Statistics New Zealand released the first reading of the country’s consumer prices. The data showed that the country’s prices moved up by 0.5% in the quarter compared to the 0.1% in the last quarter. On an annual basis, the CPI increased by 1.1% in line with the analysts’ forecasts but lower than last quarter’s reading of 1.6%. Inflation was mostly influenced by the annual increase in tobacco taxes, and the increase in accommodation and petrol prices. The biggest decline was the price of tertiary education, which fell by 16% during the quarter.

In the UK, data from the Bureau of National Statistics (ONS) showed that retail sales decreased in March. Retail sales declined by negative 1.2% in the month compared to February’s 0.8% increase. On an annual basis, the sales rose by 1.1%, which was lower than the previous month’s 1.5% and the expected 2.0%. The core retail sales which exclude automobiles and fuel declined by negative 0.5% compared to February’s growth of 0.4%. On an annualized basis, the core retail sales grew by 1.1% compared to the expected 1.2%. The fall in retail sales was attributed to the prolonged winter weather. This data came a day after the country’s inflation eased during the month to an annual low.

The Australian Bureau of Statistics released the country’s jobs numbers. The numbers showed that the unemployment rate remained at 5.5% while participation rate fell to 65.5%. The participation rate shows the percentage of people of working age who are actively working or those who are looking for work. Traders were expecting the rate to improve to 65.7%. In the month, the country added 4.9K new jobs compared to the 20K analysts were expecting.

Meanwhile, Russia wrote to the WTO asking compensation for the steel and aluminum tariffs arguing that the tariffs were safeguard measures to protect the US economy instead of national security. Russia joined other major exporters like China, India, and the EU in opposing the tariffs.

