- Nonfarm payrolls add 49,000 positions in January as forecast.

- ADP and Employment Indexes were better than predicted in January.

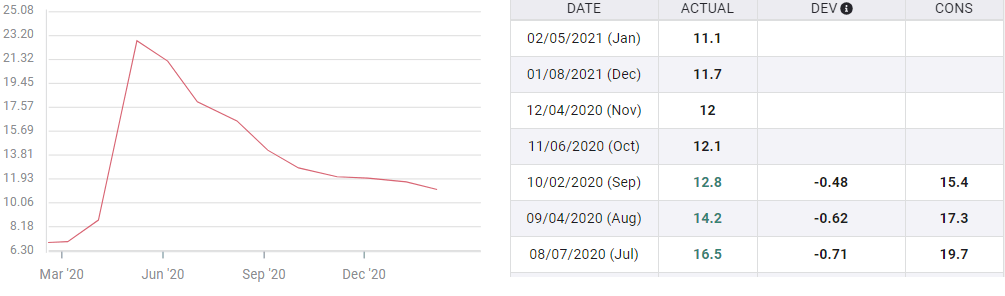

- Unemployment rate falls to 6.3% from 6.7%, underemployment to 11.1%.

- Dollar fades from January and February rally, remains bid.

- December's job losses increase to 227,000 from 140,000.

American employers resumed hiring in January and the unemployment rate fell to a pandemic low as California ended its lockdown and viral rates fell across the country.

Nonfarm Payrolls rose 49,000 and the unemployment rate dropped to 6.3%, reported the Labor Department on Friday. Analysts surveyed by Reuters had predicted an expansion of 50,000 and the jobless rate to be unchanged at 6.7%.

Despite the expected NFP performance, credit and currency markets faded from their positions before the release as many participants had been looking for better numbers. Earlier in the week ADP's clients had reported 174,000 new employees, more than three times the forecast and the Manufacturing Employment PMI registered a 19 month high. Estimates for payrolls ranged from -240,000 to 400,000.

