-

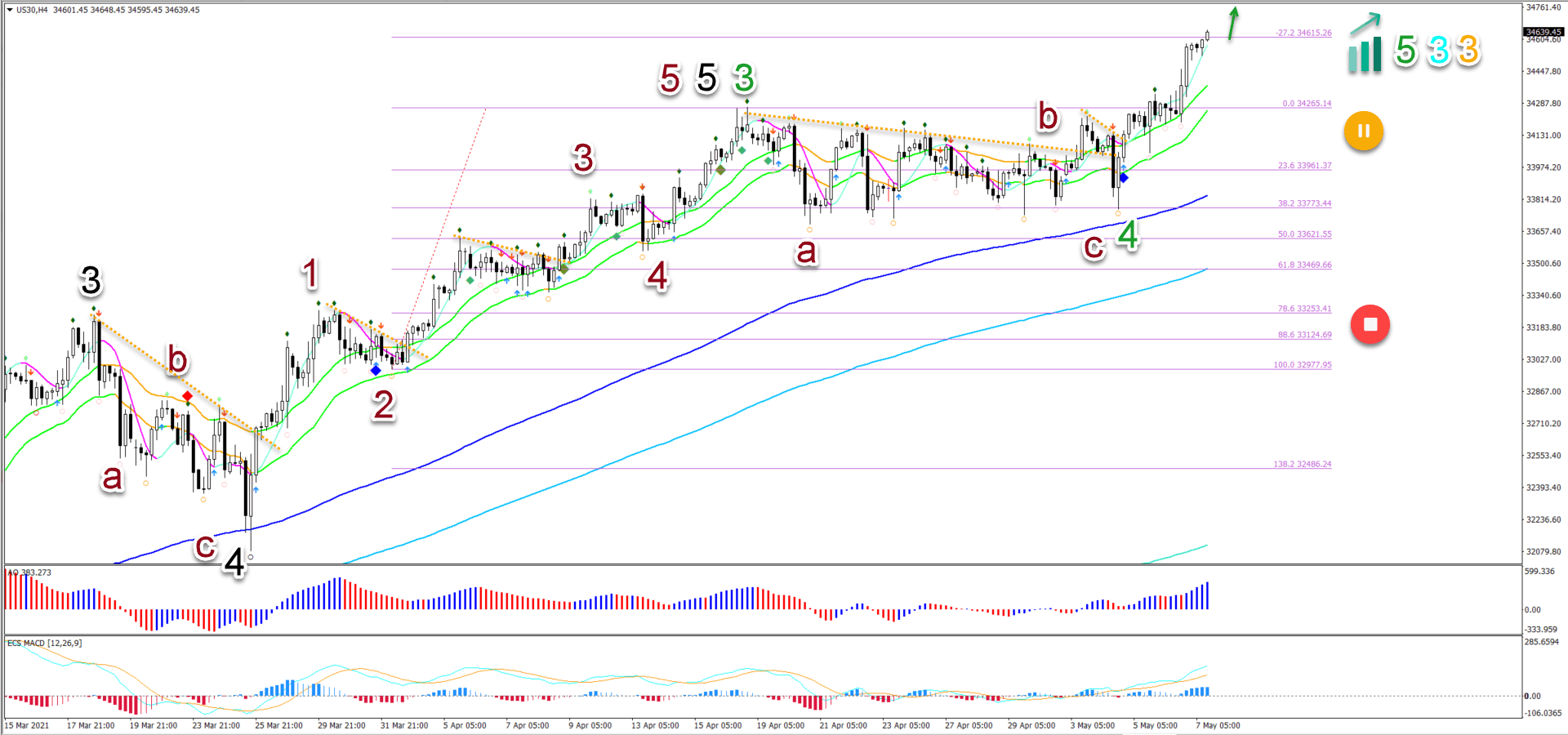

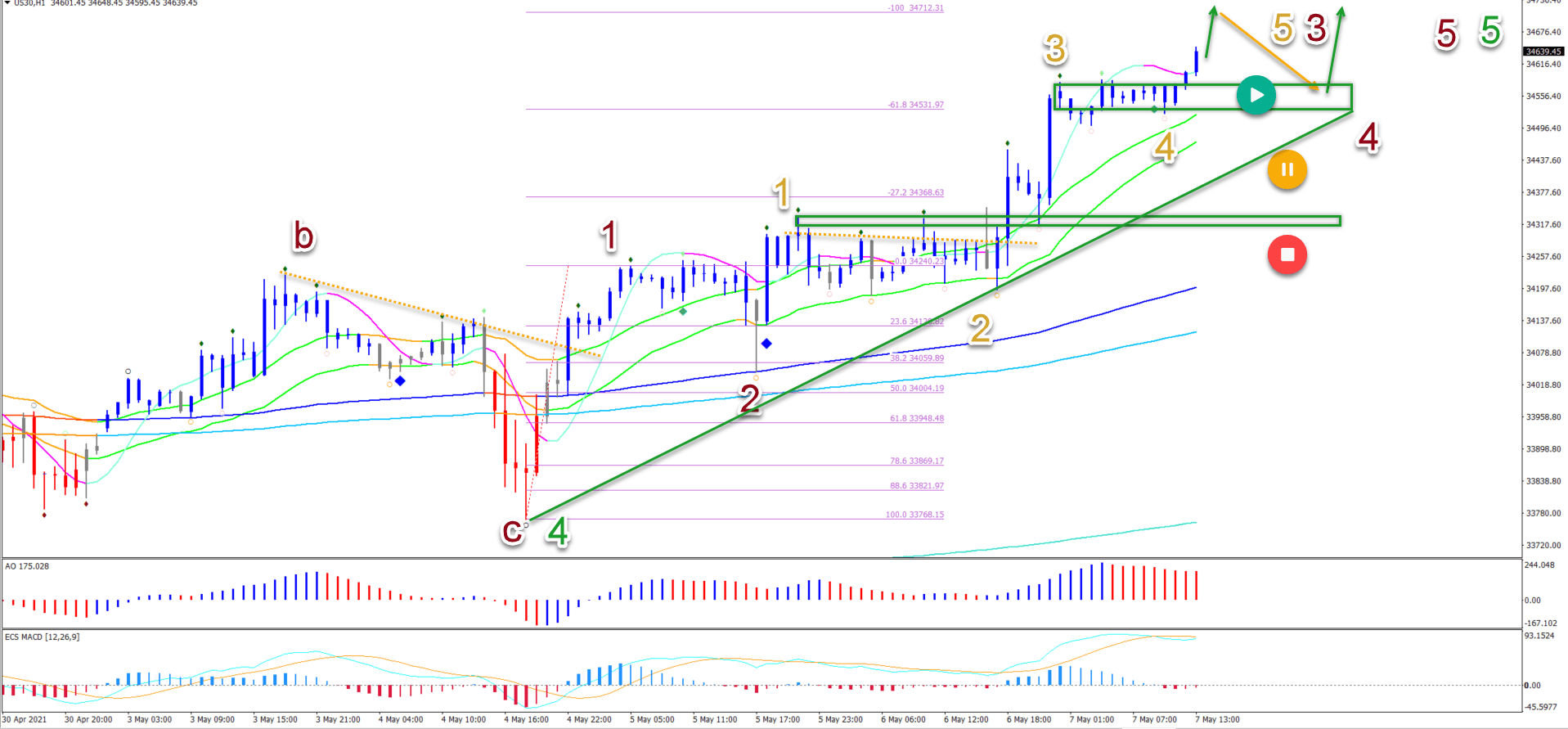

The US30 daily chart made a bearish ABC (brown) sideways pullback towards the 38.2% Fibonacci retracement level.

-

On the 4 hour chart, price action is showing bullish impulsiveness again above the 21 ema zone. The shallow pullback is typical for a wave 4 (gold).

-

The bullish breakout above the resistance (dotted orange) lines indicates the uptrend continuation in wave 5 (green).

The Dow Jones Index (US30) is back in the uptrend after a lengthy sideways correction.

As mentioned in our previous analysis, the correction turned out to be a wave 4pattern (green) which respected the shallow Fibonacci levels. Let’s analyse what to expect next.

Price charts and technical analysis

The US30 daily chart made a bearish ABC (brown) sideways pullback towards the 38.2% Fibonacci retracement level:

-

The pullback completed a wave 4 (green) pattern. The strong bullish push upwards before the correction is a wave 3 (green):

-

A strong uptrend was visible with all the moving averages aligned (21 emas above the 144 ema which is above the 233 and 610 ema).

-

The bullish breakout above the resistance (dotted orange) lines indicates the uptrend continuation in wave 5 (green).

-

The bullish uptrend seems far from over if the current wave 3 (blue) of wave 3 (orange) of waves 3 of higher degrees is correct.

-

The next immediate target is the $35,000 round level.

-

A deeper pullback could indicate a warning sign (orange pause button) or invalidate the uptrend (red stop button).

On the 4 hour chart, price action is showing bullish impulsiveness again above the 21 ema zone:

-

The shallow pullback is typical for a wave 4 (gold).

-

The current bullish swing is probably a wave 5 (gold) of wave 3 (brown).

-

After the wave 5 (gold) finishes, there should be one more pullback in wave 4 (brown).

-

The previous wave 4 (gold) should now act as a support zone (green box).

-

A break below the support trend line (green) places the uptrend on hold (yellow button). A deep breakout invalidates it (red button).

