As we move towards the second half of 2020, it's fair to say that the majority of us did not forecast what took place between January - June.

Markets and life in general, have both been rocked by the COVID-19 crisis. However as we try to forecast the remainder of the year, what are the points to consider? And could there be more historic moves in financial markets?

Key Fundamentals to consider

Second Wave

Entering Q3, there are several key points to consider. Firstly markets will be paying close attention to a potential second wave of coronavirus cases. As some of the world's economies have slowly started lifting lockdown restrictions, and returning to work. We’ve seen some countries like Brazil and the U.S. report a spike in new infections.

In the case of the U.S. this has seen the likes of Texas, Florida and Oklahoma all register a daily increase in new cases.

A fortnight ago, stock indices like the S&P500 had their biggest 1- day decline since the peak in March, before recovering. Many believe that the selloffs weren’t sustained as the increase in cases were a result of more testing, rather than a second wave.

However from seeing the recent reactions, any further waves of COVID-19 this year could see us return to the levels of volatility seen in March.

Jobs Market

Another key point will be the impact of the global jobs market. After the record amount of job losses in March and April in particular. May saw a record amount of jobs created globally, led by the U.S. which added over 2.5 million to its workforce.

This Thursday will see the NFP number for June, currently expected to show an addition of 3 million jobs, which would be a new record high.

As the European economies have also reopened many will see jobs recovered, or hanging in the balance due to furlough schemes.

What will be interesting is to see how many jobs are kept once furlough ends. With Consumer spending still yet to fully pick up to pre-pandemic levels, could a rise in bankruptcy of businesses see the permanent loss of certain jobs?

The UN has recently stated that the equivalent of 400 million jobs could be lost in Q2 as working hours fall.

U.S. Election

The U.S. election, as with many, usual market moving fundamentals, have all been sidelined as the world battles COVID-19.However as we draw near to the election date, markets will begin to price in who they believe will be the winner.

Taking all the above into consideration, In recent weeks the Fed, OECD, World Bank and IMF have all pointed to contraction for the remainder of 2020, possibly into 2021.

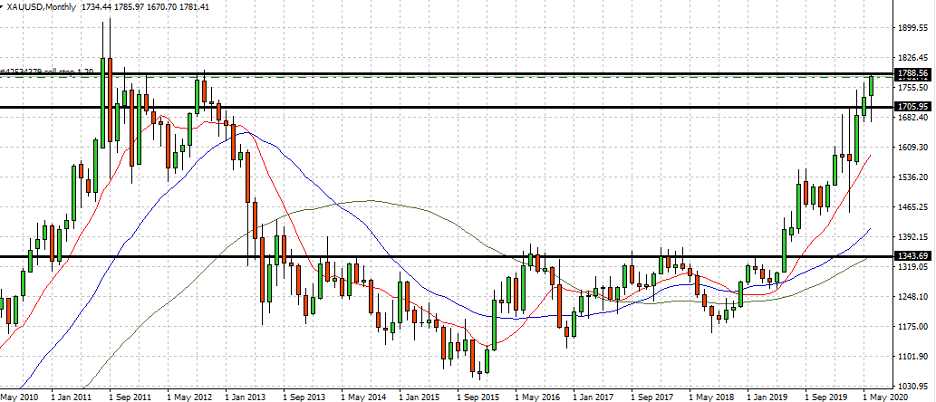

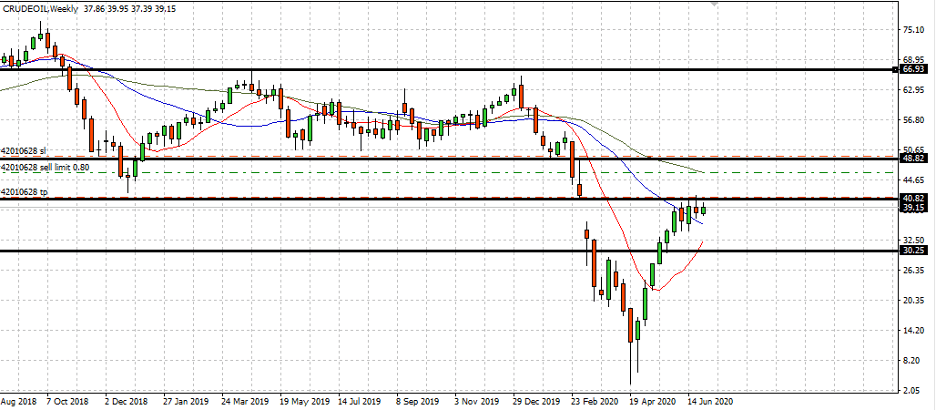

However equity markets have continued to recover from the lows seen in March. Gold edges ever closer to break the $1,800 level, and Crude Oil has so far recovered from the dismal lows of April.

Looking forward, how can we expect these markets to move in the next 6 months?

Gold

Gold looks as though it is currently at its long term resistance level. However if broken, we could see new record highs.

Crude Oil

No one saw Crude falling to the unprecedented lows in April, however since the 9.7 millions bpd OPEC cuts, we’ve seen a rally in price. This could still head to as high as $66 should demand continue to pick up and production cuts are maintained.

S&P500

Bulls have bought U.S. indices like never before during Q2. This comes as many remained optimistic of a rebound in economic activity. Jobs are slowly coming back, so is confidence. The benchmark index could reach a new high in the mid-term. However there may be yet another record selloff further down the road.

Visit here to see raw, real-time ECN spreads

Trading any financial instrument on margin involves considerable risk. Therefore, before deciding to participate in margin trading, you should carefully consider your investment objectives, level of experience and risk appetite. Most importantly, do not invest money you cannot afford to lose. Consulting with your investment counselor, attorney or accountant as to the appropriateness of an investment in margin trading is recommended. This electronic mail message is intended only for the person or entity named in the addressee field. This message contains information that is privileged and confidential. If you are not the addressee thereof or the person responsible for its delivery, please notify us immediately by telephone and permanently delete all copies of this message. Any dissemination or copying of this message by anyone other than the addressee is strictly prohibited.

Recommended Content

Editors’ Picks

AUD/USD rises to two-day high ahead of Aussie CPI

The Aussie Dollar recorded back-to-back positive days against the US Dollar and climbed more than 0.59% on Tuesday, as the US April S&P PMIs were weaker than expected. That spurred speculations that the Federal Reserve could put rate cuts back on the table. The AUD/USD trades at 0.6488 as Wednesday’s Asian session begins.

EUR/USD holds above 1.0700 on weaker US Dollar, upbeat Eurozone PMI

EUR/USD holds above the 1.0700 psychological barrier during the early Asian session on Wednesday. The weaker-than-expected US PMI data for April drags the Greenback lower and creates a tailwind for the pair.

Gold price cautious despite weaker US Dollar and falling US yields

Gold retreats modestly after failing to sustain gains despite fall in US Treasury yields, weaker US Dollar. XAU/USD struggles to capitalize following release of weaker-than-expected S&P Global PMIs, fueling speculation about potential Fed rate cuts.

Ethereum ETF issuers not giving up fight, expert says as Grayscale files S3 prospectus

Ethereum exchange-traded funds theme gained steam after the landmark approval of multiple BTC ETFs in January. However, the campaign for approval of this investment alternative continues, with evidence of ongoing back and forth between prospective issuers and the US SEC.

Australia CPI Preview: Inflation set to remain above target as hopes of early interest-rate cuts fade

An Australian inflation update takes the spotlight this week ahead of critical United States macroeconomic data. The Australian Bureau of Statistics will release two different inflation gauges on Wednesday.