The Dollar Index lost 0.4% on the day to 98.30 on Friday, as other major currencies were lifted by optimism on both U.S.-China trade talks and Brexit.

The euro gained 0.3% to $1.1042, extending its rally to a third session. Later today, the eurozone August industrial production will be reported (+0.3% on month expected).

The British pound surged 1.7%, following a 1.9% rally in the prior session, to a three-month high of $1.2649. E.U. chief Brexit negotiator Michel Barnier said on Friday that the U.K. and the E.U. "could see a pathway" to a Brexit deal. On Sunday, E.U. officials were briefed that talks had not made enough progress, and both sides' "intense technical discussions" would continue on Monday before E.U. member states were updated on the progress at a meeting in Luxembourg on Tuesday.

President Trump said the White House would suspend a part of the tariffs on Chinese imports set to be active next week, while China would increase purchases of U.S. agricultural products.

U.S. official data showed that import prices rose 0.2% on the month (+0.0% expected, -0.5% in August). The University of Michigan Sentiment Index came in at 96.0 (preliminary) in October (92.0 expected, 93.2 in September).

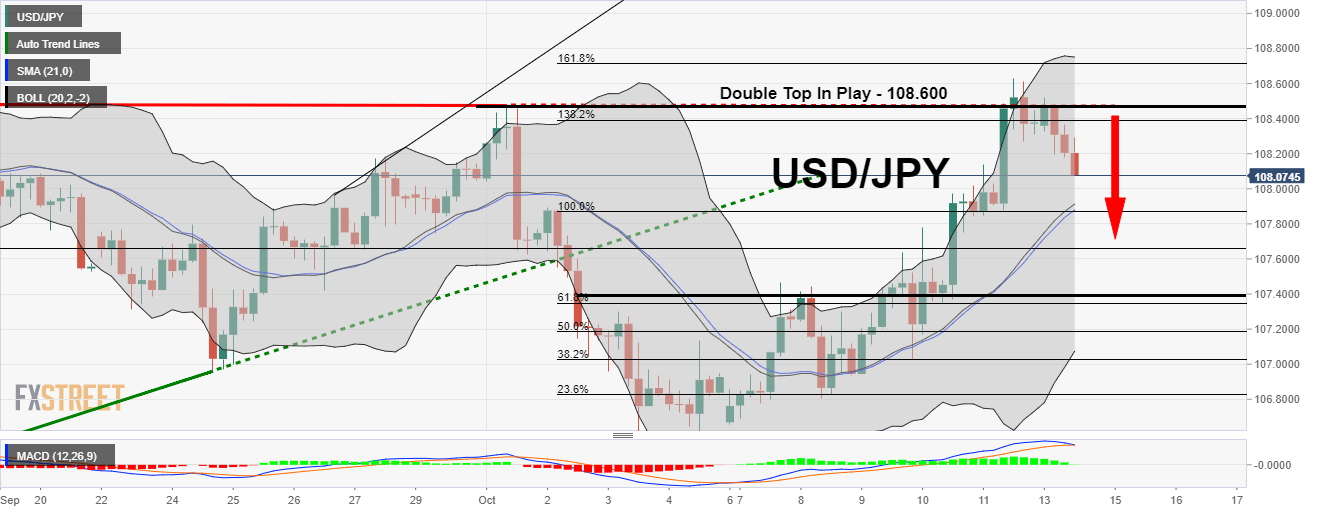

USD/JPY - Double Top Pattern Pushing USD/JPY Lower

The USD/JPY closed at 108.420 after placing a high of 108.628 and a low of 107.846. The overall movement of USD/JPY remained Bullish that day.

On Friday at 4:50 GMT, the M2 Money Stock from Bank of Japan remained flat 2.4%.

