All eyes are on Fed interest rate decision on Wednesday while later in the week, traders’ attention will turn to U.S. non-farm payrolls report on Friday. In the meanwhile, traders keep a tab on the 45th President of the United States, Donald Trump, who was not only fast in taking actions, but he shocked the whole country, as well as other countries around the world in just one week since he took office and drove the greenback sharply lower.

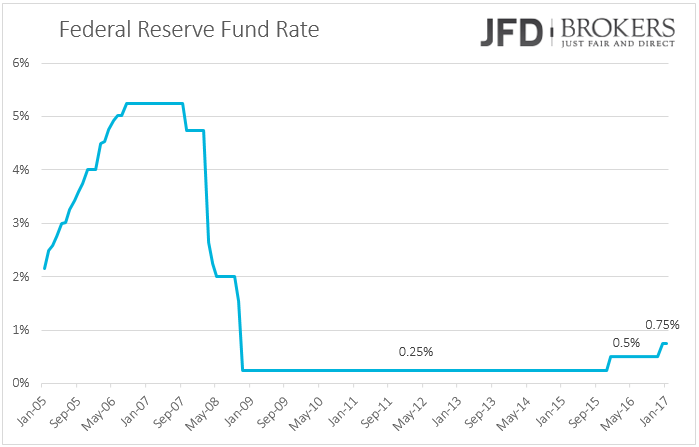

Going back to the previous Fed meeting on December 14th the Fed raised its interest rates for the second time in a decade to 0.75% from 0.5% before and the U.S. dollar moved broadly higher. No one was surprised from the rate hike while Fed policymakers projected three more in 2017 and Yellen said that more than three are possible, as the economy is performing well. Thus, if the economy keeps its solid improvement, a gradual rate hike is likely in the next couple of years. Even though, the gross domestic product Q4 increased annually by 1.9% in the three months to December, higher than the annual 1.7% expansion the three months to September, the growth is well below the GDP figures two years ago. The economy grew only 1.6% in 2016, the weakest pace since 2011.

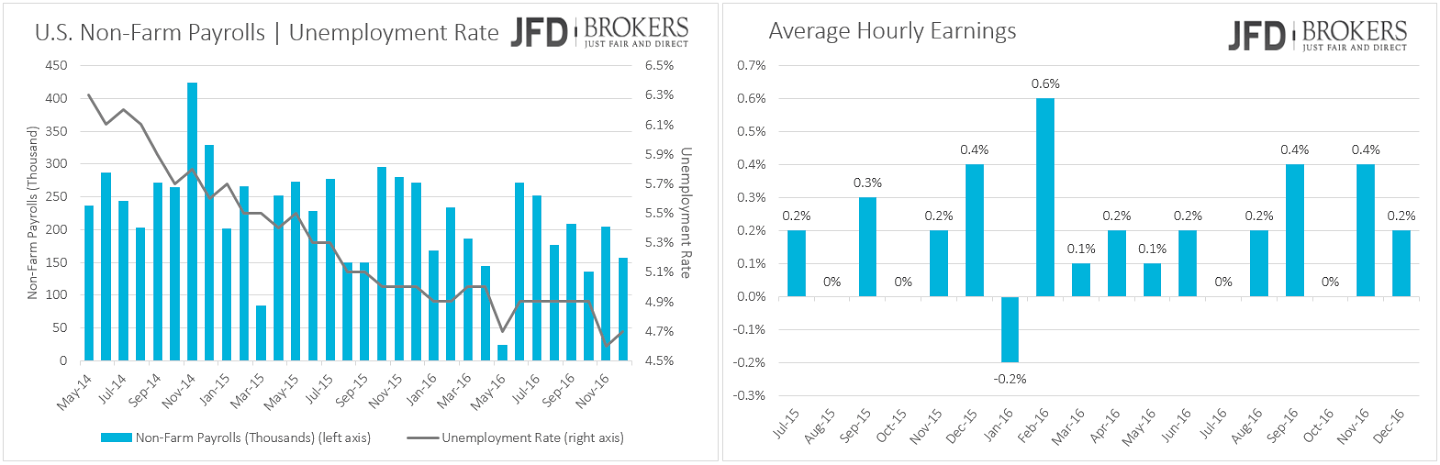

It’s important to mention that inflation rate met Fed’s 2% inflation target and even rose above it, showing that people are more confident to spend money, keeping the economy’s gears working. The headline CPI showed that consumer prices picked up by 2.1% yoy in December, as expected, from an increase of 1.7% the month before. If Trump successfully implements his fiscal plan in its budget proposal, which is scheduled to take place on February 6th, consumer inflation will surely rise, giving the Federal Reserve wider space for an interest rate hike. Meanwhile, the U.S. unemployment rate is 4.7% , according to December’s figures, a level the Fed considers near full employment and they expect to continue that way in the new year. The U.S. labour market is predicted to add 165K jobs in January from 156K the month before this Friday.

