- Job creation falls by more than half in November to 245,000 from 610,000.

- Markets ignore weak US jobs data as payrolls rise for the seventh month.

- US equities, Dow, S&P and Nasdaq rise to records.

- Initial Jobless Claims revert to descending trend in November.

- Vaccine and stimulus potential keep markets looking to Q1.

- Dollar gains in most major pairs, loses against the loonie.

The US economy turned in its weakest job performance of the pandemic era in November adding 245,000 jobs as COVID-19 closures in several states and rising diagnoses may have inhibited hiring across the country. Economists in the Reuters Survey had forecast 469,000 new positions.

Overall, nonfarm jobs remained 9.8 million, 6.5%, below their February levels.

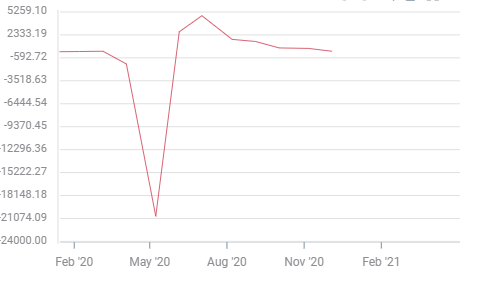

Nonfarm payrolls

Markets turned a blind eye to the disappointing labor performance, keeping attention focused on the potential boom in the first quarter as vaccine distribution accelerates and Congress agrees on a new stimulus package, either now or after the new legislature is seated in January.

Another reason for buoyant market response was Thursday's unemployment claims which reverted to their declining trend at 712,000. This was far less than the 775,000 estimate or the 768,000 average of the two prior weeks.

Markets

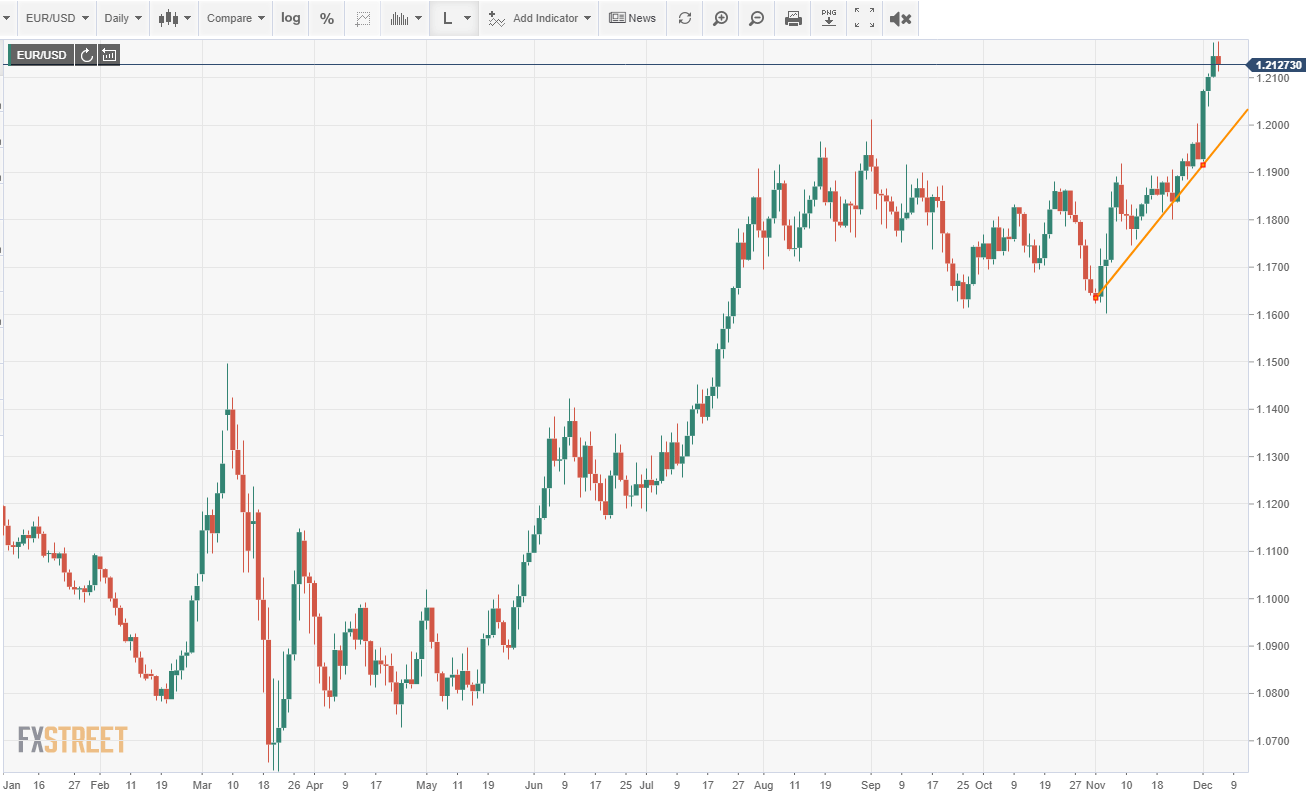

The dollar reversed some its recent losses but it remained lower on the week against all the majors. The EUR/USD fell about 20 points on the day from its open ending at 1.2127 but it is up 1.4% from last Friday's close at 1.1960 and 4.2% from its finish at 1.1638 on November 2.

The USD/JPY added 27 points from Thursday's close to 104.16. It is little changed on the week having ended last Friday at 104.07. In the period from November 2 it is down less than 1%, 104.80 to 104.16.

