Highlights:

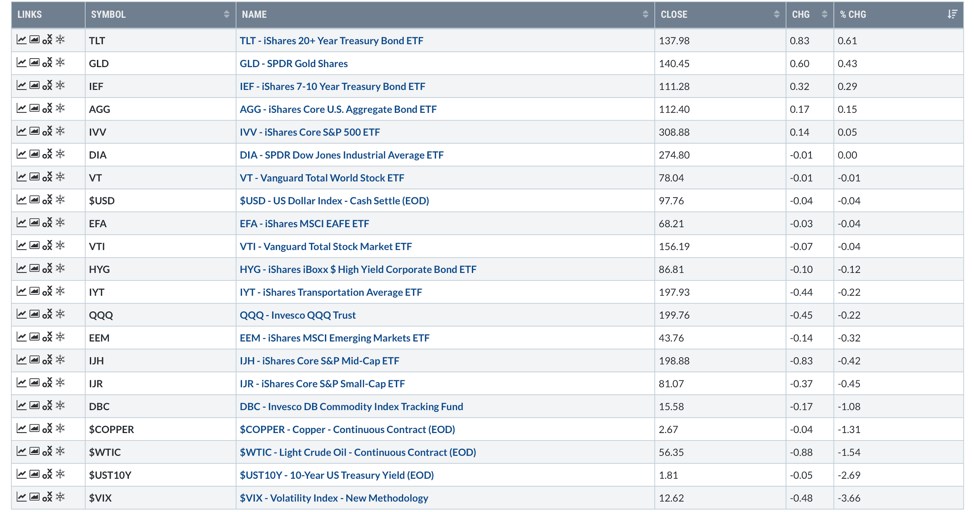

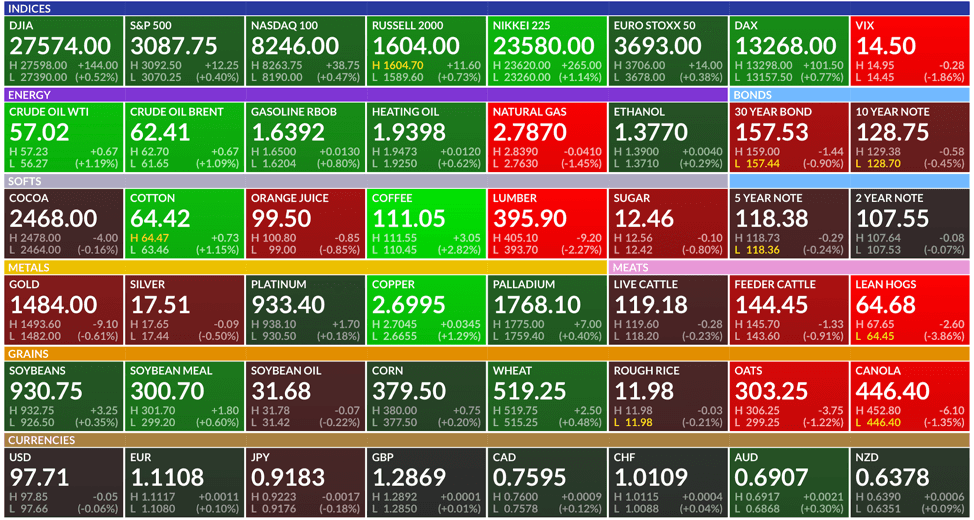

Market Summary: Stocks were little changed yesterday. The S&P 500 ETF (IVV) finished higher by 0.05%. Long-term Treasuries and gold were the clear winners in the asset class department as interest rates on the 10-year Treasury note fell 5 basis points. Commodities were hit hard as copper and crude oil both fell over -1% on the day.