On Friday, Donald Trump announced that the US & China had reached a solid phase one deal. The deal included purchases of US agricultural goods from China and specific intellectual property measures and concessions related to financial services and currency. In return, the US agreed to delay a tariff increase. The United States was due to raise tariffs on Chinese goods to 30% next week, but after the meeting of Trump with Chinese premier Liu He on Friday, the US agreed to suspend its next tariff hike on Chinese goods.

After the Trump meeting with Chinese Premier on Friday, the optimism due to partial deal possibility in December emerged in the market and gave hope to an end in the economic contradiction caused by prevailing US-China Trade War. The Trade war has been affecting the growth of the global economy for more than 15 months and has increased the fears for the US to fall into Recession.

After this news, US Treasury yields rose to their highest of October; the 10-Year Treasury Note showed a closing of 1.73% at the end of the week. The demand for safe-haven assets dropped, and USD/JPY prices showed a sharp rise.

USD/JPY - Daily Technical Levels

Support Resistance

108 108.75

107.57 109.07

106.81 109.82

Pivot Point 108.32

USD/JPY - Daily Trade Sentiment

The safe-haven currency pair gained bullish momentum as the demand for haven assets slipped on the U.S. China partial trade deal. The USD/JPY extends to trade following a bullish violation of a long-held 61.8% Fibonacci retracement level of 107.350. For now, this level is likely to work as support. The MACD is likely to give us a bearish crossover, supporting the bearish bias in the USDPJPY.

On the upper side, the USDJPY is facing resistance at 108.600, the double top pattern. The candlestick pattern "three black crows" are suggesting odds of a bearish breakout. On the lower side, the USD/JPY can trade bearish until 107.800 today.

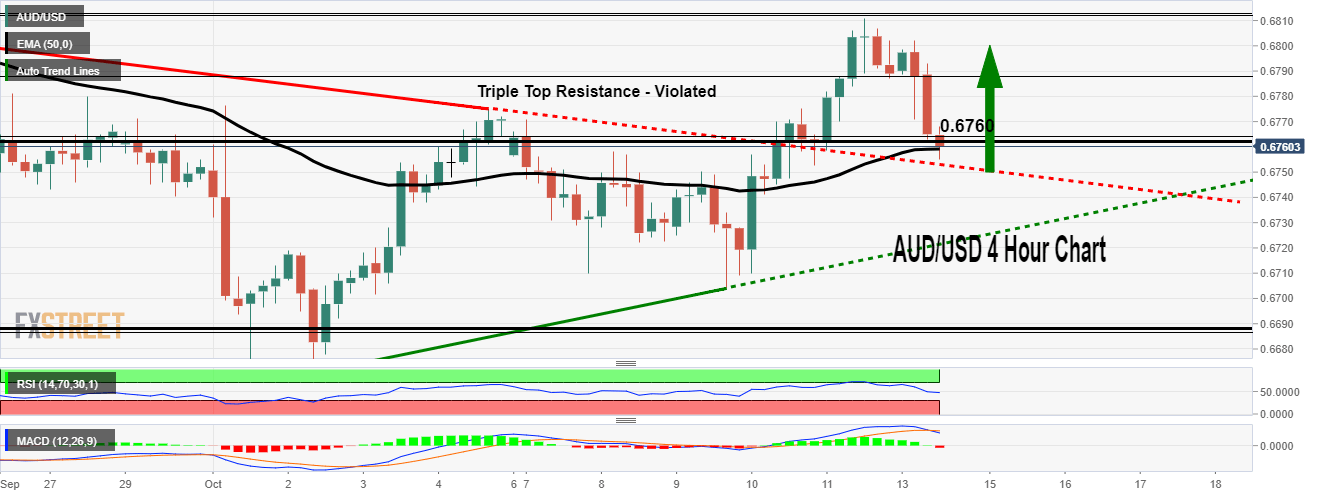

AUD/USD – 50 Periods EMA Supports

The AUD/USD was closed at 0.67903 after placing a high of 0.68104 and a low of 0.67530. The overall movement of AUD/USD remained Bullish that day.