On Wednesday, the Fed wraps up its first monetary policy meeting since raising policy rates by a quarter basis point in December. The U.S. Federal Reserve is expected to keep interest rates unchanged for now as the United States are under the administration of Donald Trump, who has very different opinions from the last U.S. President. Thus, the central bank will probably keep the current monetary policy on hold, awaiting a greater clarity on his economic policies. If the economy continues to advance, we may see a rate hike in March when Fed Chair Janet Yellen will give also a speech, explaining Fed’s decision and moreover, appraisal for the economy will take place by Fed to update its economic projections for the following twelve months.

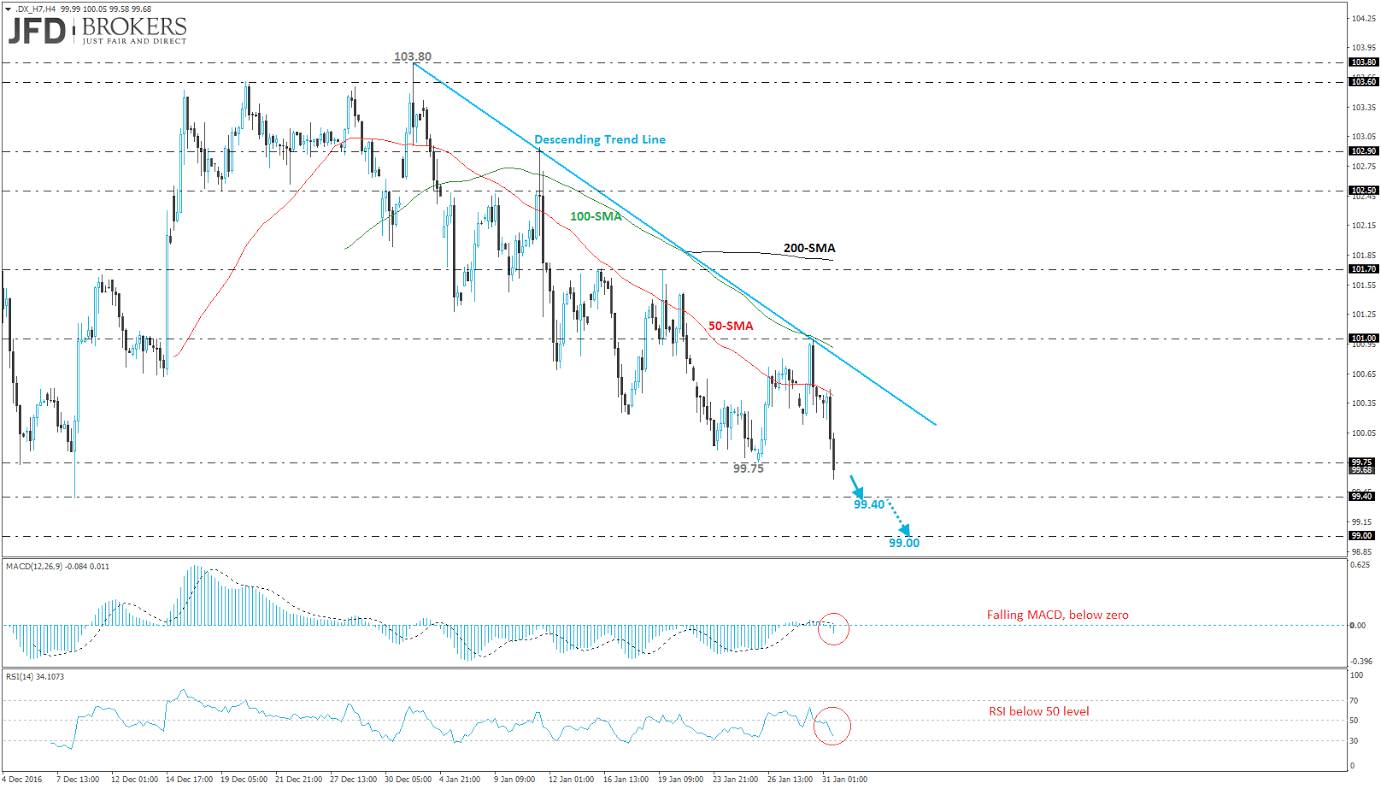

Dollar Index – Technical Outlook

The U.S. Dollar Index (.DX_H7) created an aggressive rally to the upside while it hit a fresh 14-year high, near 103.80 resistance barrier, after Fed raised rates in December. However, over the last five weeks, the price is falling and plunged more than 2.2% in January. Currently, the index is recording the seventh red week in a row while it slipped below the three SMAs (50, 100 and 200 SMAs), on the 4-hour chart, and is approaching the 99.40 support barrier or moreover, the 99.00 handle.

On the 4-hour chart, the technical indicators seem to be in agreement with the bearish scenario as both are following a negative path. The MACD oscillator fell below the zero line while the RSI indicator is sloping downwards with strong momentum and it is holding below the 50 level.