The USD/JPY added 27 points from Thursday's close to 104.16. It is little changed on the week having ended last Friday at 104.07. In the period from November 2 it is down less than 1%, 104.80 to 104.16.

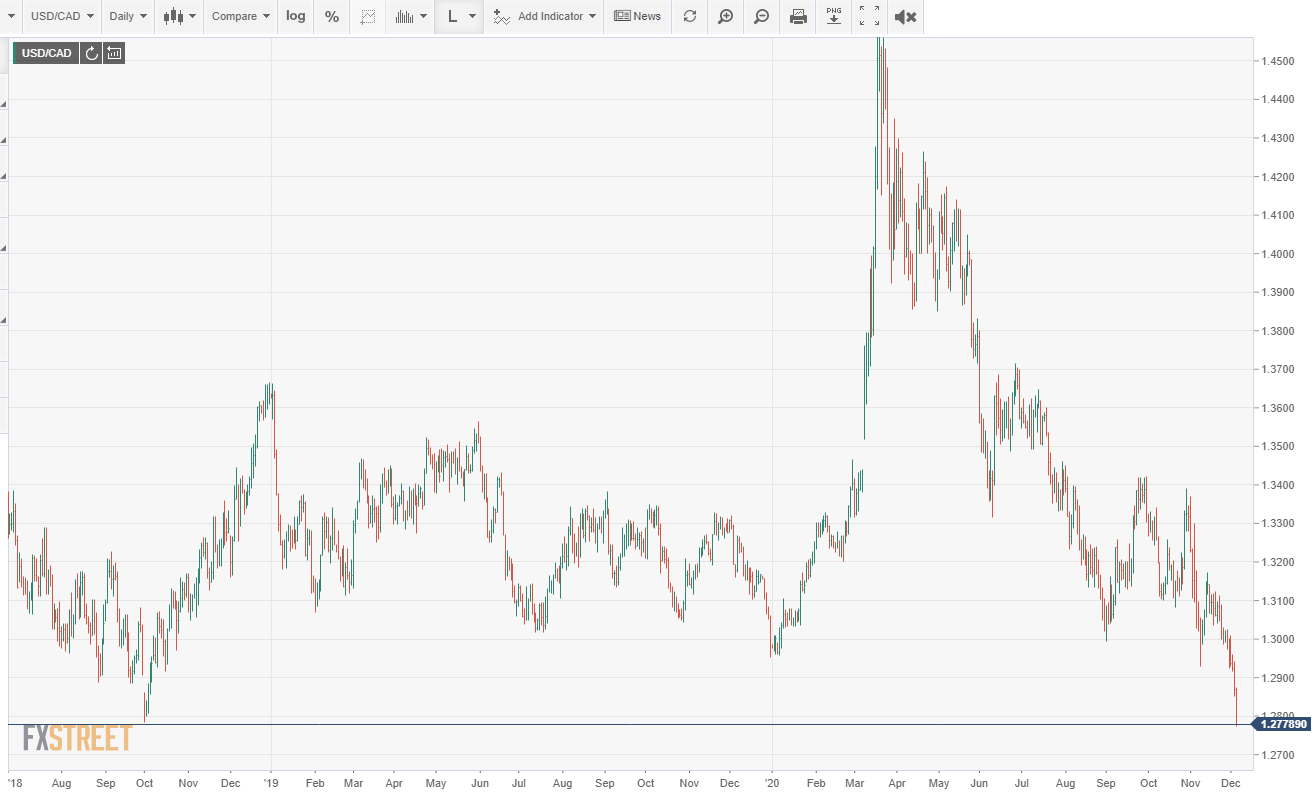

The Canadian dollar was the big winner on the day with the USD/CAD falling to a two-year low at 1.2779. The pair is down 1.6% on the week and 4% since its close on October 30 at 1.3319. The Employment Change Report from Statistics Canada, issued at the same time as Nonfarm Payrolls, was considerably better with 62,000 new jobs, more than three times the 20,0000 forecast. The Canadian unemployment rate dropped to 8.5% rather than remaining at 8.9% as forecast.

The sterling, Swiss franc, Australian and New Zealand dollars were lower by modest amounts against the greenback on Friday though all were higher on the week.

All three US equity averages posted intra-day and closing record highs. The Dow finished up 248.74 points, 0.8% at 30,218.26. The S&P 500 added 0.9%, 32.40 points to 3,699.12 and the Nasdaq climbed 0.70%, 87.05 points to 12,464.23. Friday's gain for stocks was their fourth weekly increase in five weeks with the Dow adding 1% and the Nasdaq Composite 2.2% since Monday's open.

Treasury yields rose also, though restrained by the Federal Reserve bond buying program. The yield on the 10-year Treasury added 5 basis points to 0.973% and the 30-year rose 7 points to 1.741%. The 2-year was unchanged at 0.153%.

Private payrolls

Private payrolls rose 344,000 but government employees at all levels fell 99,000, largely due to the loss of 93,00 temporary census workers, for the third decline in a row.

Warehouse employment increased 145,000 and manufacturing by 27,000. Retail stores lost 35,000 employees, which may be a sign that businesses are not expecting a good holiday season.

The Unemployment Rate (U-3) slipped to 6.7% from 6.9% and the Labor Force participation rate dropped to 61.5% from 61.7% , as people left the workforce and were no longer counted among the jobless. The Underemployment Rate (U-6) , which is a wider measure of joblessness that includes people who have not looked for work recently, fell to 12% from 12.1%.

Average Hourly Earnings rose 0.3% on the month and 4.4% on the year.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.