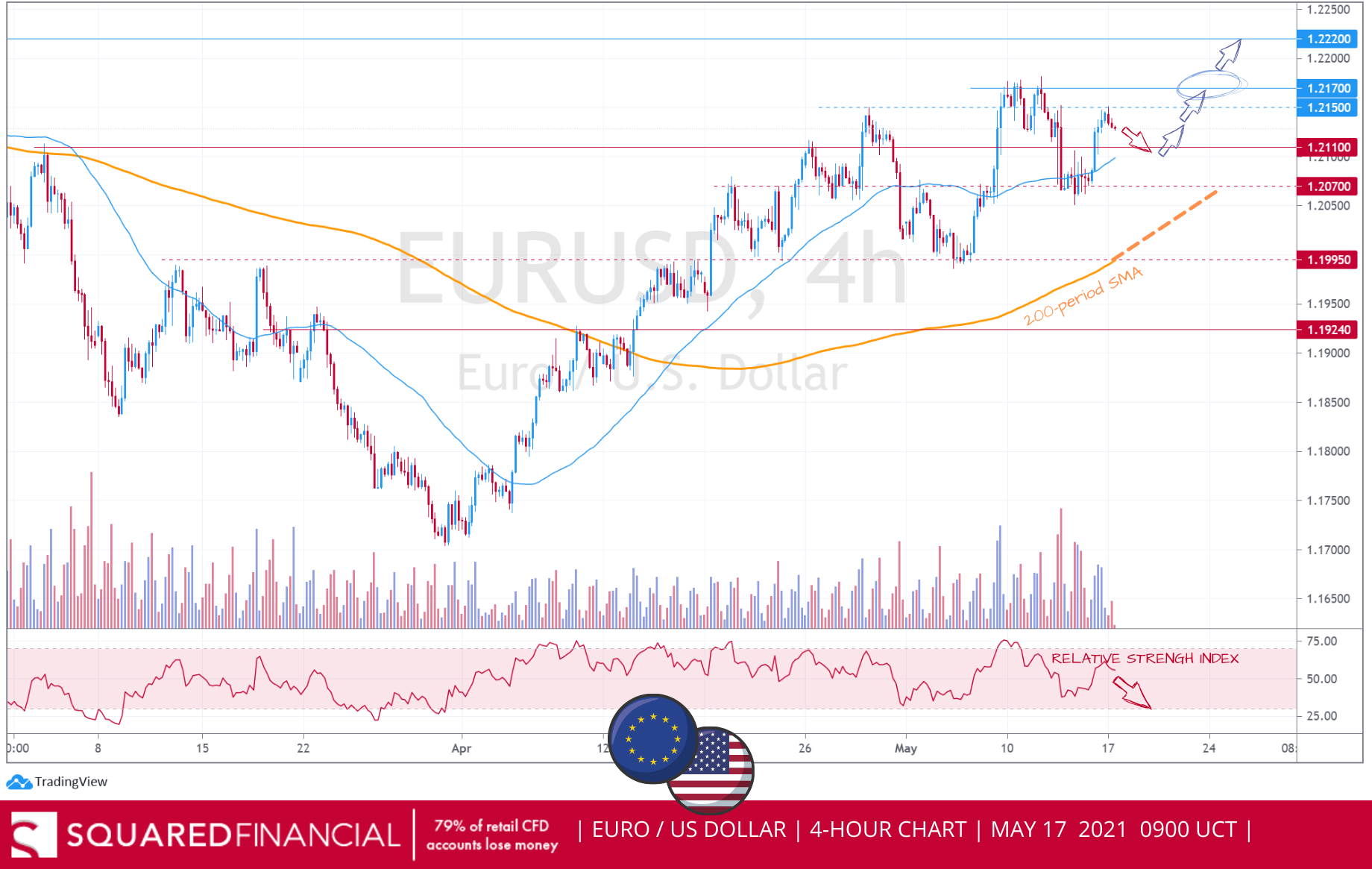

EUR/USD

Finalized inflation figures for Italy are due out later today. However, the main driver for the Euro will most likely be market risk sentiment and the reopening timeline of the Eurozone’s economy. The EURUSD currecy pair still trades above key 1.2110 support level, with a sustained move beyond the 1.2150 to 1.2170 resistance area, to trigger an acceleration to the upside with 1.2220 as nearest target.

