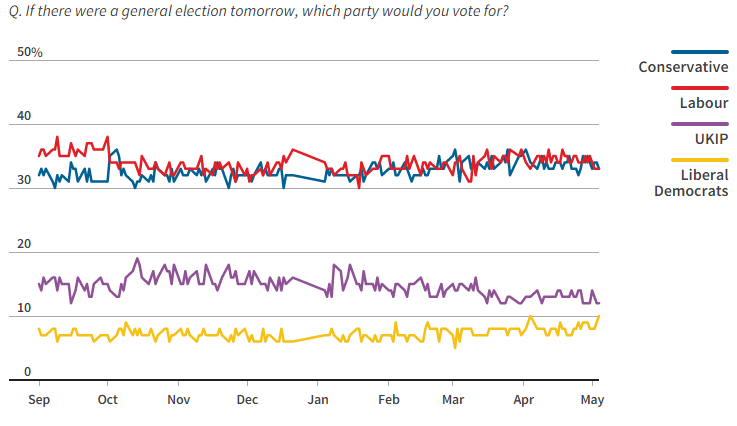

The latest polls foresee a very balanced result, with a very slight advantage for the Conservative over the Labour, but with both needing to form a coalition with parties such as the SNP, the UKIP or the LibDems if they want to reach Downing Street. Markets will not be ignorant of the results and the subsequent negotiations to form a government, and uncertainty could hit the GBP and British equity markets.

Ahead of the voting we take a look at our contributors' thoughts on the event and the effects it may have on the markets.

Source: ThomsonReuters/YouGov

GBP Bullish View

Valeria Bednarik, Chief Analyst at FXStreet: “Despite the risk and the talks, the Pound remains generally strongâ€Â

Being quite bullish on the Pound, our Chief Analyst acknowledges the strength the Pound has experienced lately against its major counterparts: “Poor UK GDP readings for the first quarter of 2015 were erased by even worse developments in the US, whilst the ECB's decision to launch QE in Europe has kept the EUR subdued against all of its major rivalsâ€Â.On her analysis, Bednarik also mentions the gains for the Pound against the US Dollar after prior elections before concluding that this time, weighing the uncertainty carried by the possibility of a Hung Parliament and Brexit talks, the market could “act 'sell the rumor, buy the fact', with Pound probably under pressure until Thursday, and regaining the upside afterwards, should the outcome result less dark than expectedâ€Â.

GBP Bearish View

Ben Ridgeway, Analyst at Saxo Capital Markets UK: “Impact on GBP appears weighted on the downsideâ€Â

Ridgeway believes this UK Election matters for the traders, arguing “the sterling will likely suffer as the uncertainty over economic policy or a vote on Europe, just like the Scottish referendum, will bring with it a hiatus for business decisions being made and deals being doneâ€Â.The analyst, though, thinks “an election with no clear outcome could be the best result for financial markets in the short-term. If no party has a clear majority, then passing legislation will be a near impossibility, so consequently the status-quo would remainâ€Â.

Ridgeway also takes a look back on past elections to learn some lessons. He sees that “market volatility tends to increase in the 15 days before an election, and then increase further in the days afterwards†and remembers “how quickly UK markets became unsettled in the run-up to the Scottish referendumâ€Â.

Possible Scenarios on EURGBP and GBPUSD

Kathleen Brooks, Matt Weller and Fawad Razaqzada, Technical Analysts at FOREX.com: “EURGBP may be the currency pair to play if the UK election results in a pound-bullish outcomeâ€Â

Brooks, Weller and Razaqzada elaborate a broad report analyzing the impact of UK Election on the markets from several points of attention. Their technical view on the EURGBP shows that the sterling bulls against the euro can make some profits in case of “a pound-bullish outcome, such as a stable coalitionâ€Â. The threesome believes that “in that case, EURGBP could break through key psychological support at 0.7000â€Â.These analysts also take a look at the technical levels of the GBPUSD, pointing to a possible bearish run. They acknowledge that “if we do see a pound-negative election result (a hung parliament or, to a lesser extent, a fractious coalition), GBPUSD could resume its downtrend for a possible test of the next level of converging previous / Fibonacci support in the 1.42-1.43 areaâ€Â.

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.