It’s relatively quiet out there at the start of this week, as most European countries have a bank holiday for Whit Monday. This has given us time to reflect on the key themes that are driving the market. There is a lot of geopolitical risk right now, including an EU leaders’ summit that could determine the strategy for opening up Europe’s economies and allowing quarantine-free travel between nations once more. There is also the fallout from Belarus’s grounding of a Ryanair flight that travelled over its airspace to arrest a dissident journalist and student on board. This has had limited impact on the airline sector, although European authorities are now threatening to limit Belarus air traffic in retaliation for yesterday’s move. Added to this, it’s another wild ride for Bitcoin. after another sharp drop on Friday, the cryptocurrency is up more than 10% on Monday. Below, we take a look at three trade ideas that could spark your trading interest at the start of a new week.

1. European focus

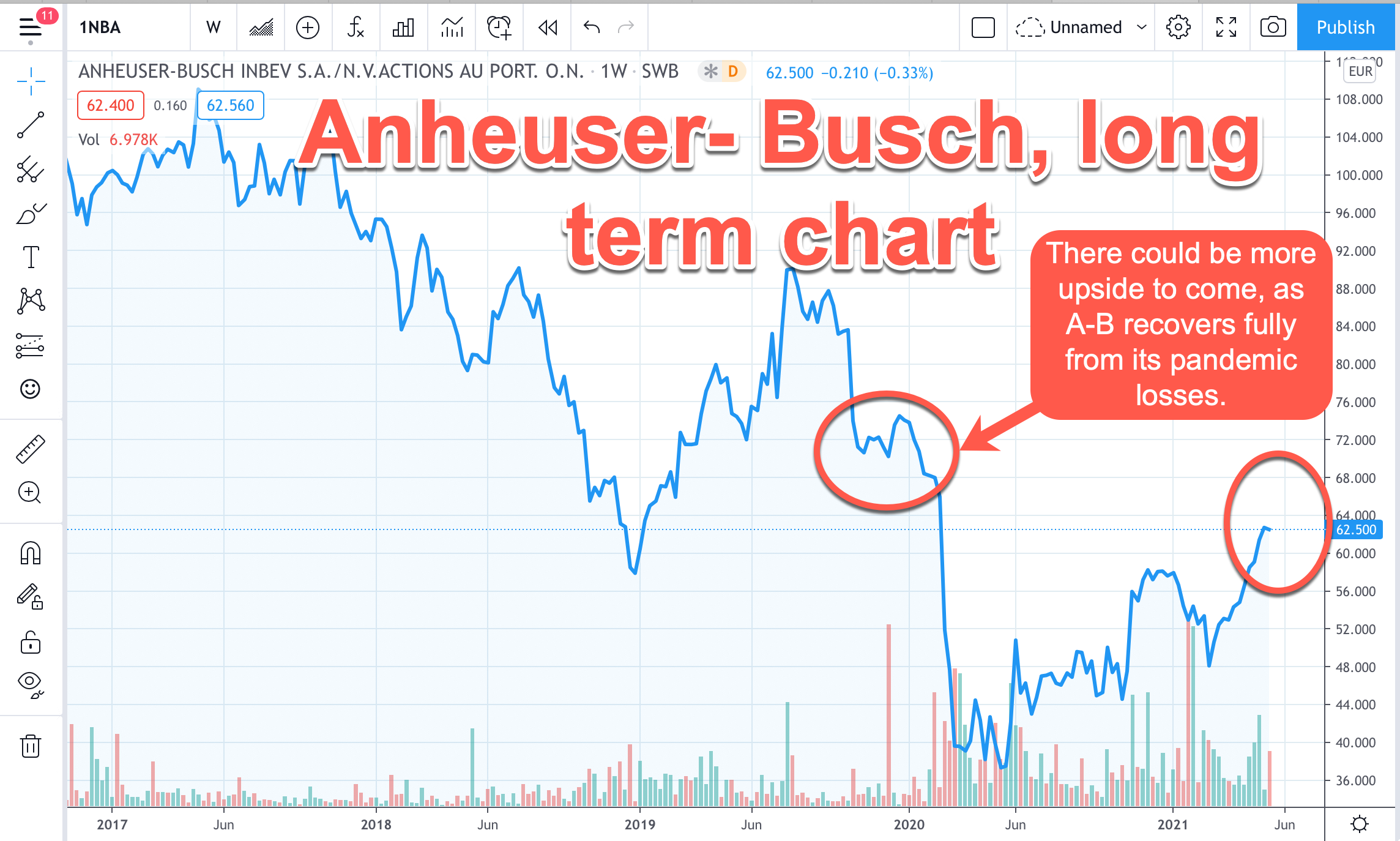

This week we see the release of German GDP for Q1, the German IFO survey and French inflation data on Friday. German GDP is expected to show a 1.7% decline for the first quarter, largely as a result of strict lockdowns. The annual rate of growth is expected to decline by 3%. However, now that Germany’s economy has started to open up, and fewer restrictions on tourists travelling within the Eurozone are expected to be decided later this week after the EU leaders’ summit on Monday, the focus is likely to switch to the strong outlook for Q2 and beyond, as pent-up demand is finally unleashed. The better outlook for Germany and Europe as a whole, is likely to be reflected in a strong IFO survey for May. This survey of Germany’s manufacturing sector is expected to show that expectations for growth have risen to their highest level for three years. The combined factors of a loosening of Covid restrictions and a demand surge this summer means that our eye is on American/European Beer maker, Anheuser-Busch, which is dual listed in the US and Germany. This is a global company that supplies some of the world’s most recognised beer brands including Budweiser and Stella Artois, along with non-alcoholic and low alcoholic beverages. These brands should do well if consumers have money in their pockets to spend on enjoying themselves in the summer months. Added to this, Anheuser-Busch also pays a decent dividend in relative terms, at 2.32%, which could act as a sweetener if inflation does rear its head and interest rates rise in the coming year or so. So-called sin stocks tend to perform well in both a recessionary and inflationary environment, which is another attractive feature of Anheuser-Busch. Its debt position may put some off, however, its debt costs are affordable, and the cost of debt has been cheap for most of the last ten years, thus, this is not a problem for us at Minerva. Added to this, its stock price has only recently regained its pandemic losses, so there is also more upside potential from a technical perspective, in our view.

Chart: Anheuser-Busch

Source: Minerva Analysis

