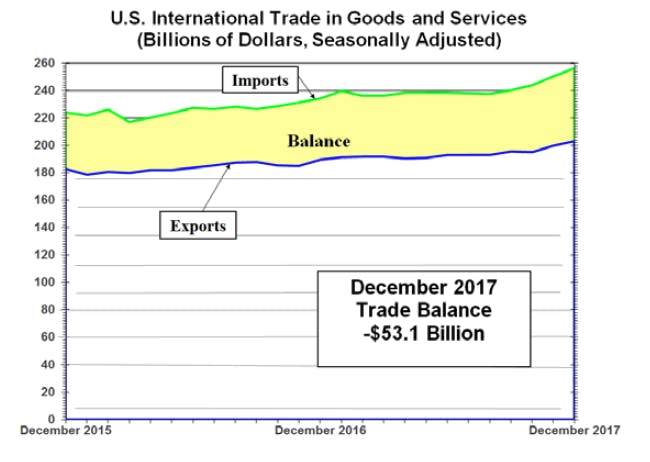

The trade gap widened much more than expected in December. Imports and exports rose, with imports rising far more.

In what's likely to negatively impact the next revision to fourth-quarter GDP estimates, the BEA's report on International Trade for December shows the trade deficit widened sharply thanks to surging imports.

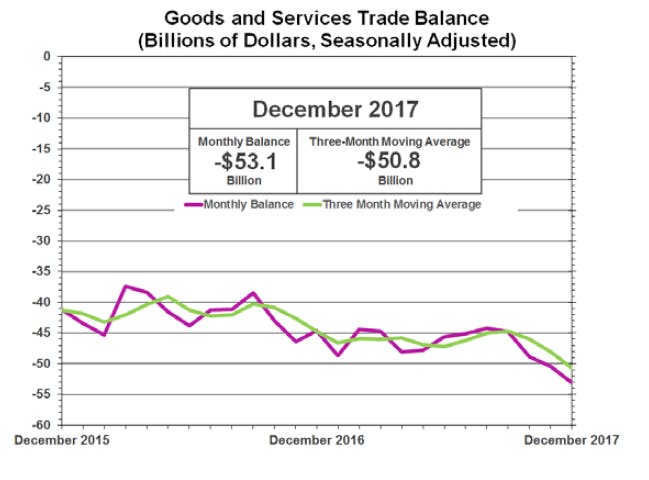

The deficit was larger than any Econoday economists' estimate. The consensus was -$51.9 billion in a range of -$51.2 billion to -$52.7 billion.

3 Month Moving Average

Those looking for an acceleration in something cannot point to wages but they can point to trade deficits. The trade imbalance for the month surged to $53.1 billion.

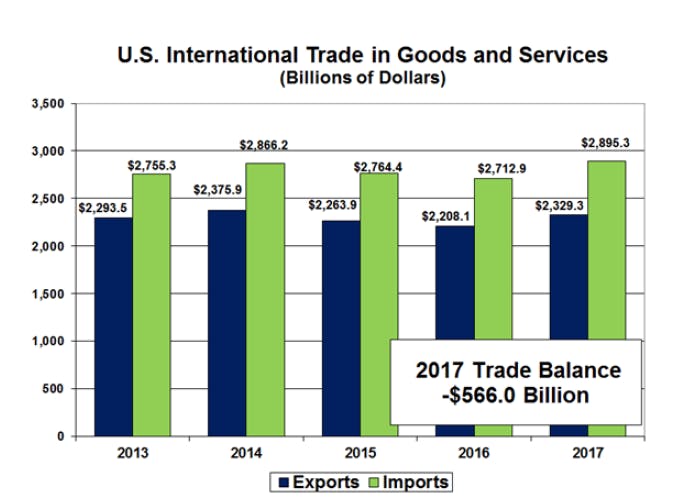

2017 Summary

2017 Exports vs Imports

For 2017, the goods and services deficit was $566.0 billion, up $61.2 billion from $504.8 billion in 2016. Exports were $2,329.3 billion in 2017, up $121.2 billion from 2016. Imports were $2,895.3 billion in 2017, up $182.5 billion from 2016.

2017 China

For 2017, the deficit with China increased $28.2 billion to $375.2 billion. Exports increased $14.8 billion to $130.4 billion and imports increased $43.0 billion to $505.6 billion.

2017 Mexico

For 2017, the deficit with Mexico increased $6.7 billion to $71.1 billion. Exports increased $13.3 billion to $243.0 billion and imports increased $20.0 billion to $314.0 billion.

2017 Japan

For 2017, the deficit with Japan was essentially unchanged at $68.8 billion. Exports were $68 billion, imports $137 billion. Imports and exports each rose about $4 billion.

2017 EU

For 2017, the deficit with the European Union increased $4.7 billion to $151.4. Exports increased $13.9 billion to $283.5 billion and imports increased $18.6 billion to $434.9 billion.

Synopsis

- 2017 Exports Up $121.2 Billion, Imports $182.5 Billion

- 2017 Deficit Up $61.2 Billion

- 2017 China Deficit $375.2 Billion, Up $28.2 Billion

- 2017 Mexico Deficit $71.1 Billion, Up $6.7 Billion

- 2017 EU Deficit $151.4 Billion, Up $4.7 Billion

Trump Will Howl

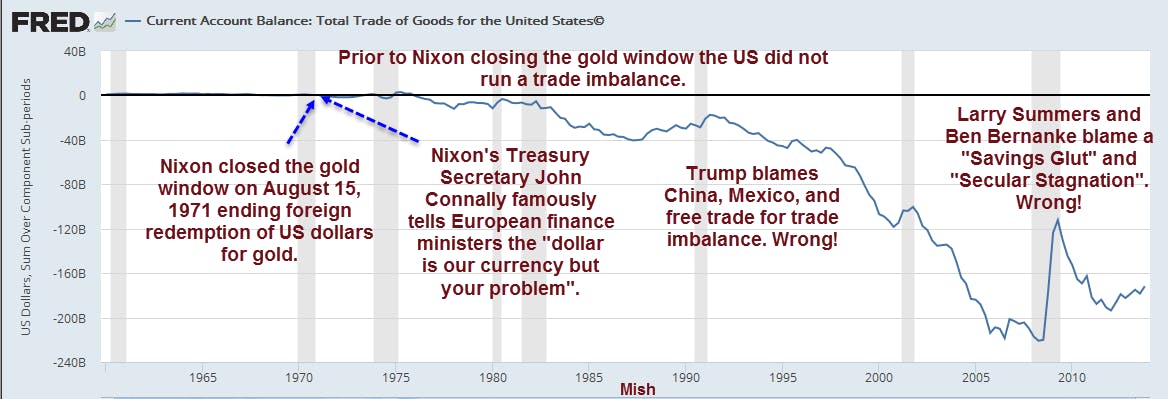

Trump will howl over these numbers but the problem is entirely the United States' making.

With US deficit spending rising, it takes capital imports to balance out. Trump's tax plan increases the deficit so expect these numbers to worsen.

For discussion of the trade deficit math, please see Trump's Tariffs Prove He's "Clueless About Trade".

Once again, the roots of this problem date back to August 15, 1971. That is when Nixon closed the gold window, ending foreign redemption of dollars for gold.

This material is based upon information that Sitka Pacific Capital Management considers reliable and endeavors to keep current, Sitka Pacific Capital Management does not assure that this material is accurate, current or complete, and it should not be relied upon as such.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.