The Federal Reserve Chairman Jerome Powell, speaking before the U.S. House Budget Committee, said he sees no current sign of a slowing economy. However, he added that the U.S.-China trade deal, along with sluggish global growth, had put a strain on business investment.

European stocks remained under pressure, with the Stoxx Europe 600 losing a further 0.4%. Germany's DAX dropped 0.4%, the U.K.'s FTSE 100 slid 0.8%, and France's CAC was down 0.1%.

The U.S. government bond prices were still firm, as the benchmark U.S. 10-year Treasury yield eased further to 1.824% from 1.870% Wednesday.

XAU/USD - US-China Trade Issue Support Gold Prices

The gold price was up for a second session as it climbed 0.5% to $1,471 an ounce. On Friday, the gold prices dropped as remarks from White House economic adviser Larry Kudlow that the United States is close to an interim trade agreement with China.

Asian stocks dropped, bending bullion's safe-haven demand, pursuing a record S&P 500 finish, as hopes revived that the world's top two economies were nearing a phase 1 deal.

On the other hand, the Federal Reserve speech did not succeed in providing any clear indicator regarding the next policy move because Chairman Powell blamed the trade war for manufacturing weakness. In contrast, some others at the Federal Reserve officials seem uncertain about the need for more stimulus.

XAU/USD - Daily Technical Levels

Support Resistance

1458.56 1467.83

1453.59 1472.13

1444.32 1481.4

Pivot Point 1462.86

Gold - XAU/USD - Daily Trade Sentiment

Gold traded precisely in line with our outlook to aim 1,472 prices have turned after examining this mark. Right now, gold is consolidating around 1,466 levels, and it appears to form three black crows pattern on the 4-hour chart. If this occurs, the odds of a bearish repeal will be stronger. On the bearish side, gold can find the subsequent support at 1,464 and 1,460 mark. While the resistance lingers at 1,469 and 1,472.

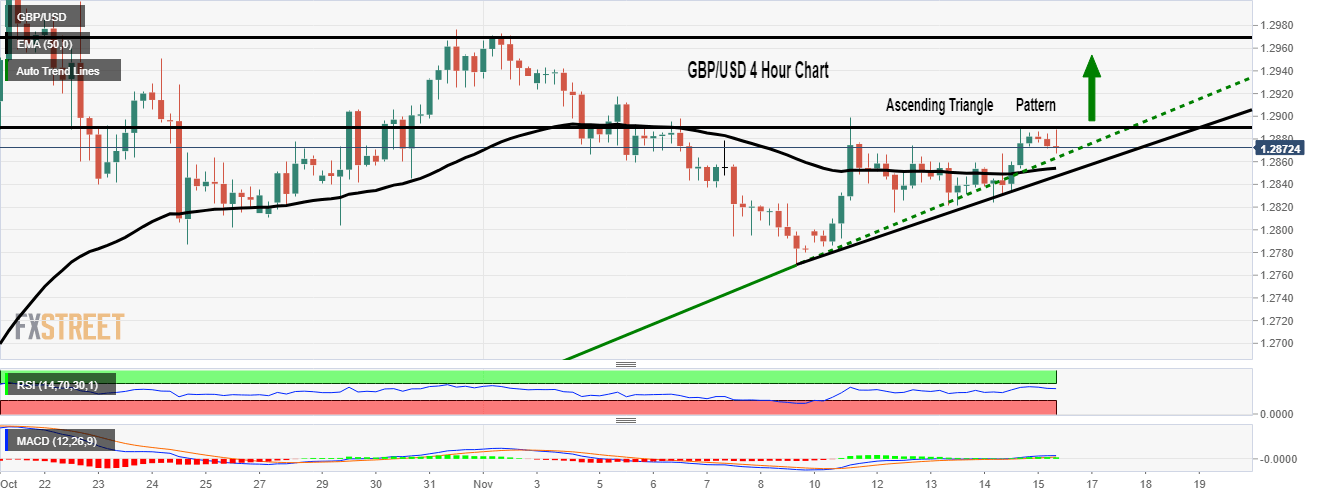

GBP/USD - Ascending Triangle Pattern

On Friday, the GBP/USD currency pair breaks the bullish range after trading between the 1.2865 and 1.2830. The pair surged to 1.2888 and reached the highest level since Monday, mainly due to the weakness in the greenback.

