Markets continue to aggressively play off the idea of a speedy US interest rates reduction and a potential easing of other key CB monetary policy. A cautious attitude on the part of the Central Bank provides visible support to stock indices, as well as returns the demand for currencies of developing countries and raw materials. Despite Powell’s concern about the business environment and the weak reporting of some large companies, the US economy continues to produce strong data, calling into question the need for emergency resuscitation of the economy through the lowering of rates until the end of July.

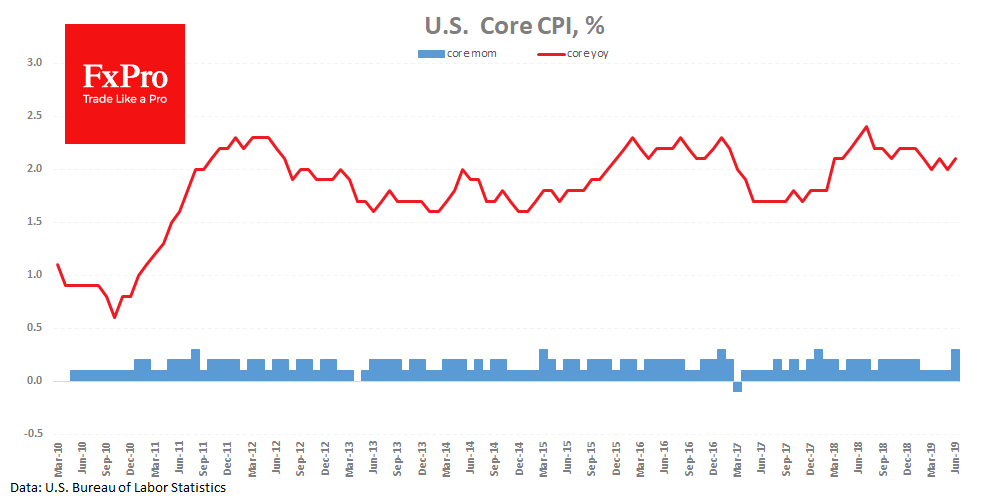

Yesterday, Core CPI surpassed analysts' expectations due to the annual growth rate of 2.1%, which corresponds to a healthy price rate. As the FxPro analysts mention, in previous years the Fed is actively raising the rate, while the FOMC now seems prepared to cut.

Initial jobless claims have been falling for the third week in a row, returning to the levels near 200K.

Alarms in the US economy are certainly beginning to sound. However, the emergency intervention from the Fed's side will look like unnecessary care, rather than prescribing much-needed medicine. Therefore, it now runs the risk of overheating of the economy.

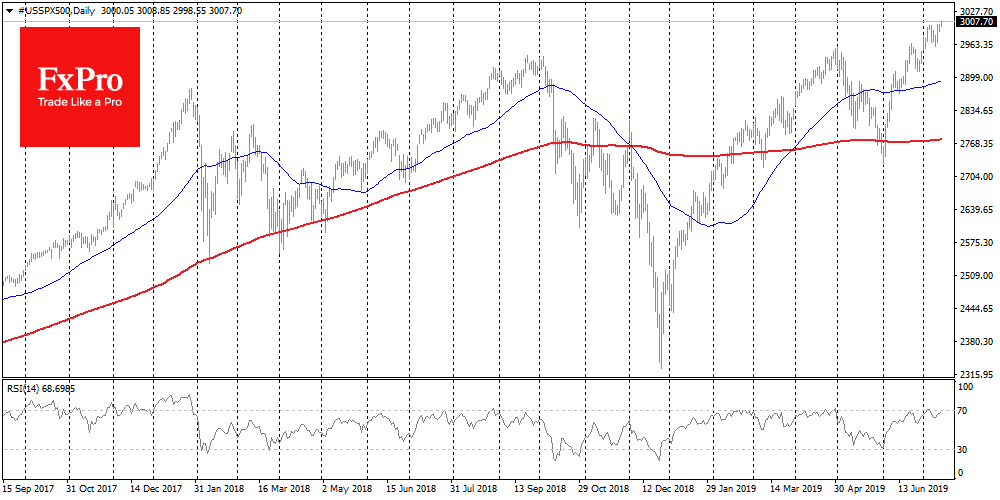

Stocks

All three key US indices - Nasdaq, S&P500 and Dow Jones - updated their historical highs yesterday. On the one hand, there are doubts about the stock market's stability on the trade conflicts and some disappointing corporate reports. On the other hand, this “fragile” market continues to set the records.