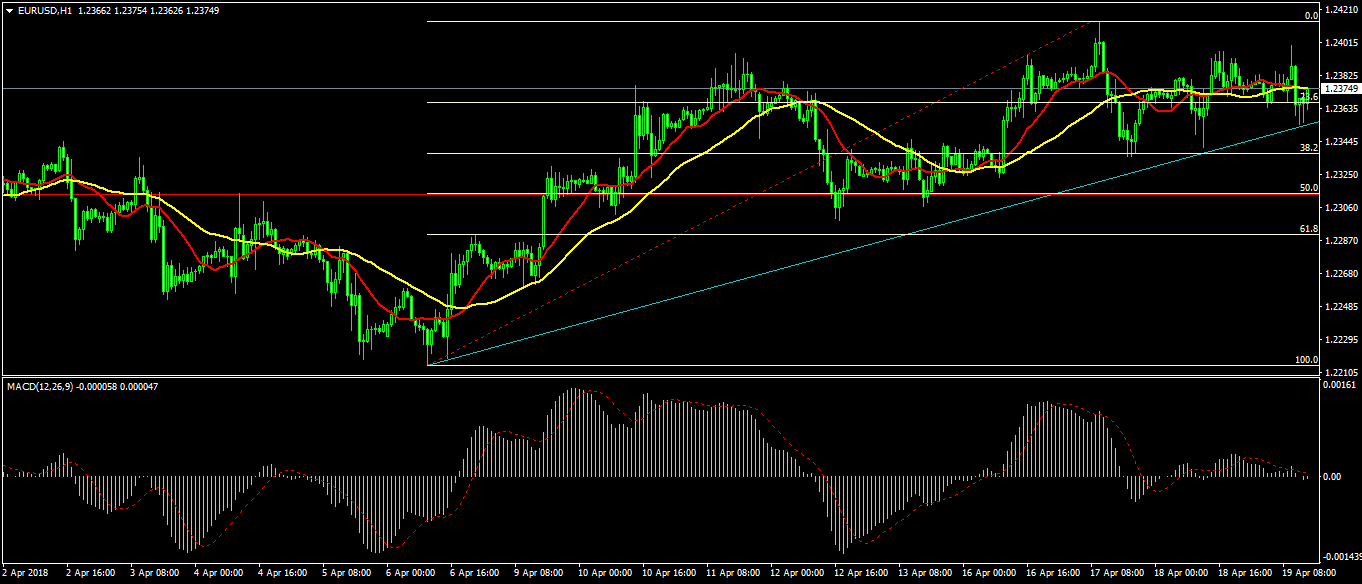

Today, the pair is little moved mostly because of the lack of major economic data. It is now trading at 1.2370 which is slightly above the important support level. The MACD and the double Moving Averages are indicating that the pair could breakout in either direction. As such, if it moves lower, you should watch out for the 1.2310 level. If it moves higher, you should watch out for it to test the multi-month high of 1.2410.

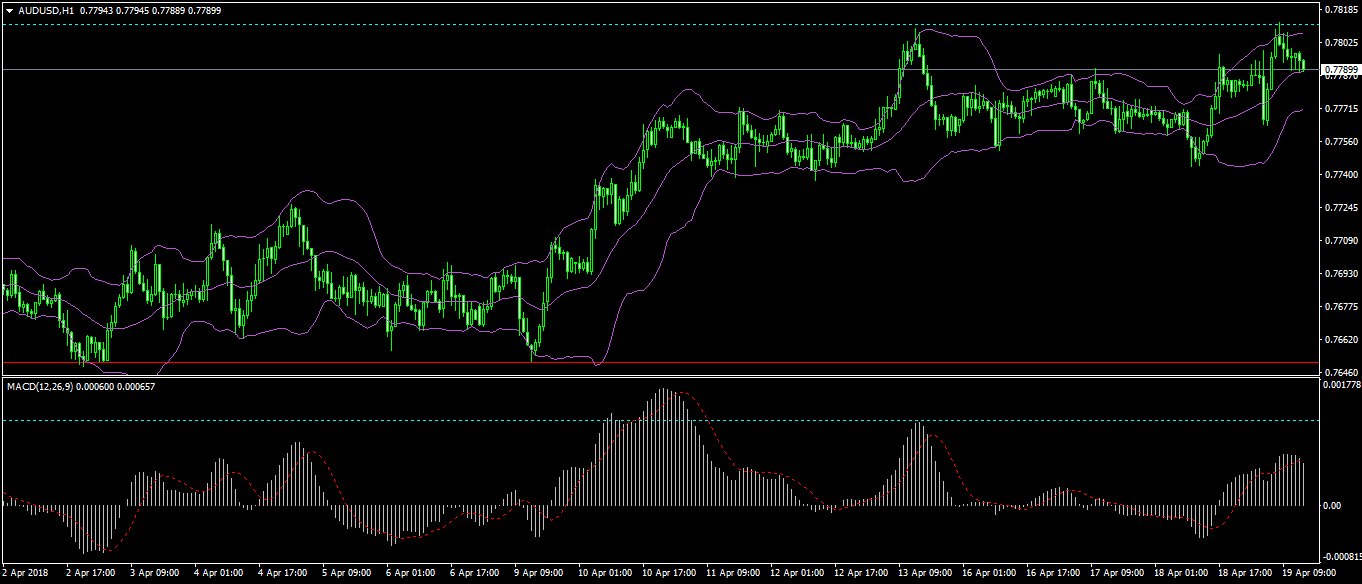

AUD/USD

The Australian dollar has moved higher against the dollar after reaching the low of 0.7650. The pair is currently trading at 0.7790 as it tries to move past the monthly high of 0.7810. At this price, using the hourly chart, its price is trading at the middle level of the Bollinger Bands. The MACD indicator is currently at 0.0007, with the possibility of moving to the weekly high of 0.00012. Therefore, there is a possibility that the pair could continue moving higher.

