellectual property rights. The trade war between the two largest economies in the world has triggered a slowdown in China and weighed on global stock markets. The U.S. has threatened to raise tariffs on March 1 if a deal is not reached, so there is strong pressure to reach a deal before the deadline. If the March 1 deadline is removed, traders can expect risk appetite to jump and the Canadian dollar to respond with strong gains.

Fed tries to stay ahead of the (yield) curve

Aussie surges on strong jobs report

USD/CAD Fundamentals

-

8:30 Canadian ADP Nonfarm Employment Change

-

8:30 Canadian Wholesale Sales. Estimate -0.2%

-

8:30 US Core Durable Goods Orders. Estimate 0.3%

-

8:30 US Durable Goods Orders. Estimate 1.6%

-

8:30 US Philly Fed Manufacturing Index. Estimate 14.1

-

8:30 US Unemployment Claims. Estimate 228K

-

9:45 US Flash Manufacturing PMI. Estimate 54.9

-

9:45 US Flash Services PMI. Estimate 54.4

-

10:00 US CB Leading Index. Estimate 0.1%

-

10:00 US Existing Home Sales. Estimate 5.01M

-

10:30 US Crude Oil Inventories. Estimate 2.9M

-

8:30 Canadian Core Retail Sales. Estimate -0.5%

-

8:30 Canadian Retail Sales. Estimate 0.0%

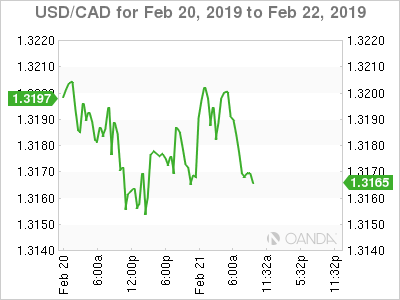

Open: 1.3177 High: 1.3207 Low: 1.3164 Close: 1.3169

USD/CAD Technical

USD/CAD posted small gains in the Asian session. In European trade, the pair posted gains but has retracted

-

1.3125 is providing support

-

1.3200 is a weak resistance line. It was tested earlier on Thursday

-

Current range: 1.3125 to 1.3200

Further levels in both directions:

-

Below: 1.3125, 1.3049 and 1.2969

-

Above: 1.3200, 1.3290, 1.3383 and 1.3445

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD posts gain, yet dive below 0.6500 amid Aussie CPI, ahead of US GDP

The Aussie Dollar finished Wednesday’s session with decent gains of 0.15% against the US Dollar, yet it retreated from weekly highs of 0.6529, which it hit after a hotter-than-expected inflation report. As the Asian session begins, the AUD/USD trades around 0.6495.

USD/JPY finds its highest bids since 1990, approaches 156.00

USD/JPY broke into its highest chart territory since June of 1990 on Wednesday, peaking near 155.40 for the first time in 34 years as the Japanese Yen continues to tumble across the broad FX market.

Gold stays firm amid higher US yields as traders await US GDP data

Gold recovers from recent losses, buoyed by market interest despite a stronger US Dollar and higher US Treasury yields. De-escalation of Middle East tensions contributed to increased market stability, denting the appetite for Gold buying.

Ethereum suffers slight pullback, Hong Kong spot ETH ETFs to begin trading on April 30

Ethereum suffered a brief decline on Wednesday afternoon despite increased accumulation from whales. This follows Ethereum restaking protocol Renzo restaked ETH crashing from its 1:1 peg with ETH and increased activities surrounding spot Ethereum ETFs.

Dow Jones Industrial Average hesitates on Wednesday as markets wait for key US data

The DJIA stumbled on Wednesday, falling from recent highs near 38,550.00 as investors ease off of Tuesday’s risk appetite. The index recovered as US data continues to vex financial markets that remain overwhelmingly focused on rate cuts from the US Fed.