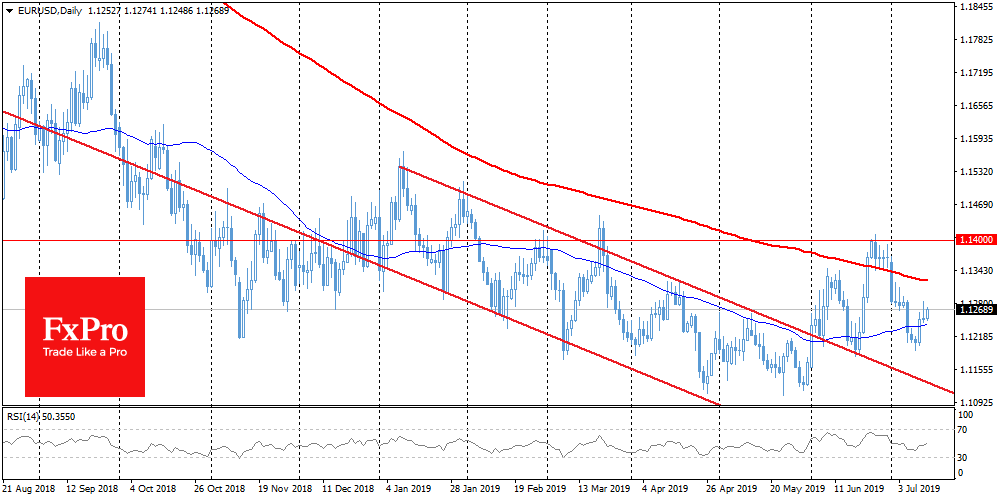

The single currency broke in the downward trend (which had lasted since the beginning of the month) and turned to growth. This is due to the lower interest rates on dollar-denominated debt markets. Strong CPI data brought EURUSD down by 40 points from the levels near 1.1280. However, the investors' positive mood returned the purchases on the pair.

Today it is worth paying attention to the US PPI. Actual data could be a good barometer for the future inflation rates.

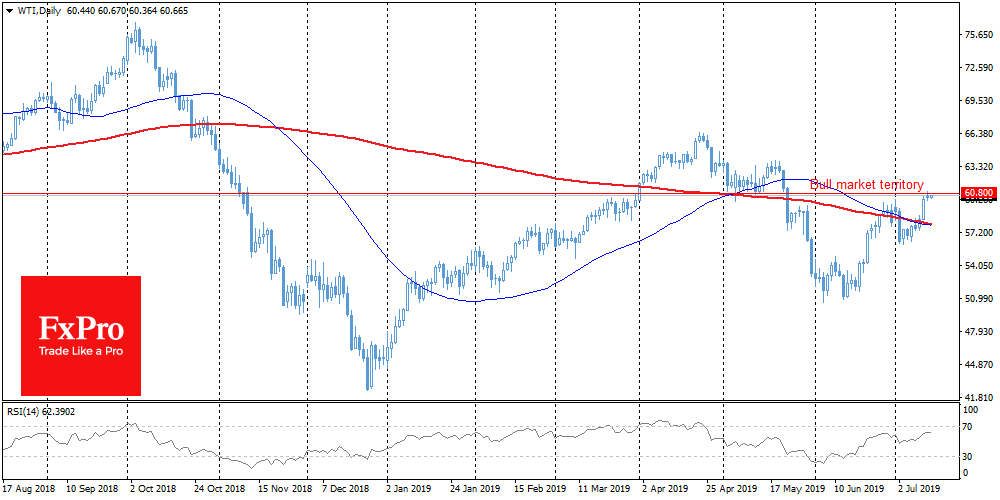

WTI

This week Crude oil prices returned above $60 per barrel. Behind the growth is a general demand for risky assets, alongside news of falling stocks market. That is another sign of the normal state of the American economy. From the side of technical analysis, it is worth paying attention to the fact that WTI quickly recovered from the decline, subsequently re-testing the bullish territory. A 20%-increase formally passes through 60.80 against current levels at 60.70. Any movement above may also attract buyers.

FxPro UK Limited is authorised and regulated by the Financial Services Authority, registration number 509956. CFDs are leveraged products that incur a high level of risk and it is possible to lose all your capital invested. Please ensure that you understand the risks involved and seek independent advice if necessary.

Disclaimer: This material is considered a marketing communication and does not contain, and should not be construed as containing, investment advice or an investment recommendation or, an offer of or solicitation for any transactions in financial instruments. Past performance is not a guarantee of or prediction of future performance. FxPro does not take into account your personal investment objectives or financial situation. FxPro makes no representation and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplied by any employee of FxPro, a third party or otherwise. This material has not been prepared in accordance with legal requirements promoting the independence of investment research and it is not subject to any prohibition on dealing ahead of the dissemination of investment research. All expressions of opinion are subject to change without notice. Any opinions made may be personal to the author and may not reflect the opinions of FxPro. This communication must not be reproduced or further distributed without the prior permission of FxPro. Risk Warning: CFDs, which are leveraged products, incur a high level of risk and can result in the loss of all your invested capital. Therefore, CFDs may not be suitable for all investors. You should not risk more than you are prepared to lose. Before deciding to trade, please ensure you understand the risks involved and take into account your level of experience. Seek independent advice if necessary. FxPro Financial Services Ltd is authorised and regulated by the CySEC (licence no. 078/07) and FxPro UK Limited is authorised and regulated by the Financial Services Authority, Number 509956.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.