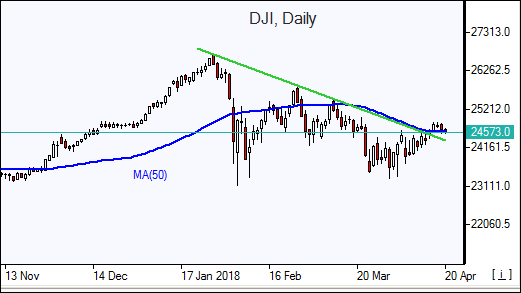

Dow dips back into negative territory

US stocks closed lower on Thursday on mixed corporate reports. Dow Jones industrial average lost 0.3% to 24664.89, falling back into negative territory for 2018. The S&P 500 fell 0.6% to 2693.13 with nine of the 11 main sectors ending lower. The Nasdaq composite dropped 0.8% to 7238.06. The dollar strengthened: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, rose 0.3% to 89.85. Stock indices futures indicate lower openings today.

The rise in yields of long dated Treasurys was also a drag on equities as inflation expectations rose to the highest level in about three years. In economic news Fed Governor Lael Brainard said she saw “some signs of financial imbalances in the economy.” Weekly jobless claims were slightly higher at 232,000 for the week while 230,000 claims were expected. And an April reading of business conditions from the Philadelphia Federal Reserve rose to 23.2 from 22.3.

DAX slides as European indices edge up

European stocks ended marginally higher on Thursday led by energy shares. The euro joined British Pound’s retreat against the dollar. The Stoxx Europe 600 index ended less than 0.1% higher. Germany’s DAX 30 underperformed falling 0.2% to 12567.42. France’s CAC 40 rose 0.2% and UK’s FTSE 100 gained 0.2% to 7328.92. Indices opened mixed today.

Pound’s weakening accelerated after report UK retail sales fell 1.2% month-on-month in March, missing forecasts, of 0.4% decline. And euro-zone’s current account surplus eased to 35.1 billion euros in February compared with January, still up compared with the year-earlier period.

Technology shares lead Asian markets lower

Asian stock indices are mostly lower today after Taiwan Semiconductor Manufacturing cut its revenue target citing softer demand for smartphones. Nikkei slipped 0.1% to 22162.24 despite continued yen weakening against the dollar. Earlier inflation report indicated Japan’s core consumer prices rose 0.9% from a year earlier in March, versus February’s reading of 1%. Chinese stocks are down: the Shanghai Composite Index is 1.5% lower and Hong Kong’s Hang Seng Index is down 1.2%. Australia’s All Ordinaries Index is down 0.2% despite Australian dollar fall against the greenback.

Brent slides

Brent futures prices are edging lower ahead of the joint Organization of the Petroleum Exporting Countries and non-OPEC ministerial monitoring committee (JMMC) meeting today. They ended higher yesterday: Brent for June settlement rose 0.4% to close at $73.78 a barrel on Thursday.

Want to get more free analytics? Open Demo Account now to get daily news and analytical materials.

This overview has an informative character and is not financial advice or a recommendation. IFCMarkets. Corp. under any circumstances is not liable for any action taken by someone else after reading this article.

Recommended Content

Editors’ Picks

AUD/USD recovers to near 0.6450, shrugs off mixed Australian jobs data

AUD/USD is rebounding to near 0.6450 amid renewed US Dollar weakness in the Asian session on Thursday. The pair reverses mixed Australian employment data-led minor losses, as risk sentiment recovers.

USD/JPY bounces back toward 154.50 amid risk-recovery

USD/JPY bounces back toward 154.50 in Asian trading on Thursday, having tested 154.00 on the latest US Dollar pullback and Japan's FX intervention risks. A recovery in risk appetite is aiding the rebound in the pair.

Gold rebounds on market caution, aims to reach $2,400

Gold price recovers its recent losses, trading around $2,370 per troy ounce during the Asian session on Thursday. The safe-haven yellow metal gains ground as traders exercise caution amidst heightened geopolitical tensions in the Middle East.

Manta Network price braces for volatility as $44 million worth of MANTA is due to flood markets

Manta Network price was not spared from the broader market crash instigated by a weakness in the Bitcoin market. While analysts call a bottoming out in the BTC price, the Web3 modular ecosystem token could suffer further impact.

Investors hunkering down

Amidst a relentless cautionary deluge of commentary from global financial leaders gathered at the International Monetary Fund and World Bank Spring meetings in Washington, investors appear to be taking a hiatus after witnessing significant market movements in recent weeks.