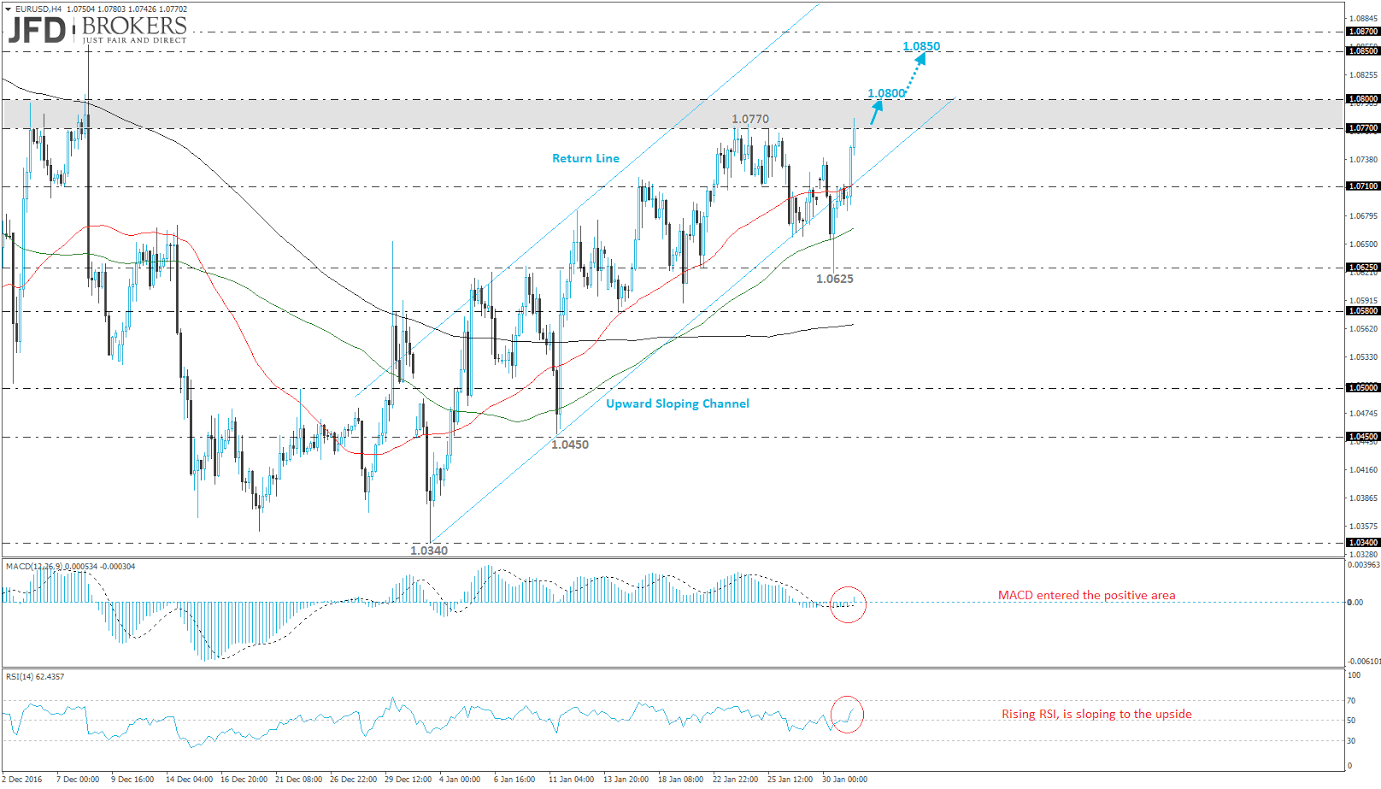

EUR/USD – Technical Outlook

The most traded currency in the world – the EUR/USD pair – traded higher in January as it surged more than 2.2% and halted three consecutive negative months. The euro jumped to a fresh eight-week high against the U.S. dollar at 1.0770 price level and following the strong rebound on the 1.0625 support barrier. Over Monday’s session, the single currency pair dropped below the upward sloping channel but failed to end the day below the ascending trend line. Currently, is approaching the 1.0800 strong psychological level which tried several times to hit it. If the price surpasses the latter level, it would be exposed towards 1.0850.

Technical indicators are moving sharply higher within its positive territory. The MACD oscillator has just entered the bullish path while the RSI indicator lies slightly below the 70 level. In addition, the price climbed above the three SMAs (50, 100 and 200 SMAs) on the 4-hour chart, as well as the two moving averages (50 and 100 SMAs) on the daily chart.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD comes under pressure near 1.0630

Further gains in the Greenback encourage sellers to maintain their control over the risk complex, forcing EUR/USD to retreat further and revisit the 1.0630 region as the US session draws to a close.

GBP/USD retreats toward 1.2450 on modest USD rebound

GBP/USD edges lower in the second half of the day and trades at around 1.2450. Better-than-expected Jobless Claims and Philadelphia Fed Manufacturing Index data from the US provides a support to the USD and forces the pair to stay on the back foot.

Gold is closely monitoring geopolitics

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Ripple faces significant correction as former SEC litigator says lawsuit could make it to Supreme Court

Ripple (XRP) price hovers below the key $0.50 level on Thursday after failing at another attempt to break and close above the resistance for the fourth day in a row.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.