After a year of talks on U.S. barriers to Indian steel and aluminum, India retaliates against Trump.

The Hindu reports India to Impose Retaliatory Tariffs on 29 U.S. Goods Starting June 16.

India has decided to impose retaliatory tariffs on 29 goods imported from the U.S. from June 16 onwards, officials in the Commerce Ministry told The Hindu. The decision comes a year after New Delhi initially decided to do so.

The tariffs will place a burden of $220-290 million on the U.S., about the same amount imposed by Washington on India in 2018.

Spotlight Almonds

The New York Times reports India Raises Tariffs, Escalating Trade Fight With Trump.

India announced late Saturday that it would raise tariffs on 28 categories of imports from the United States, the latest escalation in what has been a slow-motion trade fight between the two countries.

The increased tariffs, on $1.4 billion of goods, went into effect Sunday morning in India and cover almonds, walnuts, apples and finished metal items, among other products.

Tariffs on almonds, for example, will go up about 20 percent under the new rules — but that translates into a wholesale price increase of about 4.5 cents a pound for almonds in the shell, according to industry officials. India is one of the largest markets in the world for almonds from California, which produces most of the global supply, but growers are more focused on wooing Indian shoppers from locally grown nuts like cashews than on the trade duties.

Minor Skirmish

This is a minor skirmish. No one cares much about almonds other than California, and Trump does not care much about California.

Besides, Trump is winning.

Thanks to Chad P. Bown for compiling this likely incomplete list of 10 successes.

10 Tweets Highlighting Trump's Progress

Here are a few charts and ideas.

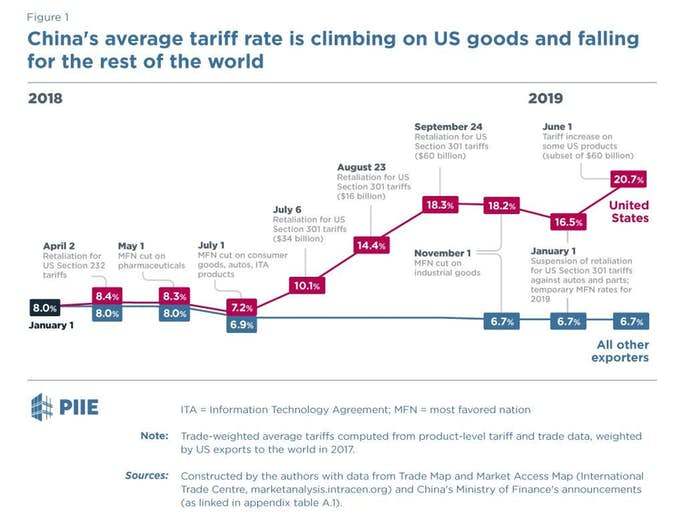

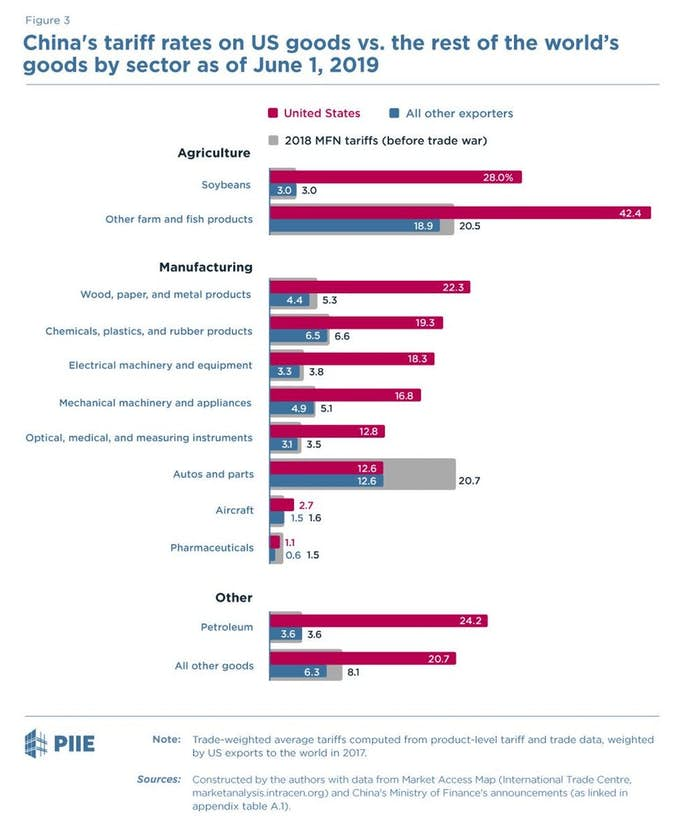

China's Tariff Rate Climbing on US, Falling on Rest of World

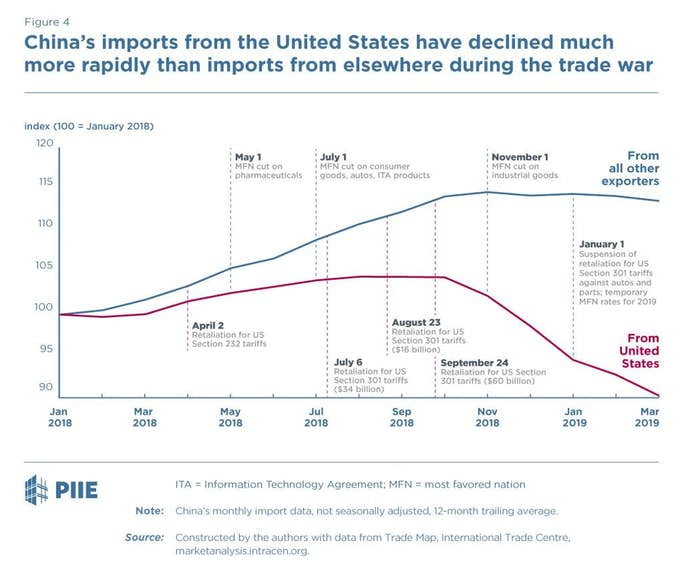

China's Imports From US vs the World

US vs Canada

- China imposes 25% retaliatory tariff on US lobster

- US lobster exports fall by 70%

- China cuts tariff on Canadian lobster by 8 percentage points

- Canadian lobster exports to China nearly double

Soybeans

- China retaliated with 25% tariffs, US soybean exports plummet

China did not need to cut its 3% soybean tariff toward Brazil or Argentina to shift its consumption toward those countries

Success Defined

Winning

Trump successfully got China to lower its tariffs rates with the rest of the world.

Clearly this is winning.

What the hell else can it possibly be?

This material is based upon information that Sitka Pacific Capital Management considers reliable and endeavors to keep current, Sitka Pacific Capital Management does not assure that this material is accurate, current or complete, and it should not be relied upon as such.

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.