- Second quarter GDP at 6.5% misses 8.5% forecast by wide margin.

- Core CPI at 4.5% in June, Core PCE expected at 3.7%.

- Inflation control will become a rising DC priority as Congressional elections approach.

The US economy pulled up short of expectations in the second quarter, expanding at a 6.5% annualized rate despite government largesse of $1.9 trillion that began in March. Economists had predicted a 8.5% growth rate.

Consumers were once again the engine as Personal Consumption Expenditures rose 11.8% in the quarter, accounting for 69% of all economic activity, after an 11.4% gain in the first three months of the year.

In an economic disconnect that illustrates the difficulty many firms are having finding sufficient labor and material to maintain production, business spending dropped 3.5% in the just completed quarter following a 2.3% fall ending in March.

Market response

Equities rose as weaker than expected GDP will negate any pressure for reducing the $120 billion a month in bond purchases from rising inflation.

In late afternoon trading the Dow and S&P 500 were up by around 0.5%. The tech-heavy Nasdaq was higher by nearly 0.2%, still recovering from the sell-off prompted by China’s critical crackdown on its domestic tech stocks.

S&P 500 Dow

CNBC

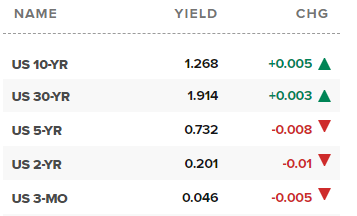

Treasury rates were largely unchanged with the 2-year, 10-year and 30-year all rising or falling by less than one basis point.

US Treasury yields

CNBC

The dollar was the chief victim of the disappointing growth as the greenback fell in all major pairs. The EUR/USD rose to a four-week high and USD/CAD dipped below 1.2500 support for the first time in three weeks

GDP, Inventory and inflation

Real final sales were another indicator of business restrictions.

Domestic sales rose 7.7% in the first quarter, far more than the 6.5% increase in GDP. This follows an even bigger gap in the first quarter, 9.1% sales and 6.3% (revised) GDP.

When consumers are buying more than the economy produces, the difference comes from imports and inventory.

Booming sales in the first quarter would, under normal circumstances, have prompted production increases from domestic factories in the second. That anticipation was one of the reasons for the 8.5% consensus GDP estimate. Labor and material shortages are restricting production to a much greater degree than analysts expected.

In a perverse twist, the relative scarcity of consumer products in the face of very strong demand, caused in part by a reluctance of workers to return to their jobs, has stoked the inflationary pressures that many manufacturers are more than willing to pass on to consumers.

CPI and PCE Prices

The rampant inflation in the first half has caught the attention of markets and the Fed. Consumer prices have averaged 3.8% for the first six months, culminating at 5.4% annually in June. The core rate is 2.4% this year, ending in 3.4% last month.

The PCE Price Index averaged 2.6% for the half year, 2.3% in core, finishing the second quarter at 3.9% and 3.4% respectively.

All four inflation averages will rise substantially in the third and fourth quarters as the low rates at the beginning of the year roll off and are more than doubled by their replacements.

For instance, the yearly Core PCE rates in January, February and March were 1.4%, 1.5% and 1.9%. If they are replaced in the third quarter with the projected 3.7% for June, the six month average would jump to 3.6%. Other averages would be commensally higher.