The analysis has been done with the ecs.SWAT method and ebook.

Elite CurrenSea Training Program(s) should not be treated as a recommendation or a suggestion to buy or sell any security or the suitability of any investment strategy for Student. The purchase, sale, or advice regarding any security, other financial instrument or system can only be performed by a licensed Industry representative; such as, but not limited to a Broker/Dealer, Introducing Broker, FCM and/or Registered Investment Advisor. Neither Elite CurrenSea nor its representatives are licensed to make such advisements. Electronic active trading (trading) may put your capital at risk, hence all trading decisions are made at your own risk. Furthermore, trading may also involve a high volume & frequency of trading activity. Each trade generates a commission and the total daily commission on such a high volume of trading can be considerable. Trading accounts should be considered speculative in nature with the objective being to generate short-term profits. This activity may result in the loss of more than 100% of an investment, which is the sole responsibility of the client. Any trader should realise the operation of a margin account under various market conditions and review his or her investment objectives, financial resources and risk tolerances to determine whether margin trading is appropriate for them. The increased leverage which margin provides may heighten risk substantially, including the risk of loss in excess of 100% of an investment.

Recommended Content

Editors’ Picks

EUR/USD fluctuates near 1.0700 after US data

EUR/USD stays in a consolidation phase at around 1.0700 in the American session on Wednesday. The data from the US showed a strong increase in Durable Goods Orders, supporting the USD and making it difficult for the pair to gain traction.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold stays in consolidation above $2,300

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.