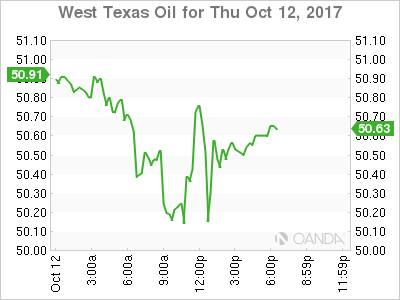

The Canadian dollar depreciated on Thursday due to a report by the International Energy Agency that dampened the energy market’s optimism on demand growth. The IEA numbers put demand for Organization of the Petroleum Exporting Countries (OPEC) crude would be at around 32.5 million barrels which is 150,000 barrels below current production levels. The OPEC and other major producers agreed to cut output and it seems that even after that supply is still higher than demand.

Canadian home resale prices dropped to a seven year low, while new home prices remained flat. The major catalyst of the Canadian real estate cool down was the Bank of Canada (BoC) two rate hikes so far in 2017. The central bank remains cautious about what even higher rates could do to households that are carrying record levels of debt, particularly in mortgages.

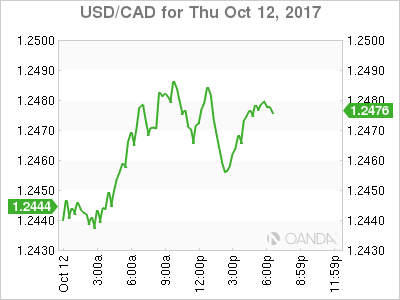

The US dollar traded higher versus the loonie after US data posted strong gains. US producer prices rose by the most in six months. The PPI was up 0.40 percent in September and comes at a time when the market is giving more weight to inflation data. The data is particularly strong considering the weather played a huge factor during that period.

The fourth round of NAFTA negotiations will kick off in Virginia this week. The Trump administration has played hardball ahead and during the negotiations with even the US Chamber of Commerce saying that rules of origin demands could torpedo the talks.

The USD/CAD is trading at 1.24780 at the end of the North American session. Inflation data in the US is expected to continue to boost the USD after a strong PPI. The Fed minutes released yesterday were full of concerns from FOMC members about persistent low inflation. Canadian data will be absent on Friday as there are no major releases schedules with all eyes on US retail sales and consumer price index.

The US Bureau of Labor Statistics will release the consumer price index (CPI) on Friday, October 13 at 8:30 am EDT. Core CPI is expected to have gained 0.2 percent, the same as last month for the change in inflation excluding food and energy. The more volatile CPI reading is forecasted at 0.6 percent. US retail sales data will also be released at the same time with core sales anticipated to have gained 0.9 percent. The headline figure adding back auto is expected to have jumped 1.7 percent. The rebound in both is expected to be directly linked to the negative impact hurricanes Harvey and Irma had on purchasing decisions.

The rise of US producer prices (PPI) on Thursday by 0.4 percent doubled the forecast and another inflationary data gain on Friday could put the FOMC minutes in a new light. If inflation is indeed rising faster than expected it could move the emphasis on the doves and put the hawks back in the drivers seat ahead of the December Fed meeting.

The release of the consumer price index on Friday will be a decisive indicator to close out the week of the US dollar. The minutes from the September Federal Open Market Committee (FOMC) meeting showed a growing concern that the factors keeping inflation low could be more longer term than originally thought. Many FOMC members still see another rate hike as appropriate despite those concerns leaving the decision on the table for December but the outlook for 2018 is for less tightening actions from the U.S. Federal Reserve.

Oil gave back some of the gains of the week despite optimism from producers about higher energy demand forecasts and the release of the US weekly crude inventories showing a 2.7 million barrel drawdown on Thursday. The main factor for the decline in prices was a report by the International Energy Agency that forecasted lower demand for Organization of the Petroleum Exporting Countries (OPEC) crude. Current production is more that the appetite which means that oil prices can only recover if OPEC and other major producers not only extend the duration of the cut agreement, but limit their production even further.

US supply is not bound by this agreement and continues to ramp up higher making the OPEC cuts less effective. The US has turned from a net importer of oil to an exporter and with global demand for energy products stable the downward pressure on prices will continue until something changes.

Market events to watch this week:

Friday, October 13

8:30am USD CPI m/m

8:30am USD Core CPI m/m

8:30am USD Core Retail Sales m/m

8:30am USD Retail Sales m/m

*All times EDT

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD posts gain, yet dive below 0.6500 amid Aussie CPI, ahead of US GDP

The Aussie Dollar finished Wednesday’s session with decent gains of 0.15% against the US Dollar, yet it retreated from weekly highs of 0.6529, which it hit after a hotter-than-expected inflation report. As the Asian session begins, the AUD/USD trades around 0.6495.

USD/JPY finds its highest bids since 1990, approaches 156.00

USD/JPY broke into its highest chart territory since June of 1990 on Wednesday, peaking near 155.40 for the first time in 34 years as the Japanese Yen continues to tumble across the broad FX market.

Gold stays firm amid higher US yields as traders await US GDP data

Gold recovers from recent losses, buoyed by market interest despite a stronger US Dollar and higher US Treasury yields. De-escalation of Middle East tensions contributed to increased market stability, denting the appetite for Gold buying.

Ethereum suffers slight pullback, Hong Kong spot ETH ETFs to begin trading on April 30

Ethereum suffered a brief decline on Wednesday afternoon despite increased accumulation from whales. This follows Ethereum restaking protocol Renzo restaked ETH crashing from its 1:1 peg with ETH and increased activities surrounding spot Ethereum ETFs.

Dow Jones Industrial Average hesitates on Wednesday as markets wait for key US data

The DJIA stumbled on Wednesday, falling from recent highs near 38,550.00 as investors ease off of Tuesday’s risk appetite. The index recovered as US data continues to vex financial markets that remain overwhelmingly focused on rate cuts from the US Fed.