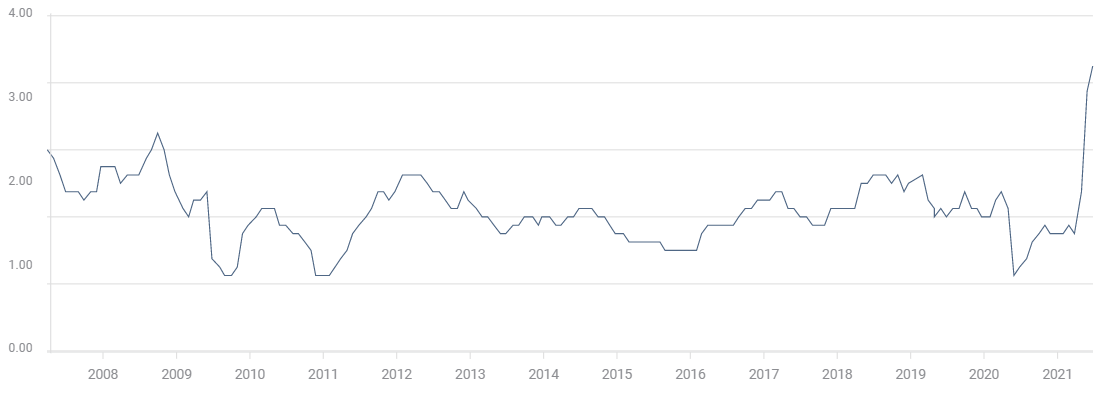

Core PCE Price Index

If the similar rates continue through the end of the year the Core PCE average would be 3.6% in December. It is hard to imagine the Fed resisting the political pressure to act with Core PCE closing in on 4% for 2021.

At yesterday’s news conference following the FOMC decision, Chair Jerome Powell answered more questions on prices than any other topic. As the inflation rates continue their inexorable rise, the attention on the Fed will only grow.

Fed’s Dilemma: Growth, employment and inflation

The Fed’s two Congressional mandates, full employment and price stability, are, from a policy perspective, mutually exclusive.

Fostering economic growth and hiring requires low or at least reducing interest rates. Containing or preventing inflation needs tighter monetary conditions.

The weaker than expected second quarter growth contains the potential for the worst of both economic worlds, weak economic growth and hiring and rampant inflation.

In making its policy choice, the Fed has clearly and justifiably come down on the side of economic growth. Zero rates have been in effect for 18 months and no change is envisioned in the Projection Materials for another year and a half.

Inflation was expected to rise, the oft-mentioned base-effect from last year’s collapse, and the Fed prepared for that with its adoption of inflation-averaging last September.

The governors could not foretell the extensive and more durable material and component shortages that have hampered production. Nor did they predict the negative impact on employment from the Biden administration’s extension and enhancement of unemployment benefits.

Each has served to incur higher inflation and stands a good chance of raising inflation expectations.

Conclusion: In DC you cannot hide from politics

Inflation is hated by consumers. The longer it persists, the greater the political impact. Congressional elections in 2022 are shaping to be difficult for the Democrats. The House and Senate are within reach of a Republican majority.

Polls indicate that a majority of American (59%) blame the White House for the current bout of inflation *.

It does not take a great deal of imagination to predict that, if inflation continues to run hot, the Democrats and the administration will add their voices to the market clamor for Fed action.

Mr. Powell’s term as Federal Reserve chair runs out in February. Reappointment lies with President Biden and his advisors.

Chair Powell and the governors should be able to fend off criticism for another quarter.

But unless there is a change in the current growth and inflation trends, market acceptance of Fed policy could vanish before the end of the year with all the implications apparent for the dollar, Treasury yields and equities.

* Politico/Morning Consult Survey--39% held the administration "very responsible" for the higher costs and 20% said President Biden was "somewhat" responsible.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0650 after US data

EUR/USD retreats from session highs but manages to hold above 1.0650 in the early American session. Upbeat macroeconomic data releases from the US helps the US Dollar find a foothold and limits the pair's upside.

GBP/USD retreats toward 1.2450 on modest USD rebound

GBP/USD edges lower in the second half of the day and trades at around 1.2450. Better-than-expected Jobless Claims and Philadelphia Fed Manufacturing Index data from the US provides a support to the USD and forces the pair to stay on the back foot.

Gold clings to strong daily gains above $2,380

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Ripple faces significant correction as former SEC litigator says lawsuit could make it to Supreme Court

Ripple (XRP) price hovers below the key $0.50 level on Thursday after failing at another attempt to break and close above the resistance for the fourth day in a row.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.

-637631835810453184.png)

-637631835984527560.png)