Market response

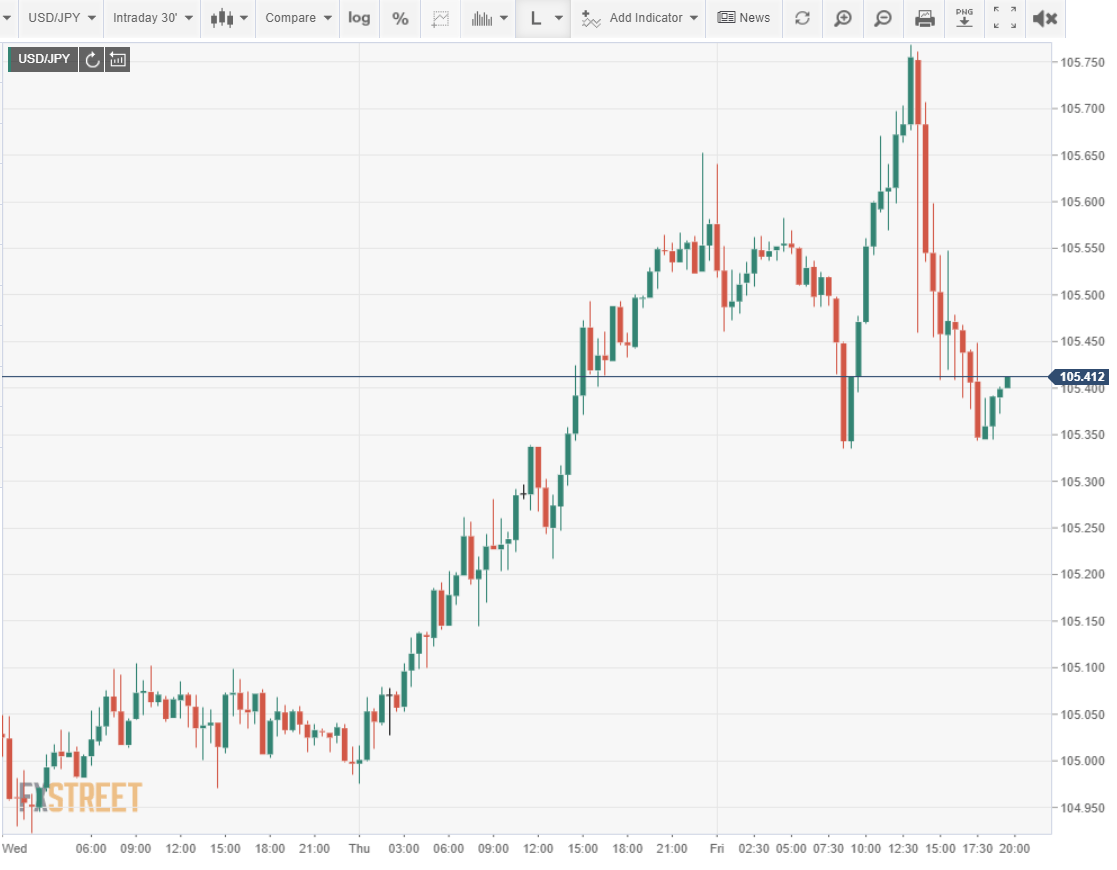

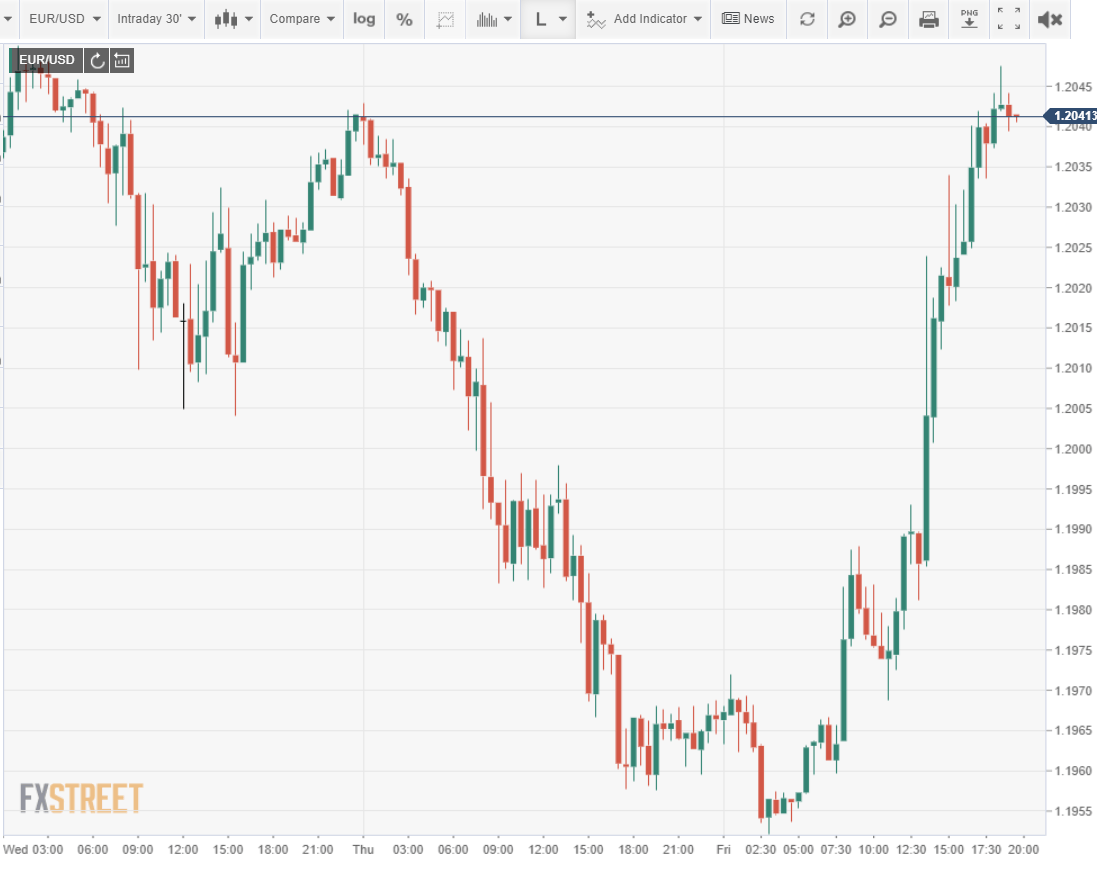

The USD/JPY was at 105.75, a three-month high just before the release and the EUR/USD was trading at 1.1987.

By the early afternoon the USD/JPY had dropped to 105.41 and the euro had claimed almost a figure from its European lows to 1.2041.

