The safe-haven appeal triggers after a news report that Russia will diminish the share of the U.S. greenback in its National Wealth Fund and is thinking of investing in other international currencies, covering the Chinese yuan. Besides, the adjustments to the composition of the National Wealth Fund, which is part of Russia's sovereign wealth, will come into force following year, he said.

The greenback gave back most of its profits on Wednesday following U.S. President Donald Trump's speech, where he stated that the trade deal with China was "close." This renews the trade war sentiment and improves investors' investors' concern about the trade deal. Brace for U.S. Inflation figures now.

XAU/USD - Improve Risk Appetite

Helps Gold Prices On Wednesday, the precious metal gold prices increased following a speech by U.S. President Donald Trump dampened expectations for a positive sign on a U.S.-China trade agreement, motivating traders to explore safety in the metal. Gold climbed 0.4% at $1,463.89 per ounce today, and investors await the CPI figures before entering more volume.

Global stock markets traded bearishly as mounting concerns that trade discussions are stalling, and anxiety about raising unrest in Hong Kong hurt the market for risky assets.

During the speech to the Economic Club of New York, President Donald Trump said, the U.S. and Chinese talks were "close" to a "phase one" trade agreement.

The bearish trend in gold has paused as the U.S. President Trump also announced the agreement was close and, on the other hand, said he would boost the tariffs if a settlement is not attained.

XAU/USD - Daily Technical Levels

| Support | Pivot Point | Resistance |

| 1472.82 | 1490.3 | 1501.14 |

| 1461.98 | 1518.62 | |

| 1433.66 | 1546.93 |

Gold - XAU/USD- Daily Trade Sentiment

Gold has produced three white soldiers on the 4-hour chart, which is proposing the odds of a bullish trend in gold. Furthermore, the Doji candle nearby 1,450 may encourage further buying in the XAU/USD. At the moment, the yellow metal may trade bullish to aim for 1,466 and 1,469. Whereas, on the downside, the support lingers at 1,457 and 1,450 range.

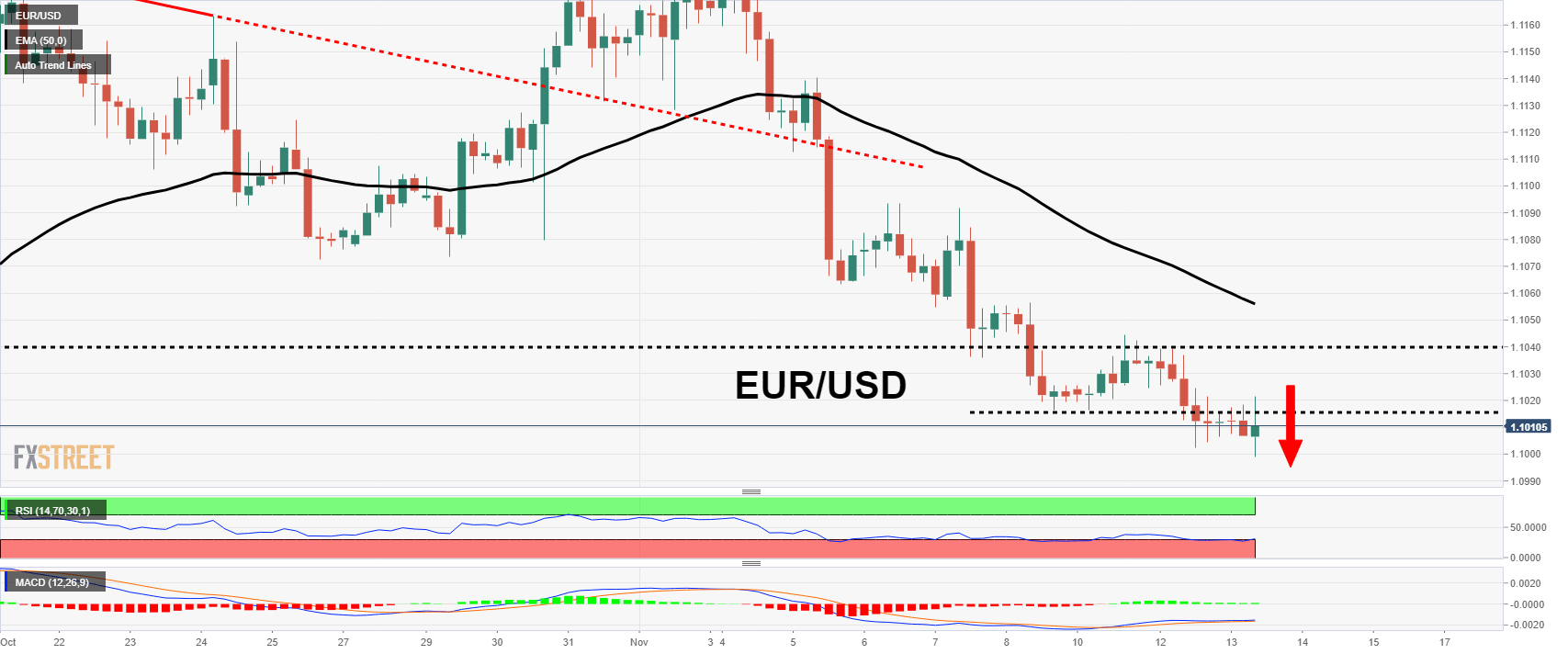

EUR/USD - Euro Stretches Losses

The single currency euro fell against the U.S. Dollar to levels not observed since the middle of October. However, it was last witnessed jumping higher from the psychological 1.10 mark.