2. Plant based mania

Oatly listed on the Nasdaq stock index last week to much funfair. The plant-based milk product has a powerful marketing strategy and some equally powerfully celebrity backers, such as Oprah Winfrey and Jay-Z. Oatly’s share price remains in the volatile phase, it jumped back above $22 on Friday and rose 11% at the end of last week. This still gives the oat milk producer a valuation of $13bn, however, we prefer to look a bit closer to home to get exposure to plant-based foods. Unilever has a huge range of plant-based foods and has already made vegan-friendly versions of some of its favourite snacks, including Magnum and Walls, the ice cream brands. It is about to launch the Vegetarian Butcher, which has generated a huge amount of publicity in the industry press in recent months. It’s pivot to plant-based products is attractive, however, two other factors are making Unilever jump out at us right now. Firstly, the dividend yield has grown consistently after falling during the peak of the pandemic last year. The dividend in Q1 was a healthy EUR 0.37, which is stronger than Q1 2020. Also, Unilever is in the consumer staples sector, which should absorb any inflation pressures well, if inflation continues to rise in the coming months. This is because consumer staples tend to be able to increase their prices in line with inflation, most of the time. From a valuation perspective, Unilever looks cheap in comparison to some of its American counterparts, from a technical perspective, after losing momentum in February, we believe that it could regain January’s high of 4,465p based on momentum indicators.

3. Inflation hedge

You may think that gold is the traditional inflation hedge, actually, it’s performance in periods of inflation is mixed, and gold mining stocks do not tend to outperform either. Instead, when you look at the analysis of companies that do well in an inflationary environment, the one sector that stands out is the energy sector. This is unsurprising, after all revenues of energy stocks are closely tied to energy prices and these are a key component of inflation indices. Thus, as inflation rises, so too should energy company revenues. Two energy stocks that are on our radar are Exxon Mobil and BP. We prefer BP because it appears to have a stronger focus on green energy initiatives and a decent cash position to follow through on its pledge to go green. This is important, since the IEA said that oil companies will have to stop drilling new prospects after 2025 if developed nations are to reach their emissions targets. BP is also expected to raise its dividend in the coming quarters, after it declared its dividend for Q1, which will make it an even better prospect in the long term. In the short term, there could be further upside in the stock price to 325p, the 12th March high, ahead of 350p, the high from the May 2020.

CFD’s, Options and Forex are leveraged products which can result in losses that exceed your initial deposit. These products may not be suitable for all investors and you should seek independent advice if necessary.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.