- The first US Consumer Price Index report for 2023 is set to show a minor pickup in underlying price pressures.

- Robust labor market figures and a bounce in used vehicle costs have been worrying markets.

- A minor miss would trigger a massive retreat for the US Dollar and calm Fed-fearing markets.

Clunkers are causing calamity – at least for stock markets, which have clung to Manheim's report about the costs of used vehicles to fear robust inflation figures. The United States Consumer Price Index (CPI) report has been the No. 1 market mover in 2022. The new year is no different.

Here is where we stand ahead of the US CPI release for January, scheduled for Tuesday, February 14th at 13.30 GMT, and how I expect markets to respond.

Consumer Price Index Background

The Federal Reserve (Fed) is focused on bringing inflation down, and within the components of price rises, it has been zeroing in on costs related to wages. Everything else is coming down. Headline inflation has dropped dramatically thanks to the drop in fuel prices, while supply-chain issues no longer buoy the costs of goods.

The Fed's higher interest rates are working by bringing down housing costs via elevated mortgage costs – and further declines are on the horizon. That leaves "non-shelter core services costs" – or wage-related inflation in layman's terms.

While the latest Nonfarm Payrolls (NFP) report showed an ongoing decline in the pace of annual earnings, the 4.4% level exceeded expectations. Moreover, the leap of 517,000 jobs shocked markets. Will inflation also follow?

As in previous releases, the focus is on Core CPI MoM. Economists expect a rise of 0.4% MoM in January, 0.1% above the original read of 0.3% for December, or equal to the revised version of the Consumer Price Index data.

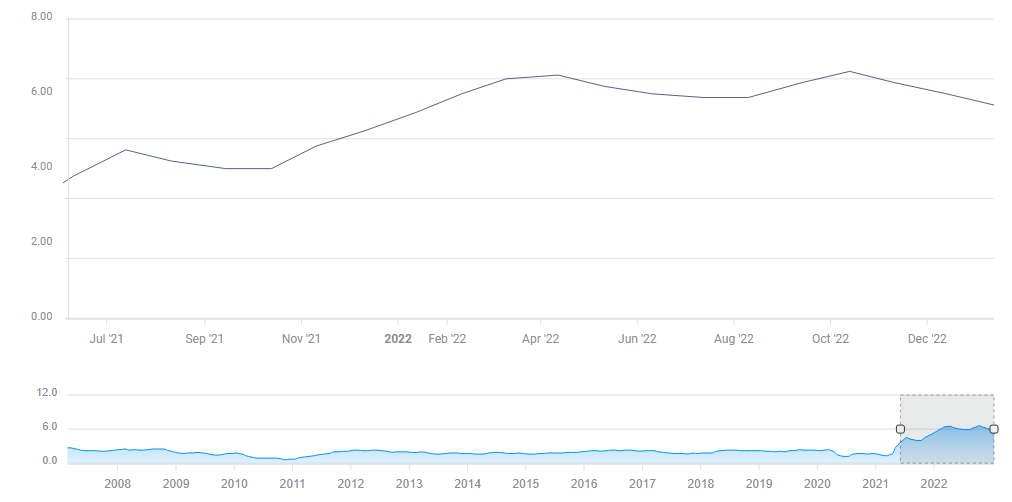

Core CPI is coming down:

Source: FXStreet

Why markets expect a higher outcome, and why another US Dollar surge is unlikely

As mentioned at the outset, market expectations may be higher due to the reported rise in prices of used cars. Cars are goods, not services, but their costs have a significant impact on overall Core CPI.

Another driver of higher prices comes from the leap in jobs reported in the NFP report – yet this argument is somewhat weakened by the moderation in wage growth.

The big-known unknown is annual revisions to the basket of goods and services the CPI comprises. Once a year, authorities update the weights of costs according to what consumers do.

If the price of lettuce jumped early in 2022 and shoppers ditched it for spinach, the latter will have more impact on overall inflation calculations than the former. The same goes for services, such as going less to the barber shop if beards go out of fashion.

According to some economists, these changes may trigger a bounce in January's Consumer Price Index report. They may or may not be correct, but the mere talk of stronger has already been pushing the US Dollar higher and stocks lower.

It also means that without a positive surprise, recent moves may come undone. I expect the Greenback to fall on an increase of 0.4% in CPI. It may also suffer an adverse "buy the rumor, sell the fact" response in response to a 0.5% read.

It would take an unequivocally strong 0.6% figure to send the US Dollar up. A downbeat 0.3% figure or below would send it .

Final thoughts

The Federal Reserve's hawkish tone in recent days has also triggered a risk-averse mood, and expectations for a calmer tone for officials could also add to a potential reversal in markets.

I would like to emphasize that the US Consumer Price Index report is the No. 1 market mover, triggering massive volatility. Will it be the kind of volatility that traders fall in love with on Valentine's Day? It could also trigger a heart-breaking whipsaw. Trade with care and low leverage.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.