The Polish Zloty is experiencing a very good week, gaining against major currencies throughout the whole week. For sure internal macro news were not the major influencer. The published CPI for September was “only” 2.2%. This was an increase from the previous month (1.8%) but much lower than expectations (3.6%). So the MPC might be right saying that we have been observing a spike in inflation and that its level will go back to normality. Then, the hike of interest rates will be postponed in time. The main reason EM currencies have been on the raise this past week, was the weakening USD. The FOMC minutes revealed that tightening monetary policy in the U.S might not be as quick as everybody is expecting. Sure, most FOMC members believe the Fed should hike interest rates in December, but the lack of inflationary pressure might extend in time. At this moment, it is hard to forecast if the tightening process will continue next year. News affected the USD immediately, and the greenback had to give up some of its gains. In turn, the PLN got a boost and kept appreciating. The yields on 10y treasury bonds dropped to 3.4%.

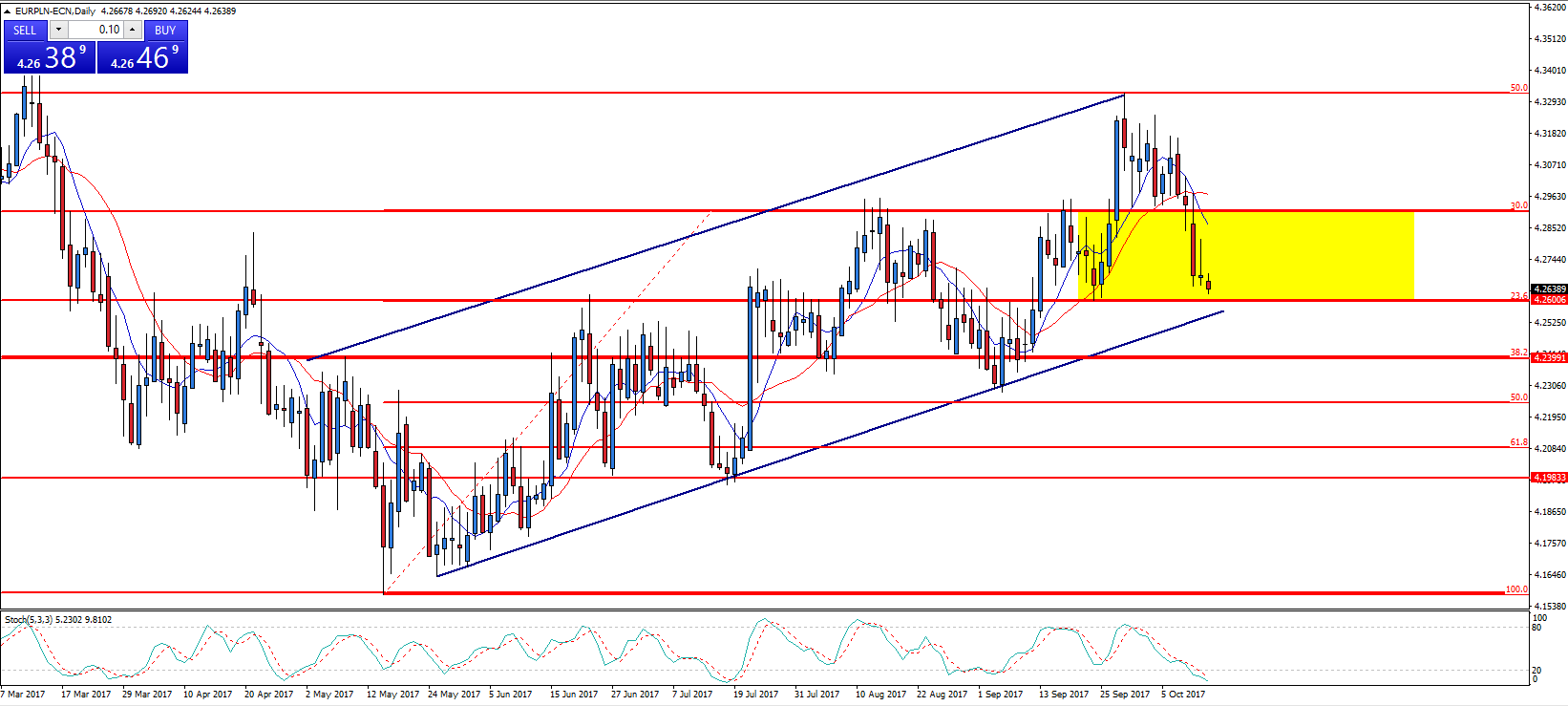

As we see on the daily chart, the EUR/PLN broke the crucial 4.29 support and continued its way down to reach the 4.26 level. This support is strong and it seems it can hold. The stochastic oscillator shows the market is oversold and that we should expect an upward move. If so, the first target will be 4.27 and the next 4.29 (again). Breaking the 4.26 support should trigger a downward move toward 4.24.