The demand for Australian Dollar kept limited at the ending day of the week because of the speculations about the possibility of a further rate cut by Reserve Bank of Australia in its next meeting. And the lack of economic release from Australia also caused the movement of this pair AUD/USD dependant on US Dollar and Sino-American Trade Talks.

The US President, Donald Trump, and Chinese Premier, Lie He met each other on Friday, and after their meeting, a partial deal was announced between them. The deal included holding the due tariff on Chinese goods by America against more US farm goods purchases from china and some particular measures of intellectual property and concessions on financial services.

Australia is the most important trading partner of China, was profoundly affected due to optimism of US-China trade talks. The deal suggested growth in the Chinese economy and more trade flow between Australia and China hence caused an upward trend in AUD.

AUD/USD moved in an upward direction after the news about the partial deal between the US & China came out. The upward movement was further supported by the weak macroeconomic release from the US side on Friday.

AUD/USD - Technical Levels

Support Resistance

0.6773 0.6812

0.6752 0.6831

0.6712 0.6871

Pivot Point 0.6792

AUD/USD - Daily Trade Sentiment

During the last week, the AUD/USD violated a long-held 0.6770 resistance area and placed a high of around 0.6800 on the 4-hour timeframe.

Looking at the MACD and Stochastics, the AUDUSD has crossed below the mid-level, suggesting a bearish trend. The pair is completing 50% Fibonacci retracement at 0.6850, and below this, it can also go after 61.8% Fibo level of 0.6740. Hence, the AUD/USD pair may trade bullish above 0.6840 today.

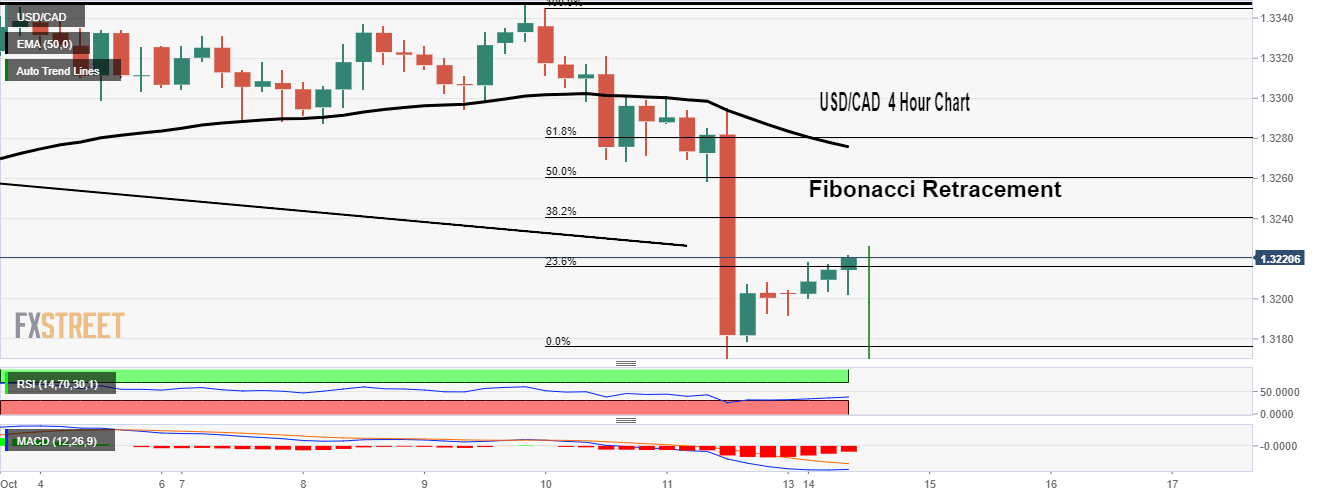

USD/CAD - Oversold Pair Look for Correction

The USD/CAD closed at 1.31970 after placing a high of 1.33000 and low of 1.31708. The overall movement of USD/CAD remained strong Bearish that day.

