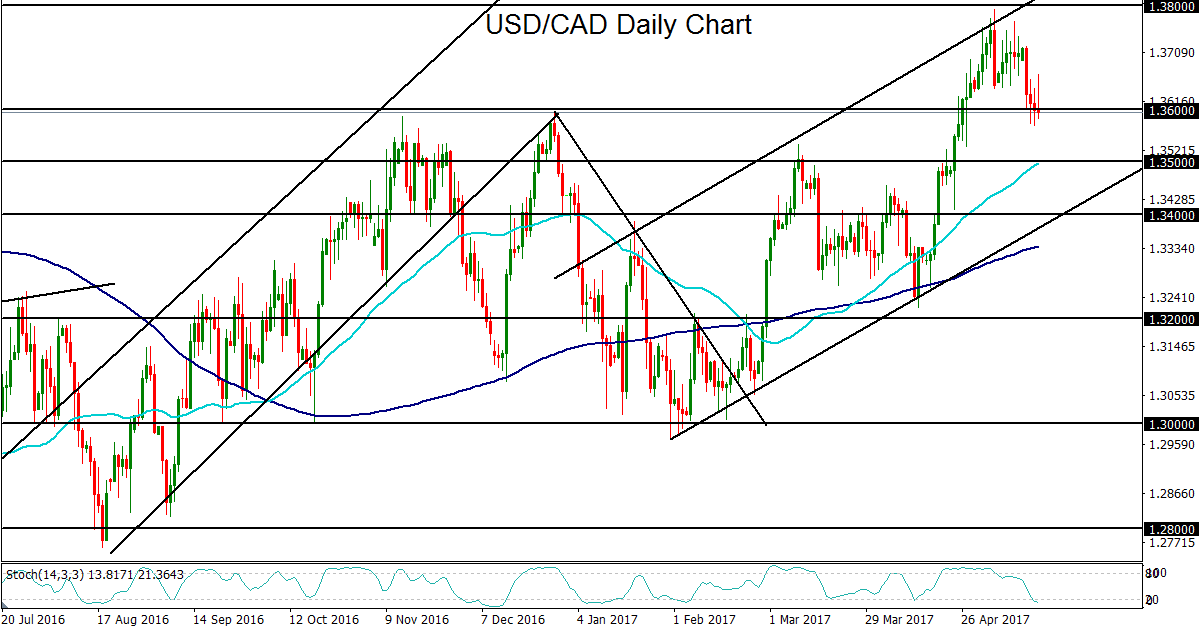

USD/CAD has fluctuated around the key 1.3600 price level for the past three days as a weakened US dollar and volatile crude oil prices affecting the Canadian dollar have pushed and pulled on the currency pair. A decisive breakdown below 1.3600 support has not quite occurred yet (though it may be imminent), as shifting speculation over crude oil supply and the path of the US dollar amid Trump-driven political turmoil has kept USD/CAD in a relative state of flux.

On the very near-term horizon, key events will play an important role in USD/CAD’s trajectory going forward. Though the US dollar gained back a bit of stability on Thursday after a sharp fall for much of this week, it should continue to be affected heavily by the dark political clouds that have formed over US President Trump. These clouds center on his administration’s dealings with Russia and allegations that he could possibly be charged with obstruction of justice, a potentially impeachable offense, as a result of his past remarks to former FBI Director James Comey. Though an actual impeachment would not be easy and would undoubtedly be a long, drawn-out process if it ever came to pass, the specter of such a far-reaching scandal threatens a complete disruption of Trump’s economic reform agenda. Any increased likelihood of this occurring should continue to weigh heavily on the US dollar, potentially extending its recent plunge in the short-term.

On the Canadian dollar side, Friday brings key economic data from Canada in the form of April’s Consumer Price Index (CPI) and March’s retail sales data. CPI, a key inflation indicator, is expected to come in at +0.5% after the previous month’s lower-than-expected 0.2%. March retail sales is expected at +0.4% after February’s disappointing -0.6% reading, while core retail sales (excluding automobiles) is expected at +0.2% versus the previous month’s -0.1%.

Yet another factor potentially affecting the Canadian dollar will be OPEC’s meeting in Vienna next week, on May 25th. It is widely expected that the meeting will result in an extension of the current OPEC-led agreement limiting crude oil production. Earlier this week, crude oil prices surged, boosting the Canadian dollar with it, after officials from Saudi Arabia and Russia agreed in principle to extend oil production cuts. Despite the ever-present threat of rising US oil production, any actual agreement to extend the OPEC-led cuts next week should result in a further short-term boost for crude oil prices, which could provide further fuel for a Canadian dollar rebound and a USD/CAD breakdown.

As Trump-driven political issues evolve, Canadian economic data is released, and OPEC’s intentions come into clearer focus, USD/CAD is set for increased volatility. From a technical perspective, as mentioned, USD/CAD continues as of Thursday to fluctuate around the critical 1.3600 support/resistance level. Though the longer-term trend is bullish, the currency pair has just begun a retreat from the top of a clear parallel uptrend channel, and could have further to fall within this channel before potentially resuming the uptrend. In the event of a near-term breakdown below 1.3600, major downside targets are at the 1.3500 support level followed by the 1.3400 level, which is currently near the bottom of the noted parallel uptrend channel.

Investopedia does not provide individual or customized legal, tax, or investment services. Since each individual’s situation is unique, a qualified professional should be consulted before making financial decisions. Investopedia makes no guarantees as to the accuracy, thoroughness or quality of the information, which is provided on an “AS-IS” and “AS AVAILABLE” basis at User’s sole risk. The information and investment strategies provided by Investopedia are neither comprehensive nor appropriate for every individual. Some of the information is relevant only in Canada or the U.S., and may not be relevant to or compliant with the laws, regulations or other legal requirements of other countries. It is your responsibility to determine whether, how and to what extent your intended use of the information and services will be technically and legally possible in the areas of the world where you intend to use them. You are advised to verify any information before using it for any personal, financial or business purpose. In addition, the opinions and views expressed in any article on Investopedia are solely those of the author(s) of the article and do not reflect the opinions of Investopedia or its management. The website content and services may be modified at any time by us, without advance notice or reason, and Investopedia shall have no obligation to notify you of any corrections or changes to any website content. All content provided by Investopedia, including articles, charts, data, artwork, logos, graphics, photographs, animation, videos, website design and architecture, audio clips and environments (collectively the "Content"), is the property of Investopedia and is protected by national and international copyright laws. Apart from the licensed rights, website users may not reproduce, publish, translate, merge, sell, distribute, modify or create a derivative work of, the Content, or incorporate the Content in any database or other website, in whole or in part. Copyright © 2010 Investopedia US, a division of ValueClick, Inc. All Rights Reserved

Recommended Content

Editors’ Picks

AUD/USD remained bid above 0.6500

AUD/USD extended further its bullish performance, advancing for the fourth session in a row on Thursday, although a sustainable breakout of the key 200-day SMA at 0.6526 still remain elusive.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.