|

S3 |

S2 |

S1 |

R1 |

R2 |

R3 |

|

1.3125 |

1.3200 |

1.3290 |

1.3383 |

1.3445 |

1.3552 |

The Canadian dollar has dipped on Thursday. Currently, USD/CAD is trading at 1.3357, up 0.29% on the day. On the release front, the sole Canadian event is a minor housing report. The U.S. will release producer price index reports. PPI is expected to rise to 0.3% and Core PPI is forecast to improve to 0.2%. Unemployment claims is projected to rise to 210 thousand. On Friday, the U.S. posts UoM consumer sentiment and the semi-annual Treasury currency report.

The Federal Reserve was in focus on Wednesday, with the release of the minutes from the March meeting. The Fed left the door open to rate hikes in 2019, provided that economic conditions improved. Some members said that they expected the economy to improve, while others said that rate movement could shift “in either direction based on incoming data and other developments”.

The IMF downgraded economic forecasts worldwide, and Canada was no exception. The IMF lowered its forecast from 1.9% to 1.5%. The report noted that Canada would be a major beneficiary if the U.S and China can hammer out a deal and end their bruising trade war. The IMF also lowered its forecast for global growth, from 3.5% to 3.3%.

Oil prices have dipped on Thursday, but remain close to 5-month highs. Civil unrest in Libya and Venezuela have tightened supplies, as have a cut in supplies by OPEC members. Canada is a major oil producer, so the rise in oil prices has helped bolster the Canadian currency, despite lukewarm Canadian data.

European update – Mixed trading continues

USD/CAD Fundamentals

Thursday (April 11)

-

All Day – OPEC Meetings

-

8:30 U.S. PPI. Estimate 0.3%

-

8:30 US Core PPI. Estimate 0.2%

-

8:30 US Unemployment Claims

Friday (April 12)

-

10:00 US UoM Consumer Sentiment. Estimate 98.1

-

Tentative – US Treasury Currency Report

Open: 1.3319 High: 1.3361 Low: 1.3313 Close: 1.3354

USD/CAD Technical

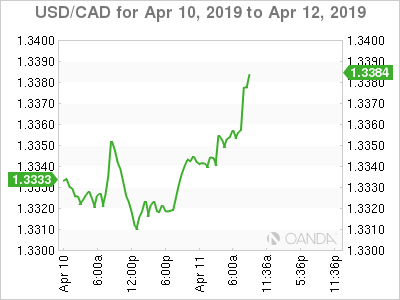

USD/CAD posted small gains in the Asian session and the trend continues in European trade

-

1.3290 is providing support

-

1.3383 is the next resistance line

-

Current range: 1.3290 to 1.3383

Further levels in both directions:

-

Below: 1.3290, 1.3200 and 1.3125

-

Above: 1.3383, 1.3445, 1.3552 and 1.3662

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold climbs above $2,340 following earlier drop

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.