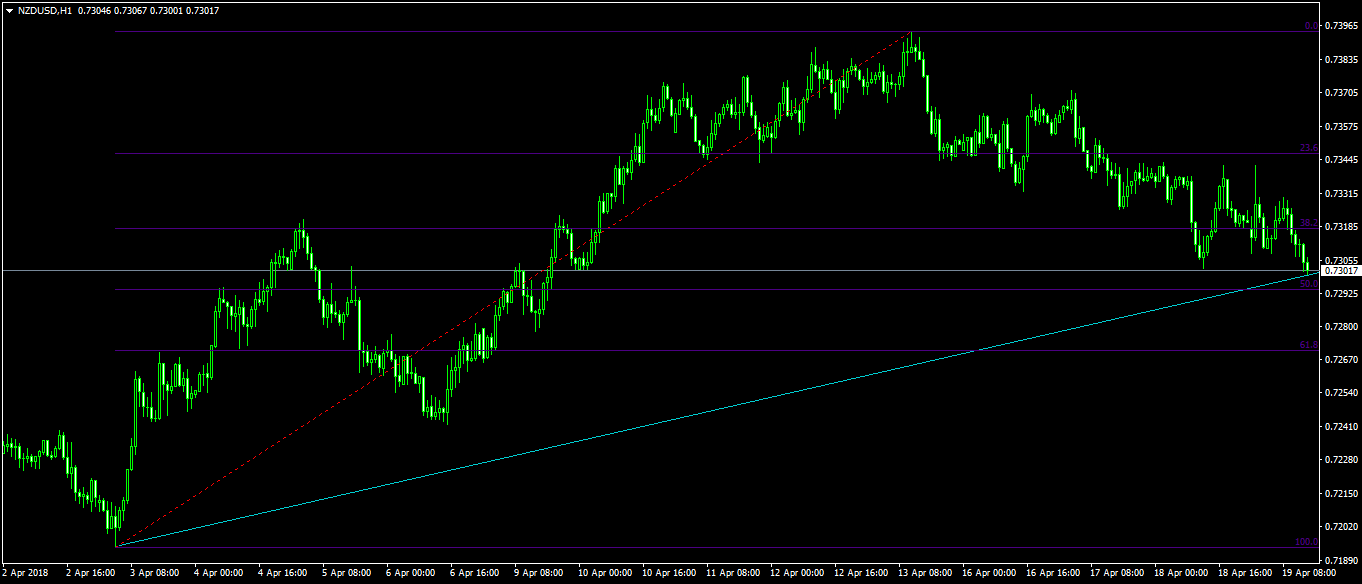

NZD/USD

The Kiwi bottomed at 0.6780 in November last year. After that, it started moving higher, boosted by the rising commodity prices and the general weakness of the dollar. It rose and reached a YTD high of 0.7430 in January. Now, the pair is trading slightly lower than the peak and is headed to the 50% Fibonacci Retracement level. Traders should watch out for this level. If it continues going down, it could test the 0.7270 level, which is the 61.8% Fibonacci Retracement level.

General Risk Warning for FX & CFD Trading. FX & CFDs are leveraged products. Trading in FX & CFDs related to foreign exchange, commodities, financial indices and other underlying variables, carry a high level of risk and can result in the loss of all of your investment. As such, FX & CFDs may not be appropriate for all investors. You should not invest money that you cannot afford to lose. Before deciding to trade, you should become aware of all the risks associated with FX & CFD trading, and seek advice from an independent and suitably licensed financial advisor. Under no circumstances shall we have any liability to any person or entity for (a) any loss or damage in whole or part caused by, resulting from, or relating to any transactions related to FX or CFDs or (b) any direct, indirect, special, consequential or incidental damages whatsoever.

Recommended Content

Editors’ Picks

AUD/USD remained bid above 0.6500

AUD/USD extended further its bullish performance, advancing for the fourth session in a row on Thursday, although a sustainable breakout of the key 200-day SMA at 0.6526 still remain elusive.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.