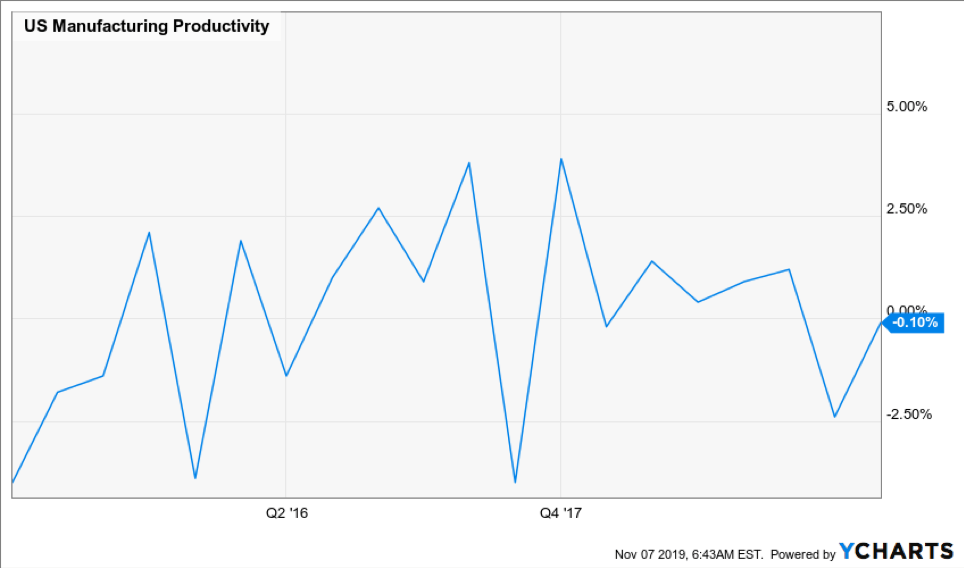

Economic Data: U.S. manufacturing productivity came in at -0.10%. This is up from the lows but still negative. This is yet another sign that although data has improved, it remains suggestive of a slowing economic growth environment.

Top Three Things:

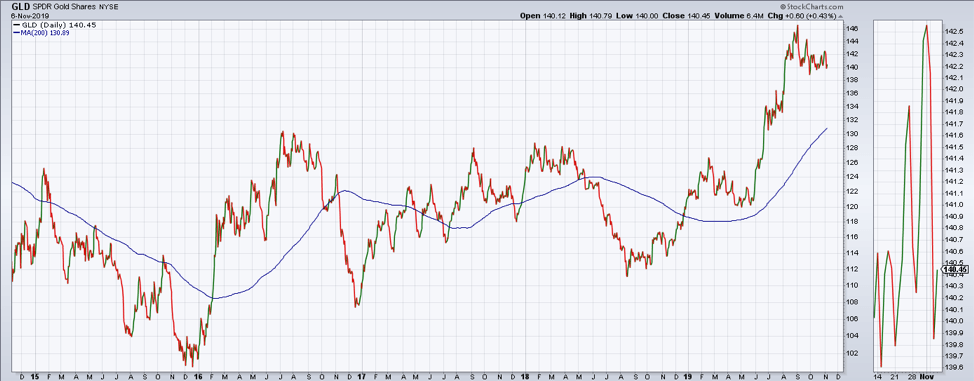

Gold: Gold has continued to consolidate in a positive trend, holding above its rising 200-day moving average and above recent support. Similar to long-term Treasuries, it appears to be forming a triangle pattern. Triangle patterns are historically continuation patterns, but nothing is guaranteed. We will be watching for a breakout to new highs in gold to confirm a continued positive trend. A breakdown would suggest more downside for precious metals.

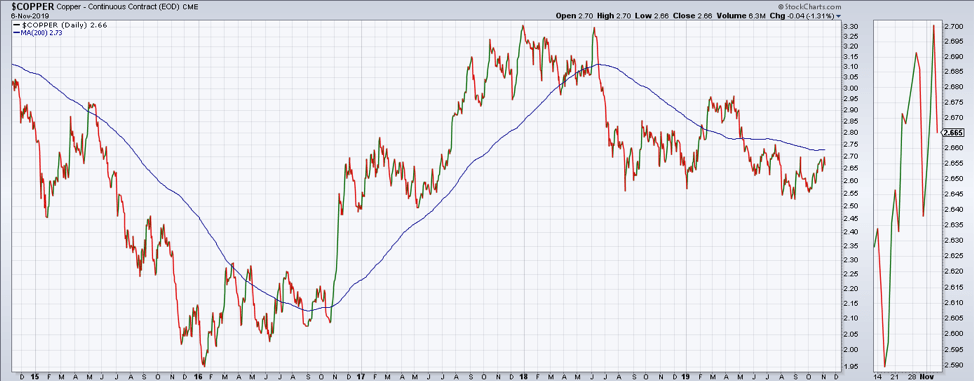

Copper: Copper remains below its 200-day moving average, although it is holding above support. Copper is not confirming the move higher in global stocks and is indicative of the fact that stimulus and lower interest rates are supportive of asset prices, but not necessarily economic activity. We would expect copper to move higher in an environment where global manufacturing data is also accelerating. That is not the case today. Liquidity drives markets, just not the copper market apparently.

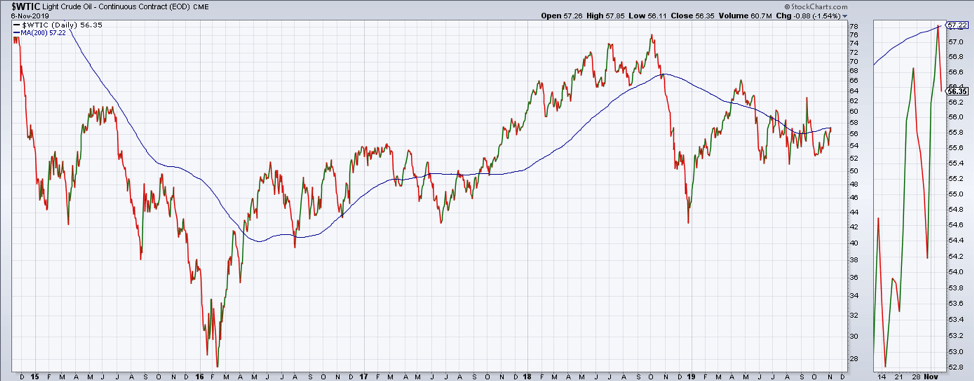

West Texas Crude Oil: Crude oil rallied to the 200-day moving average and failed in its attempt to break above this important moving average. It is currently still in a negative trend. A breakout to the upside could indicate a move higher in global economic data and inflation expectations. A continued downtrend is indicative of deflationary pressures.

