-

With less than three weeks to go before Election Day on 8 November, the third and last TV debate between Hillary Clinton and Donald Trump was held in the early hours of Thursday. The debate was probably the best between the two candidates with the focus mostly on politics. A CNN/ORC poll found that Hillary won the debate (52% versus Trump's 39%). The markets also think it was a good night for Hillary's winning chances as prediction markets moved towards Clinton.

-

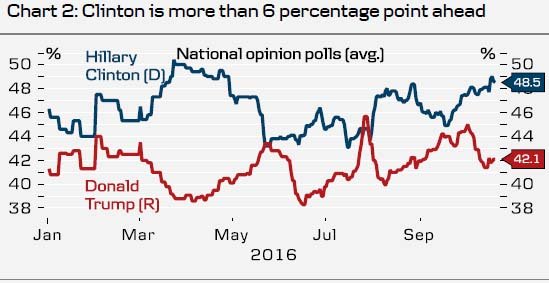

Neither polls nor model projections have changed significantly since our last monitor and it still seems most likely that Clinton becomes the next US President. Looking at national polls, Clinton is still significantly ahead (48.5% versus 42.1% for Trump), see chart 2. According to model calculations from FiveThirtyEight, the likelihood of Clinton winning the election continues to be above 85%, see chart 3. That said, with Brexit fresh in mind, we think one should be cautious in interpreting the outcome based on polls.

-

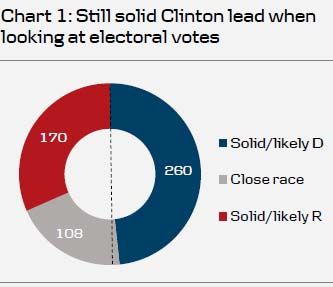

When looking at electoral votes, Clinton still has a solid lead with 260 electoral votes against Trump's now 170 votes (up from 165), see chart 1. This leaves Clinton very close to the 270 votes needed to win. Since there are only 108 electoral votes left in close race states and given that Clinton is ahead in most of them (including the important Florida), it is difficult to see how Trump could get above 270 votes at the moment. There are, however, still three weeks left and unforeseeable events could alter the picture.

-

The election is not just about who will become the next President of the US, as the Congressional elections will take place at the same time. While it is likely that Republicans will continue to have majority in the House of Representatives, the race is more close when it comes to the Senate. Of the 34 seats (out of 100) in the Senate up for election, Republicans hold 24. Current projections show a very close race with 47 seats to the Democrats and 46 to the Republicans. This still leaves seven seats on the battlefield (of which six are currently Republican). This highlights that the risk of a divided congress is high.

This publication has been prepared by Danske Bank for information purposes only. It is not an offer or solicitation of any offer to purchase or sell any financial instrument. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness and no liability is accepted for any loss arising from reliance on it. Danske Bank, its affiliates or staff, may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives), of any issuer mentioned herein. Danske Bank's research analysts are not permitted to invest in securities under coverage in their research sector.

This publication is not intended for private customers in the UK or any person in the US. Danske Bank A/S is regulated by the FSA for the conduct of designated investment business in the UK and is a member of the London Stock Exchange.

Copyright () Danske Bank A/S. All rights reserved. This publication is protected by copyright and may not be reproduced in whole or in part without permission.

Recommended Content

Editors’ Picks

AUD/USD remained bid above 0.6500

AUD/USD extended further its bullish performance, advancing for the fourth session in a row on Thursday, although a sustainable breakout of the key 200-day SMA at 0.6526 still remain elusive.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.