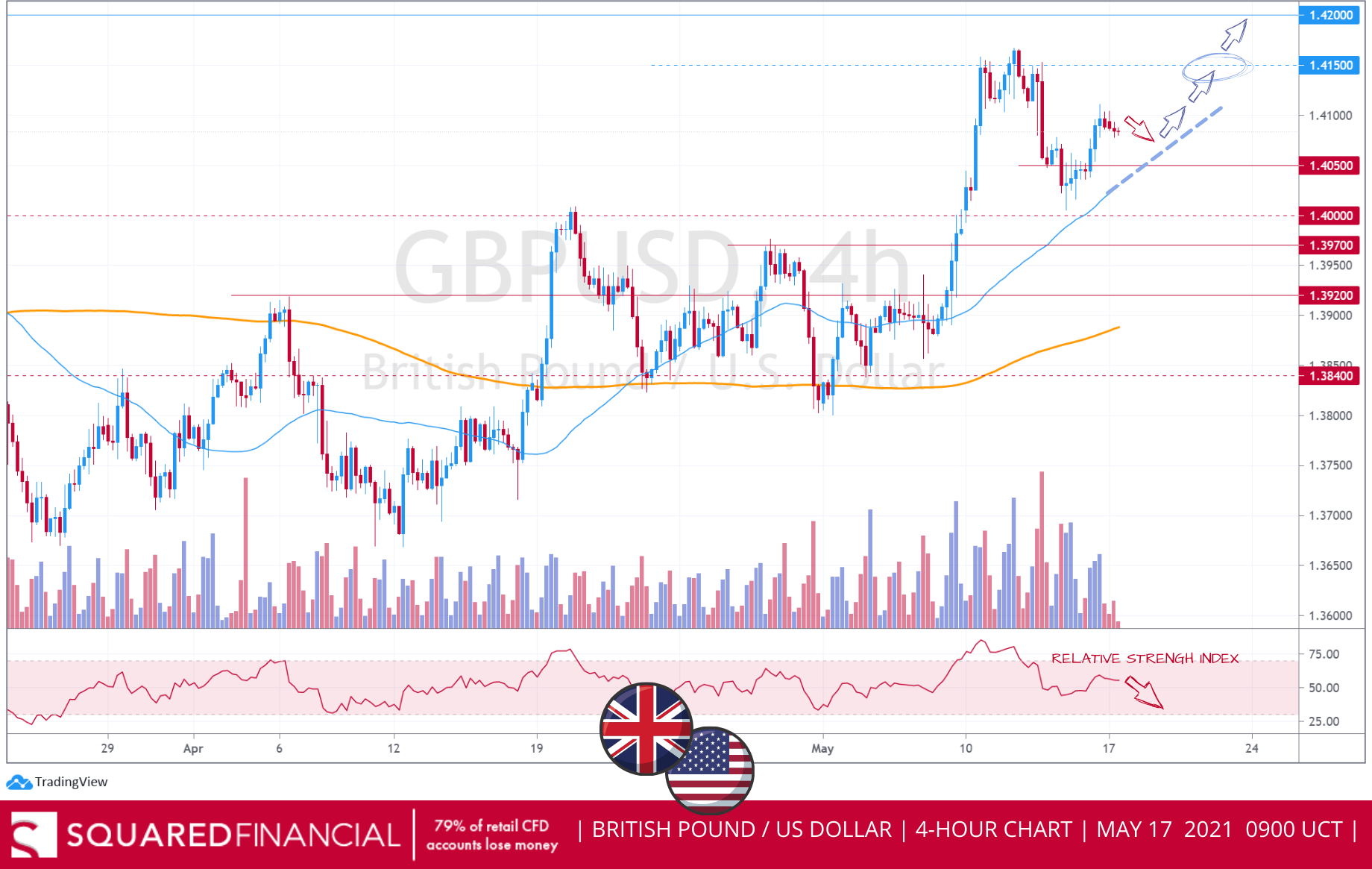

GBP/USD

The British Pound recorded strong gains last Friday closing the week just shy of 1.41 but maintaining a slightly bullish tone from a technical perspective, with 1.4150 as nearest target ahead of UK unemployment figures due tomorrow.

FTSE 100

The FTSE 100 rebounded higher on Friday with the bullish tone set to continue today as the UK government's road map out of lockdown enters its third stage with indoor socializing resuming. Technically speaking, however, the UK blue-chip index still trades below the 7065-resistance level, therefore a follow-through day is needed to keep upside momentum strong. Alternatively, a move below support at 7030 may trigger a bearish signal with the 200-period SMA around 6935 as next support.