As of writing, the GBP/USD currency pair currently trading at 1.2880, consolidating daily gains boosted by a lower greenback. The greenback dropped ground across the board during the American session due to lower U.S. yields. The ten-year dropped toward 1.80%, moving away from the weekly highs it reached a few days ago.

At the Uk front, United Kingdom retail sales data released today had not left any impact on the market, the same situation applied with US PPI. During today, the United States retail sales report is scheduled to release. Market participants will also carefully observe the headlines regarding the United States and China trade talks.

Optimism that the U.S. will reduce tariffs on China's goods wavered slightly because discussions continue to face new problems, although some positive steps were taken after both countries lifted the ban on poultry imports. On the other hand, the European automobile sector still waiting for Trump's decision on auto tariff while raising expectations that the U.S. President would delay the decision by another 180 days.

GBP/USD- Daily Technical Levels

Support Resistance

1.2841 1.2905

1.2801 1.2929

1.2738 1.2992

Pivot Point 1.2865

GBP/USD - Daily Trade Sentiment

The GBP/USD has broken the long-held trading area of 1.2850 - 1.2835, and currently, it's consolidating at 1.2880 level. Its asymmetric triangle pattern violates, and this can hold the GBP/USD bullish for several days over the 1.2830 level.

Right now, the GBP/USD is closing tweezers top on the 4-hour graph, which implies the odds of a bearish retracement. Therefore, the pair may show some correction until 1.2865 before surging higher.

AUD/USD – Tweezers Bottom Pattern

The AUD/USD currency pair move on from the bearish track and stops further loses below the 4-week low. Anyhow, the pair is currently trading at 0.678, mainly due to the positive trade headlines regarding the United States and China trade deal. The same offers recovery in the market's risk sentiment with S&P 500 Futures staying moderately positive, with 0.10% gains.

The Australian Dollar pair dropped to the lowest since October 17 the previous day after Australia's employment data, and China's Industrial Production/Retail Sales rose risk of the Reserve Bank of Australia's (RBA) additional rate cuts in 2020. Tensions between the U.S. and Chinese trade negotiators, as well as tension surrounding Hong Kong and Taiwan, retained the risk-tone under pressure on Thursday.

As a result, the U.S. 10-year Treasury yields dropped nearly 7-basis points (bps) to 1.82%, whereas Wall Street stays sluggish with major indices marking no more than 0.10% moves.

Markets are now preparing for RBA Deputy Governor Guy Debelle's speech regarding mortgage arrears at a panel discussion hosted in Sydney. It should also be noted that a shortage of significant data/events keep investor focus on trade and political headlines for fresh clues.

AUD/USD - Technical Levels

Support Resistance

0.6821 0.6849

0.6807 0.6863

0.6778 0.6892

Pivot Point 0.6835

AUD/USD - Daily Trade Sentiment

The AUD/USD exhibited a slight bullish retracement to trade at 0.6800 level after testing the support level of 0.6760. The bullish trend came after the AUD/USD formed a tweezers bottom pattern at 0.6770.

The MACD and RSI are still in the bearish zone, while the 50 periods EMA is also staying at 0.6840 level. Today, the AUD/USD may trade bearish below 0.6800 level, so better looking for a sell entry to target 0.6775.

All the best for the New York session!

Risk Warning: CFD and Spot Forex trading both come with a high degree of risk. You must be prepared to sustain a total loss of any funds deposited with us, as well as any additional losses, charges, or other costs we incur in recovering any payment from you. Given the possibility of losing more than your entire investment, speculation in certain investments should only be conducted with risk capital funds that if lost will not significantly affect your personal or institution’s financial well-being. Before deciding to trade the products offered by us, you should carefully consider your objectives, financial situation, needs and level of experience. You should also be aware of all the risks associated with trading on margin.

Recommended Content

Editors’ Picks

AUD/USD remained bid above 0.6500

AUD/USD extended further its bullish performance, advancing for the fourth session in a row on Thursday, although a sustainable breakout of the key 200-day SMA at 0.6526 still remain elusive.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.

-637094165956787662.png)

-637094167173059012.png)