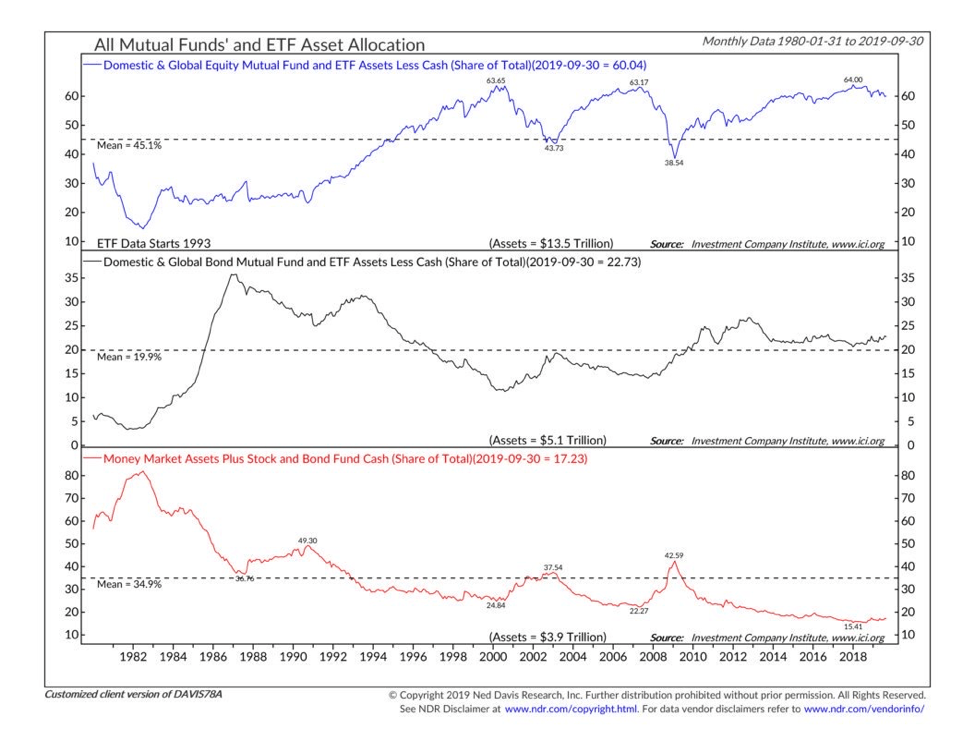

Chart of the Day: Record cash on the sideline? Not so fast. When you compare the amount of money in money market funds relative to other assets, the amount in cash is actually pretty low. Are investors all in?

Futures Summary:

News from Bloomberg:

The U.S. and China agreed to roll back tariffs on each other's goods in phases. For an initial deal, both sides should withdraw existing additional taxes in the same proportion simultaneously, which is "an important condition," the Commerce Ministry's Gao Feng said. If it's confirmed by the U.S., it may provide a road-map toward de-escalating the trade war. The removal of tariffs is China's key demand.

U.S. equity futures jumped with 10-year Treasury yields and oil as the trade pendulum swung back to positive. The dollar and gold slid. European and Asian stocks rose and the yuan strengthened. The pound gained with most major currencies before the Bank of England rate decision.

Two ex-Twitter employees were charged by the U.S., along with a Saudi national, for helping Riyadh spy on dissidents by hacking into their accounts. They were allegedly bribed to mine for data about regime critics and thousands of other users. Twitter said it is committed to protecting its users. Read more about how despots use Twitter to hunt opponents of their regimes.

Rudy Giuliani stirred up the impeachment probe. He tweeted that his controversial work with Ukraine—at the center of the House investigation—was done "solely as a defense attorney" for President Trump, undercutting the administration's claims that he was advancing U.S. foreign policy. Giuliani previously denied bypassing official diplomatic channels. Follow the developments with our Impeachment Update.

Alphabet's handling of sexual harassment and misconduct allegations against executives is being investigated by the board. Earlier this year, it formed a committee to consider claims by shareholders in lawsuits "relating to past workplace conduct." They include the behavior of Chief Legal Officer David Drummond, who's accused of having relationships with employees, CNBC reported.

WealthShield is a division of Emerald Investment Partners, an SEC Registered Investment Advisor. Advisory services are only offered to clients or prospective clients where WealthShield and it’s representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by WealthShield unless a client service agreement is in place. Before investing, consider your investment objectives and WealthShield’s charges and expenses.

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.