The Strong Canadian Jobs data on Friday made Canadian Dollars stronger against the US Dollars when there was a significant difference shown in the actual and forecasted job change. The Canadian Dollar – Loonie gained in the view that Bank of Canada will hold its Interest rates this month.

At 17:30 GMT, the Employment Change for September forms Canada showed growth of 53.7K against 11.2K forecasted. And the Unemployment Rate of Canada showed a decrease to 5.5% in September from previous months' 5.7%.

A strong Canadian Jobs gave a view of the strong Canadian economy in the current global economic slowdown. It decreased the possibility of any rate cuts in October by Bank of Canada and made Canadian Dollar stronger against the US Dollar.

Even all other central banks of the largest economies like the United States and European Union have cut their Interest rates this year, the Central Bank of Canada has not yet made any cut, and the chances for reductions in the future are also minimal.

The rise in prices of Canadian Dollar caused an inverse effect on USD/CAD and made a robust Bearish trend for it on Friday.

The weak US macroeconomic data on Friday and US-China partial deal gave further gain to Loonie.

On Friday at 17:30 GMT, the Import Prices from the US Bureau of Statistics for September came as 0.2% against -0.1% expected. At 19:00 GMT, the Prelim UoM Consumer Sentiment from the University of Michigan showed growth and came as 96.0 against 92.0 expectations. The inflation expectations of the United States came at 2.5% for this month.

Donald Trump announced that the US & China had reached a solid phase one deal on Friday and suspended the due 30% tariff on Chinese goods as part of a partial agreement between US & China. The USD/CAD showed a sharp decline dropped to the lowest in the past four weeks.

USD/CAD - Technical Levels

Support Resistance

1.3146 1.3269

1.3097 1.3344

1.2974 1.3467

Pivot Point 1.322

USD/CAD - Daily Trade Sentiment

The USD/CAD fell dramatically from 1.3280 to 1.3180 area to enter the massive oversold region. The recent bullish candle followed by a robust bearish candle is suggesting that the bears might be exhausted, and bulls may enter the market.

The USD/CAD is now likely to go for 38.2% Fibonacci retracement at 1.3240, where the bullish breakout is expected to lead USD/CAD towards a 50% Fibo level of 1.3260. The USD/CAD traders may look for buying above 1.322.

Risk Warning: CFD and Spot Forex trading both come with a high degree of risk. You must be prepared to sustain a total loss of any funds deposited with us, as well as any additional losses, charges, or other costs we incur in recovering any payment from you. Given the possibility of losing more than your entire investment, speculation in certain investments should only be conducted with risk capital funds that if lost will not significantly affect your personal or institution’s financial well-being. Before deciding to trade the products offered by us, you should carefully consider your objectives, financial situation, needs and level of experience. You should also be aware of all the risks associated with trading on margin.

Recommended Content

Editors’ Picks

US economy grows at an annual rate of 1.6% in Q1 – LIVE

The US' real GDP expanded at an annual rate of 1.6% in the first quarter, the US Bureau of Economic Analysis' first estimate showed on Thursday. This reading came in worse than the market expectation for a growth of 2.5%.

EUR/USD retreats to 1.0700 after US GDP data

EUR/USD came under modest bearish pressure and retreated to the 1.0700 area. Although the US data showed that the economy grew at a softer pace than expected in Q1, strong inflation-related details provided a boost to the USD.

GBP/USD declines below 1.2500 with first reaction to US data

GBP/USD declined below 1.2500 and erased a portion of its daily gains with the immediate reaction to the US GDP report. The US economy expanded at a softer pace than expected in Q1 but the price deflator jumped to 3.4% from 1.8%.

Gold falls below $2,330 as US yields push higher

Gold came under modest bearish pressure and declined below $2,330. The benchmark 10-year US Treasury bond yield is up more than 1% on the day after US GDP report, making it difficult for XAU/USD to extend its daily recovery.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.