Pic.1 EURPLN-ECN D1 Source: MT4 Supreme Edition, Admiral Markets

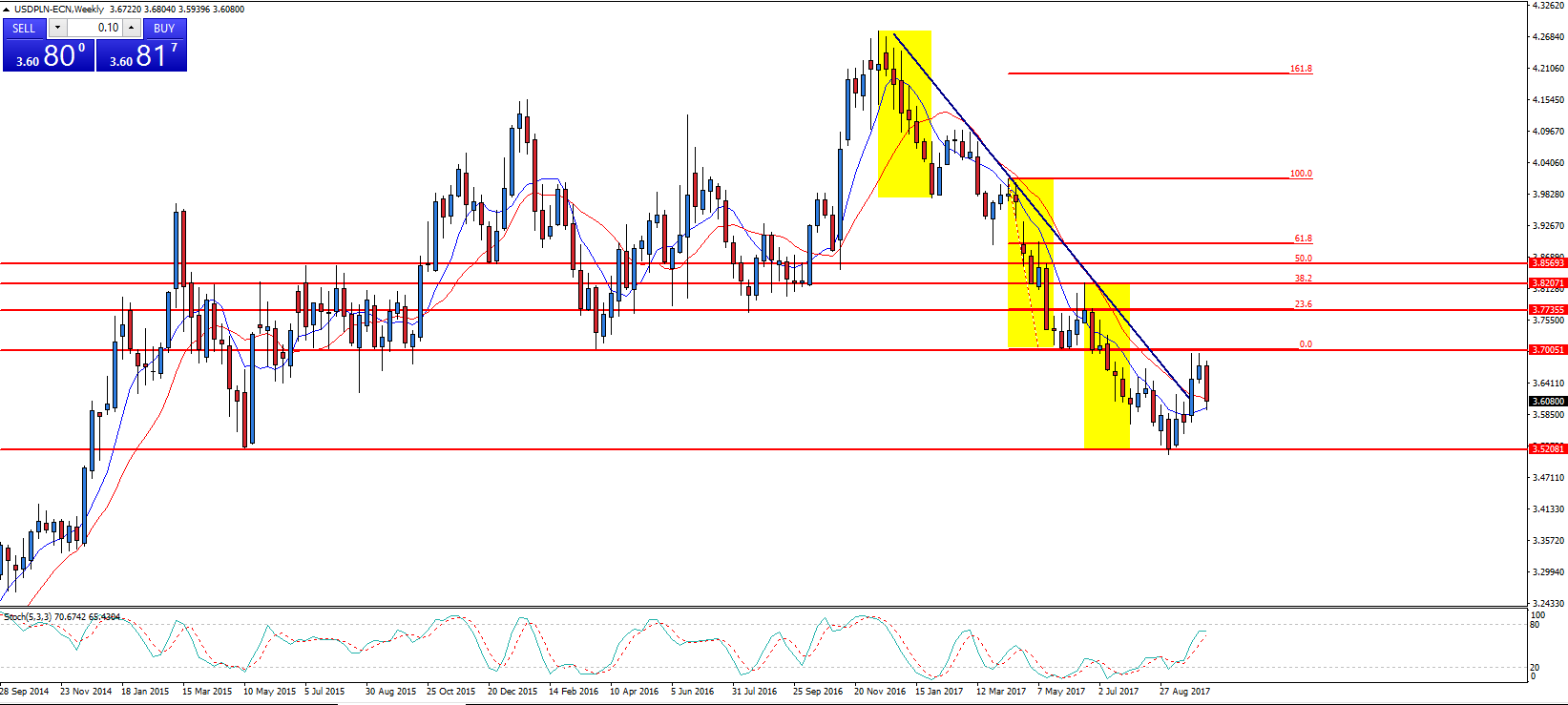

The weakness of the U.S dollar can be seen on the weekly USD/PLN chart. After approaching the 3.70 resistance, further upward move was denied. The corrective movement brought back the market to 3.60. If the USD/PLN ends up the week below that level, the 3.57 support could be tested next week. A rebound is possible with 3.64 being the first target.

Pic.2 USDPLN-ECN W1 Source: MT4 Supreme Edition, Admiral Markets

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD consolidates recovery gains above 1.0650

EUR/USD stays in a consolidation phase following Wednesday's rebound and trades in a narrow range above 1.0650. The improving risk mood doesn't allow the US Dollar to gather strength as markets await mid-tier data releases.

GBP/USD clings to moderate gains above 1.2450

GBP/USD is clinging to recovery gains above 1.2450 in European trading on Thursday. The pair stays supported by a sustained US Dollar weakness alongside retreating US Treasury bond yields. Fed policymakers will speak later in the day.

Gold shines amid fears of fresh escalation in Middle East tensions

Gold trades in positive territory near $2,380 on Thursday after posting losses on Wednesday. The precious metal holds gains amid fears over tensions in the Middle East further escalating, with Israel responding to Iran's attack over the weekend.

Ripple faces significant correction as former SEC litigator says lawsuit could make it to Supreme Court

Ripple (XRP) price hovers below the key $0.50 level on Thursday after failing at another attempt to break and close above the resistance for the fourth day in a row.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.