The Canadian dollar continues to drift in calm waters for a fourth straight day. However, with key data on both sides of the border as well as the FOMC decision on today’s calendar, USD/CAD could show some stronger movement in the North American session. In the European session, USD/CAD is trading at 1.3174, down 0.09% on the day.

Canada CPI, US retail sales next

Investors will be keeping a close eye on the FOMC decision later on Wednesday, but the opening act will feature Canadian consumer inflation and US retail sales releases. In Canada, inflation has tapered off and the August forecast is not at all promising. The headline reading came in at a flat 0.0% in July, and the August estimate stands at 0.1%. Core CPI has also struggled, with three declines in the past four months. The July release came in at -0.1%. Over in the US, retail sales are projected to dip from 1.2% to 1.1%. However, the more significant core release is expected to fall to 1.0%, down from 1.9%. If investors are sour on the retail sales numbers, risk appetite could fall and drag down the Canadian dollar, which is a minor currency.

How dovish will the Fed be?

The Federal Reserve is widely expected to maintain the Fed Funds Rate between 0.00% and 0.25%, where they have been pegged since March. In late August, Fed Chair Powell said that the Fed would use an “average inflation targeting” process, which means that inflation could overshoot the two percent threshold before the Fed responds by hiking rates. This marks a major policy change, and if Powell adds some detail to what this new policy entails, the markets will be all ears. With some analysts predicting that the Fed will not raise rates before 2023, it appears that the US dollar won’t be getting any boost from higher interest rates for the foreseeable future.

USD/CAD Technical

-

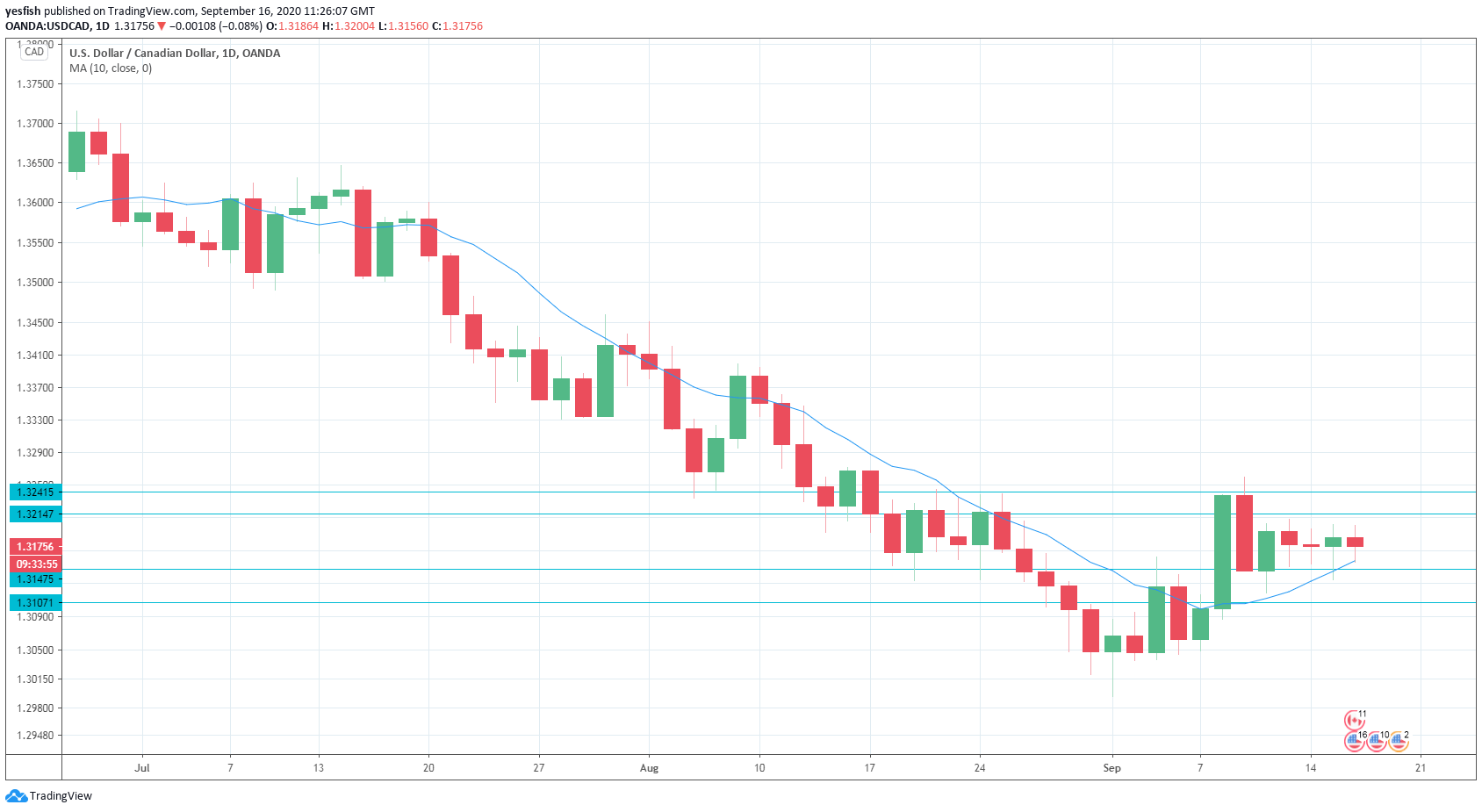

There is resistance at 1.3175, followed by resistance at 1.3214.

-

1.3147 is the first line of support. Below, there is support at 1.3107, protecting the 1.31 level.

-

USD/CAD continues to put downward pressure on the 20-day MA. If the pair breaks below this line, it would be an indication of a downward trend.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.