Last week’s UK budget marks a return to austerity. The key sentiment of Chancellor Jeremy Hunt’s statement was that the UK now intends to live within its means. There were ultimately very few surprises as a strict budget had already been priced into the GBP, since Jeremy Hunt’s appointment as UK chancellor.

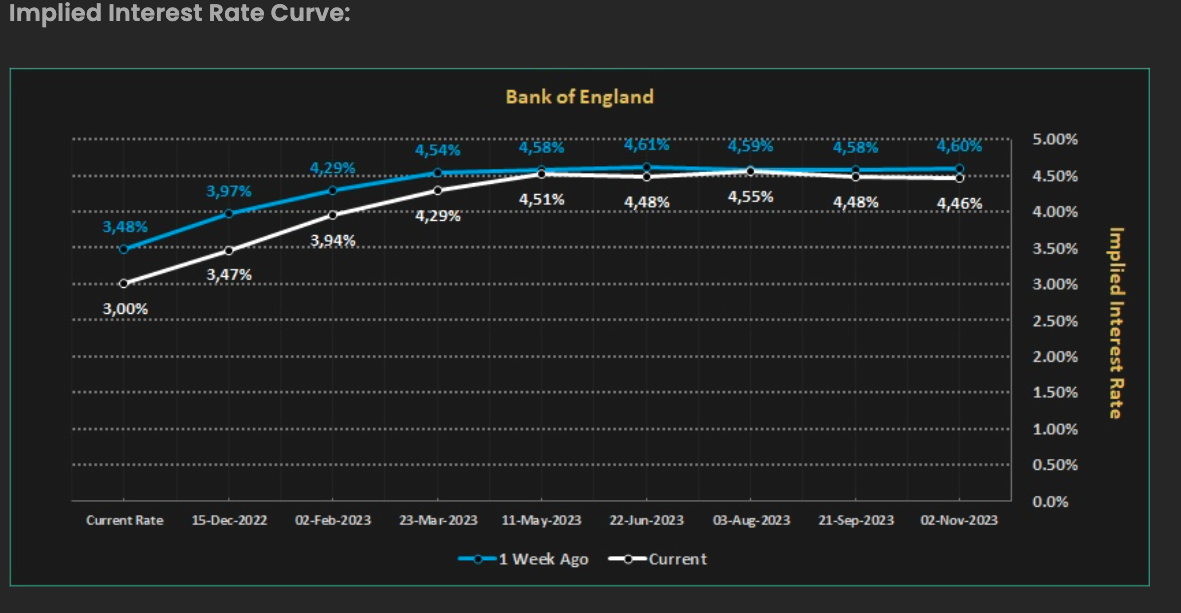

The statement delivered a consolidation of £55bln as a combination of tax rises and spending cuts. Jeremy Hunt hopes this will mean inflation and rates end up significantly lower. However, as the statement was released, expectations for next year’s interest rates remained around the 4.5% mark which was only fractionally lower than prior to the statement. However, STIR markets do now see a 50bps rate hike being the main expectation for the Bank of England’s rate meeting on December 15, which is down lower than it was a week ago. See below for the implied interest rate curve from Financial Source.

Hunt tried to deliver a UK statement that avoided being too austere. Debt to GDP ratio is due to fall as a % of GDP by the 5th year and Public Sector Borrowing must be below 3% of GDP in the same period. Yet, in real terms, public spending will increase resources spending over the next 5 years by 1%.

The UK’s Office for Budget Responsibility said that the Government plans are sufficient for underlying debt to fall modestly in 2026/2027 and 2027/2028. However, it projects the UK will fall into a 1-year recession from Q3 2022 to Q4 2023, and unemployment is set to rise to 4.9% in Q3 2024. So, this budget is trying to take the long view and not become too austere too quickly.

What it means for the GBPUSD

In terms of market reaction, this budget was, on balance, as good as it could have been and it was pretty much as expected. The GBP is most likely to be pushed and pulled around now on the latest USD news as the UK budget was fully priced into the market and pretty much as expected. Some ‘buy the rumour, sell the fact’ response could have been expected and the recessionary outlook should keep the GBP sold on any rallies higher for the very near term. However, medium term and in a longer time frame, any sign of the Fed pausing and the GBPUSD could shoot higher as lots of bad news is already priced in for the GBP. Three catalysts to look at are 1) a weak December US PCE print 2) De-escalation of the Ukraine/Russia crisis and 3) A Fed pause/pivot on December 14 Fed meeting.

Our products and commentary provides general advice that do not take into account your personal objectives, financial situation or needs. The content of this website must not be construed as personal advice.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.

-638046184440753568.png)