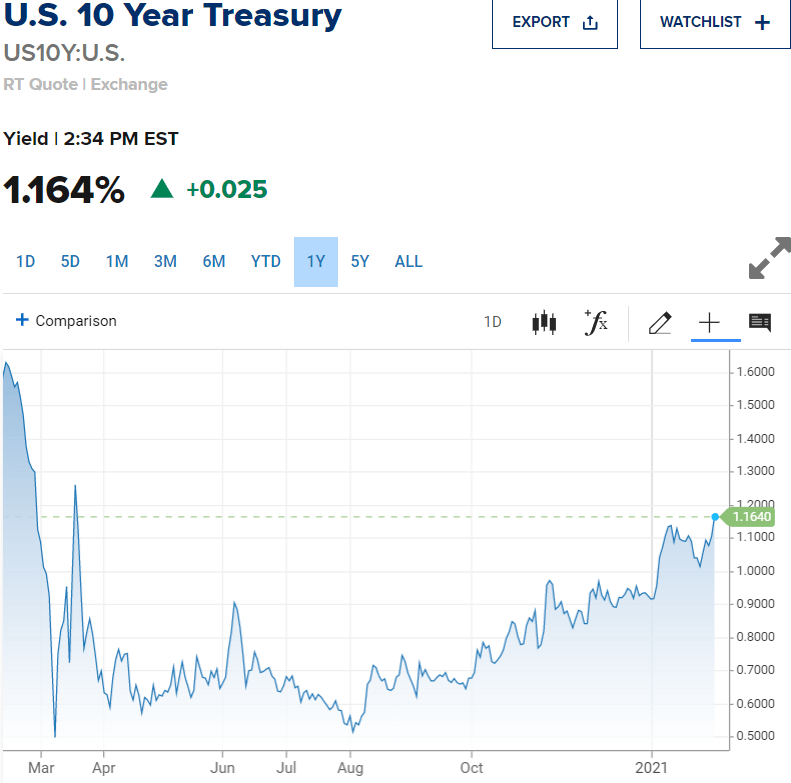

Treasury yields also pulled back with the 10-year return falling from 1.173% just before 8:30 am EST, to 1.164% in mid-afternoon, though it remained more than two points higher from Thursday's close.

Equities were largely unaffected with the Dow up 90.18 points at 2:37 pm EST and the S&P 500 ahead 15.99 points from their futures position of +123 and +14.45 prior to the release.

Unemployment rate

The decline in the unemployment rate was tied to a drop in the Labor Force Participation Rate which slipped to 61.4% from 61.5% in December as 406,000 people left the work force and were no longer counted as unemployed. To be included in the headline unemployment rate (U-3) an individual must have looked for work in the prior month. A more representative measure, the so-called underemployment rate (U-6), that counts discouraged and part-time workers, also decreased to 11.1% from 11.7% in December.

Underemployment rate

Almost a year after the March and April collapse in employment over 10 million people are yet unemployed. The jobs losses were and remain concentrated in the restaurant, travel, retail, and hospitality sectors.

The December lockdown in California, since rescinded, reversed the seven-month positive trend in job growth. The initially reported loss of 140,000 jobs was revised to -227,000 and November's addition of 336,000 was lowered to 264,000.

Hiring in January was centered in the Labor Department categories of employment and professional services, (97,000), local government education (teachers and school personnel) and wholesale trade (14,000). Retail shed 38,000 workers after adding 135,000 in December for the holidays. Health care lost 30,000 positions.

Distribution of vaccines have encouraged business optimism where investment spending has remained strong. Since early January US positive tests are down 35%, hospitalizations 28% and ICU occupied beds 20% and that has taken place before vaccines use has become widespread enough to affect transmission.

Gross Domestic Product fell 3.5% on the year in 2020 though the fourth quarter saw an annualized rate of 4%. An early estimate for first quarter growth from the Atlanta Fed dropped to 4.6% after the NFP numbers from 6% prior.

The Biden administration's $1.9 trillion stimulus and rescue package, that includes an undetermined direct payment to most Americans and extended unemployment benefits, has not yet passed Congress, where Republicans are offering a smaller proposal. However, the Democrats have just enough votes to pass the bill through the House and Senate without assistance.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD failed just ahead of the 200-day SMA

Finally, AUD/USD managed to break above the 0.6500 barrier on Wednesday, extending the weekly recovery, although its advance faltered just ahead of the 0.6530 region, where the key 200-day SMA sits.

EUR/USD met some decent resistance above 1.0700

EUR/USD remained unable to gather extra upside traction and surpass the 1.0700 hurdle in a convincing fashion on Wednesday, instead giving away part of the weekly gains against the backdrop of a decent bounce in the Dollar.

Gold keeps consolidating ahead of US first-tier figures

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Bitcoin price could be primed for correction as bearish activity grows near $66K area

Bitcoin (BTC) price managed to maintain a northbound trajectory after the April 20 halving, despite bold assertions by analysts that the event would be a “sell the news” situation. However, after four days of strength, the tables could be turning as a dark cloud now hovers above BTC price.

Bank of Japan's predicament: The BOJ is trapped

In this special edition of TradeGATEHub Live Trading, we're joined by guest speaker Tavi @TaviCosta, who shares his insights on the Bank of Japan's current predicament, stating, 'The BOJ is Trapped.'