The traders waited in expectation of additional clues on when phase one of the trade agreement between the U.S.-China will be approved but were frustrated as Trump disappointed to address in his speech on Tuesday.

Trump's speech was mainly consistent with what he told over the weekend as Trump reiterated that the U.S. is near to striking a settlement.

The euro rises to gain if the uncertainty increases and risk rally drop trend. The recent revival of risk desire has helped the Dollar, which is the strongest amongst the major currencies for the month thus far. The euro, on the other cards, is the most vulnerable on the same list.

EUR/USD- Daily Technical Levels

| Support | Pivot Point | Resistance |

| 1.1006 | 1.1031 | 1.1045 |

| 1.0992 | 1.107 | |

| 1.0953 | 1.1108 |

EUR/USD - Daily Trade Sentiment

The EUR/USD proceeds to trade in a bearish trend, despite having higher German Economic Sentiment survey. The EUR/USD is consolidating near 1.1015, right over a firm support level of 1.1010 level.

On the bullish front, the next resistance waits at 1.1050 and 1.1080 succeeding on. Still, bearish violation of 1.100 should also be eyed to aim 1.0990 as we can expect bullish repeals nearby these trading points today.

AUD/USD – Fibonacci Supports

The AUD/USD currency pair gain recovery from the 2-weeks lows, moreover still struggling to increase the momentum further from the 0.6800s. As of writing, the Aussie pair managed to find some support near the 0.6830 in the wake of the active recovery in the Westpac Consumer Confidence Index, which is increased to +4.5% during the November as compared to -5.5% shown in the previous month.

The AUD/USD pair witnessed a slightly bullish during the Asian session so far, mainly due to the US-China trade anxiety and Reserve Bank of New Zealand's (RBNZ) rates on-hold surprise decision.

Positive consumer data supported offset a slight disappointment from Australia's 3rd-quarter (Q3) Wage Price Index, which dropped to 2.2% YoY rate from 2.3% previous. Every quarter, the index-matched agreement figures and were steady at 0.5%.

On the Sino-US trade aspect, executives from the United States, which includes President Donald Trump and White House Economic Adviser Larry Kudlow, exhibit a readiness to raise the tariff on the Chinese goods if the round-1 talks fail. Moreover, the political also did clear that the existing tariff could reduce but not until the deal gets confirmation.

Therefore, it will be reasonable to wait for some follow-through buying before confirming that the AUD/USD currency pair recent recovery from the 0.6930 supply zone is over and positioning for any additional near-term fresh move ahead of the latest U.S. consumer inflation figures.

Besides this, all eyes will be on Federal Reserve Chairman Powell coming testimony, which will likely play a role in greenback price movements and support the determine the pairs next direction.

AUD/USD - Technical Levels

| Support | Pivot Point | Resistance |

| 0.6865 | 0.6885 | 0.692 |

| 0.6829 | 0.694 | |

| 0.6774 | 0.6995 |

AUD/USD - Daily Trade Sentiment

The current trend of the AUD/USD has been bearish since the violation of 50% and 61.8% Fibonacci retracement level of 0.6850.

The closing of bearish engulfing candle below 0.6850 level is suggesting the chances of a bearish reversal in the AUD/USD.

Besides, the MACD and RSI are also indicating a bearish trend in the AUD/USD. The Aussie may target 0.6820 and even 0.6805 later in the day.

Risk Warning: CFD and Spot Forex trading both come with a high degree of risk. You must be prepared to sustain a total loss of any funds deposited with us, as well as any additional losses, charges, or other costs we incur in recovering any payment from you. Given the possibility of losing more than your entire investment, speculation in certain investments should only be conducted with risk capital funds that if lost will not significantly affect your personal or institution’s financial well-being. Before deciding to trade the products offered by us, you should carefully consider your objectives, financial situation, needs and level of experience. You should also be aware of all the risks associated with trading on margin.

Recommended Content

Editors’ Picks

AUD/USD remained bid above 0.6500

AUD/USD extended further its bullish performance, advancing for the fourth session in a row on Thursday, although a sustainable breakout of the key 200-day SMA at 0.6526 still remain elusive.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.

-637092464578658919.png)

-637092465096472806.png)