- Payrolls forecast to expand 600,000 in October from 661,000.

- Unemployment rate expected to drop to 7.7% from 7.9%.

- Markets could respond to better data despite election turmoil.

Amid the election turmoil the most important US economic statistic, Nonfarm Payrolls, may offer a little distraction from the contest to be the next President.

The pandemic lockdown of March and April and the collapse of growth in the second quarter was followed by and even stronger expansion but that success has faded somewhat in October.

As Federal Reserve Chairman Jerome Powell noted on Thursday after the FOMC meeting, “Economic activity has continued to recover from the depressed second quarter level. In recent months the pace of improvement has moderated.”

Employment Situation Report

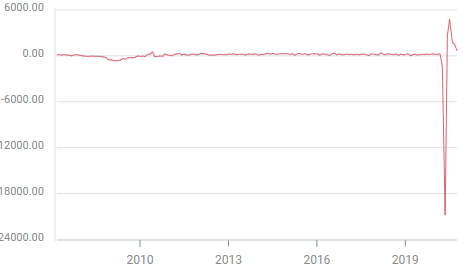

Nonfarm payrolls are forecast to add 600,000 workers in October after increasing 661,000 in September. It would be the smallest gain since the 22.16 million job losses of March and April began to reverse in May. If correct it would bring the rehires to 12.001 million and the percentage to 54.16%.

Nonfarm Payrolls

The Unemployment Rate (U-3) is predicted to drop to 7.7% from 7.9% in September . The Underemployment Rate (U-6) was 12.8% in September.

Average Hourly Earnings (YoY) is projected to slip to 4.6% from 4.7% and Average Weekly Hours are estimated to be unchanged at 34.7.The Labor Force Participation Rate was 61.4% in September.

Labor market indicators

Initial Jobless Claims fell to 751,000 in the October 30th week and Continuing Claims were 7.285 million, both the lowest since the start of the pandemic. The improvement in claims has been steady but the number of weekly layoffs has continued for over seven months at levels never seen before, except briefly in the financial crisis of 2008-2009.

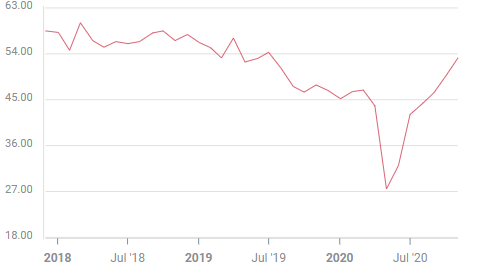

The employment indexes from the Institute for Supply Management (ISM) Purchasing Managers' Survey maintained their expansive outlook in October.

The services index was 50.1 in October down from 51.8 in September but better than the 49.8 forecast for the first two positive months since February.

The manufacturing index scored 53.2, ahead of the 49.6 result in September and vastly stronger than the 40.9 forecast. It was the first positive month in 15. The pandemic low was 27.5 in April.

ISM Manufacturing Employment Index

It may be that the excellent level of new orders in both sectors has finally induced managers to expand their payrolls.

US economy

Gross Domestic Product soared at a record 33.1% (annualized) rate in the third quarter following the equally historic 31.4% decline in April, May and June. Growth was powered by strong consumer and business spending.

Retail Sales rose 1.9% in September on a 0.7% forecast and has improved an average of 1.01% per month from March through September.

The Durable Goods business investment proxy, Nondefense Capital Goods Orders ex Aircraft, doubled its September estimate at 1% and has gained 0.5% per month in the same period.

Business sentiment on the whole in October was more positive than anticipated.

The ISM Purchasing Managers' Index for the manufacturing sector rose to 59.3 well ahead of its 55.8 forecast and the prior month's 55.4. It was the best reading on factory sentiment since September 2018.

The index of New Orders jumped to 67.9, a new record, just two months after setting the previous high at 67.6. Analysts in the Reuters Survey had predicted a drop to 45.9 in October from 60.2.

Sentiment in the much larger service sector fell slightly to 56.6 last month from 57.8, as did the New Orders Index to 58.8 from 61.5 but it was far stronger than the 49.4 forecast.

Conclusion and markets

The slowdown in hiring and the continued high level of layoffs represented by initial jobless are the chief problems for the economic recovery. Businesses continue to fail as consumer traffic in many sectors, hospitality, travel and dining primarily, remain far below normal levels.

Consumer spending has sustained remarkably well, but until there is another stimulus package, its retreat is expected.

With the holiday season looming that traditionally makes or breaks the year for many retailers, the urgency of a second bill cannot be lost on Congress, even if for the moment, the election has everyone's complete attention.

The rising COVID-19 diagnoses in many parts of the country is another concern. The daily new count passed 100,000 of the first time this week and even though hospitalizations and fatalities are increasing much more slowly and are still well below the levels of the spring, the potential for ever greater numbers of business closures is a drag on outlook and employment.

Even given the election distractions and the gathering economic worries, markets will likely respond to a positive payroll report. A weaker report will probably be ignored as not unexpected.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD climbs to 10-day highs above 1.0700

EUR/USD gained traction and rose to its highest level in over a week above 1.0700 in the American session on Tuesday. The renewed US Dollar weakness following the disappointing PMI data helps the pair stretch higher.

GBP/USD extends recovery beyond 1.2400 on broad USD weakness

GBP/USD gathered bullish momentum and extended its daily rebound toward 1.2450 in the second half of the day. The US Dollar came under heavy selling pressure after weaker-than-forecast PMI data and fueled the pair's rally.

Gold struggles around $2,325 despite broad US Dollar’s weakness

Gold reversed its direction and rose to the $2,320 area, erasing a large portion of its daily losses in the process. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% following the weak US PMI data and supports XAU/USD.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

Germany’s economic come back

Germany is the sick man of Europe no more. Thanks to its service sector, it now appears that it will exit recession, and the economic future could be bright. The PMI data for April surprised on the upside for Germany, led by the service sector.