Outlook:

We will have two new Fed appointments to talk about, plus industrial production and housing starts. But we wonder if the TICS report (Treasury International Capital System) will not be the topmost story, for once. The report shows foreign private and public purchases of US financial assets, including equities, with the most attention paid to buying of long-term sovereign paper. The report is a nightmare to decipher and we have never found a replacement for the Bank of New York economist who interpreted it in days of yore (banks are stupid and have hardly any econo-mists anymore).

The reason TICS could be critical is two-fold. First, it will remind the Trumpies that capital flows are the offset to a trade deficit and aren’t we lucky we can get it. Countries with high sovereign risk see capital outflows. Failed states (e.g., Venezuela) have a flood of outflows. This time, foreign demand for long-term US securities was only slightly lower in Feb at $57.9 billion from $62.5 billion in Jan. The 2017 average was $34.15 billion per month, so these are juicy numbers.

Here’s the rub: Trump is offended by the US trade deficit, imagining a giant conspiracy to cheat the US. But he is forgetting that one of the primary uses of that trade surplus money is buying US govern-ment securities. Trump wants to halt foreigners from making so many dollars from trade without notic-ing this is incompatible with getting them to finance his humungous budget deficit. See the chart of reserve data from ACLS.

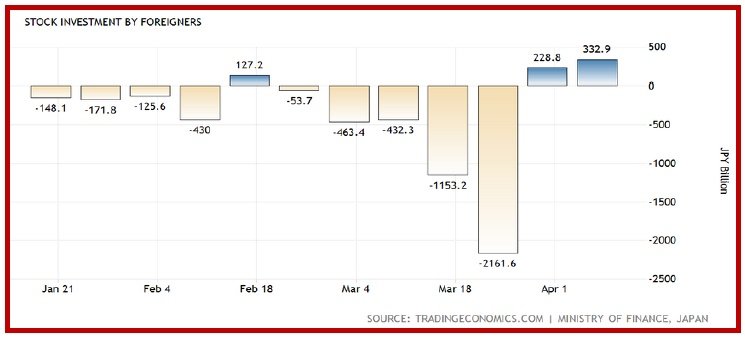

The only country that has managed to run gigantic budget deficits is Japan, but Japan has a terrific ad-vantage the US Does not have—a trade surplus (usually), massive earnings from overseas investments, *and a financial sector willing and able to buy most of the sovereign debt market. The share of foreign ers buying JGB’s has never been more than 5% of total issuance and in March, the FT reported it has fallen to nearly zero (while interest in short-term Japanese paper was rising to nearly 50%). Similarly, foreigners own little of the Tokyo stock market, although they are coming back. See the tradingeco-nomics.com chart. In one of our more spectacular errors—we ate a ton of crow—in 2002 we had ex-pected the Japanese indices to soar back to 1990’s levels.

The point, or one of them, is that a country without a high level of equilibrating foreign capital flows does not thrive. Having a current account surplus is not always a good goal if your country remains isolated on the capital front. Direct foreign investment in Japan is pitifully small—not only does Japan discourage it, but foreigners have a hard time dealing with the culture. Bottom line—seeking to emulate Japan is a stupid strategy.

To return to the trade war, a Chinese spokesman told the press “The U.S.-China trade friction can’t beat the Chinese economy.” This is slapping Trump’s face, inflaming his already outsized sense of griev-ance. It might even what’s behind the ridiculous and factually inaccurate tweet that “Russia and China are playing the Currency Devaluation game as the U.S. keeps raising interest rates. Not acceptable!” We may be entering a period of tiresome rhetorical ping-pong. The US is banning ZTE from buying US parts for 7 years, but China is imposing an anti-dumping tariff on US sorghum. China will remove ownership caps on car companies—now it’s the US’ turn. We will all go mad tracking this stuff. Again, wait for the capital control news.

And not separately, the Hong Kong Monetary Authority has been intervening to support the HKD, with spending on the order of $2.4 billion over the past week. It’s the first intervention since 2015. The peg is not really what is under attack, according to Reuters—the currency move is based on “the spread be-tween three-month HIBOR and its LIBOR equivalent in the United States, … now around [one] per-centage point, its widest since 2008.” All that cash flowing from China into Hong Kong prefers the higher USD interest rate, but the HKMA doesn’t want to raise rates lest it pull in even more cash.

“Thus, even though the U.S. dollar has been weakening against major currencies, the Hong Kong dollar peg has been weakening within its band against the U.S. dollar.” Reuters reminds us “The Hong Kong dollar was pegged at a fixed rate of 7.8 to the U.S. dollar in October 1983. Since May 2005, it has been allowed to move between 7.75 and 7.85.” Remember that year ago, during the first Asian financial cri-sis that spread around the world to emerging markets and Russia, leading to the collapse of Long-Term Capital, the Hong Kong Monetary Authority intervened by going into the stock market, a first.

We see Trump making trouble, more trouble, and the dollar benefiting from a new cycle of risk-off. The problem is that it may last only a few hours before we slingshot back to risk-on.

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes. To see the full report and the traders’ advisories, sign up for a free trial now!

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

EUR/USD holds gains near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold price defends gains below $2,400 as geopolitical risks linger

Gold price is trading below $2,400 in European trading on Friday, holding its retreat from a fresh five-day high of $2,418. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row, supported by lingering Middle East geopolitical risks.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.