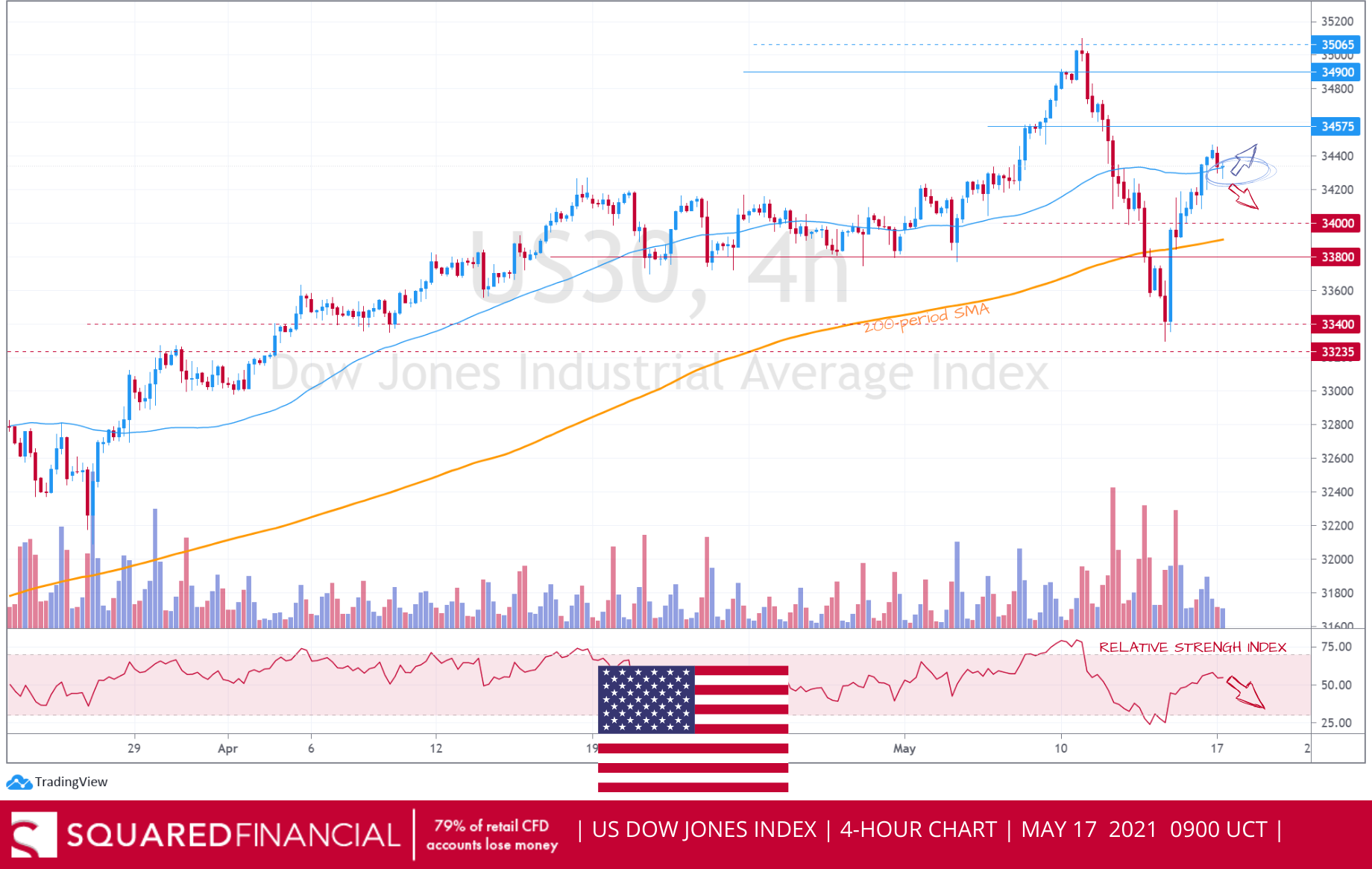

Dow Jones

Wall Street shrugged off a miss in US Retail Sales numbers closing broadly higher on Friday with technology stocks leading the rebound after slower-than-expected retail spending growth cooled tapering fears. However, following last week’s sell-off triggered by inflation jitters, the Dow Jones index still trades below crucial resistance at 34575 with a break above that resistance needed to indicate the presence of more buyers, otherwise fading momentum, as per the RSI value pointing lower, may drag the index back to the 200-period SMA around 34000.

Gold

Higher inflation expectations, weaker prints on US University of Michigan’s Consumer Sentiment along with lower-than-expected US Retail Sales data, all weighed down on the greenback, in turn raising demand on the yellow metal with $1860 and $1870 as closest resistance targets on the upside. Focus remains on Fed Speakers this week (Clarida today) ahead of Wednesday’s FOMC minutes.

This information is only for educational purposes and is not an investment recommendation. The information here has been created by SquaredFinancial. All examples and analysis used herein are of the personal opinions of SquaredFinancial. All examples and analysis are intended for these purposes and should not be considered as specific investment advice. The risk of loss in trading securities, options, futures, and forex can be substantial. Customers must consider all relevant risk factors including their own personal financial situation before trading.

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.