Highlights:

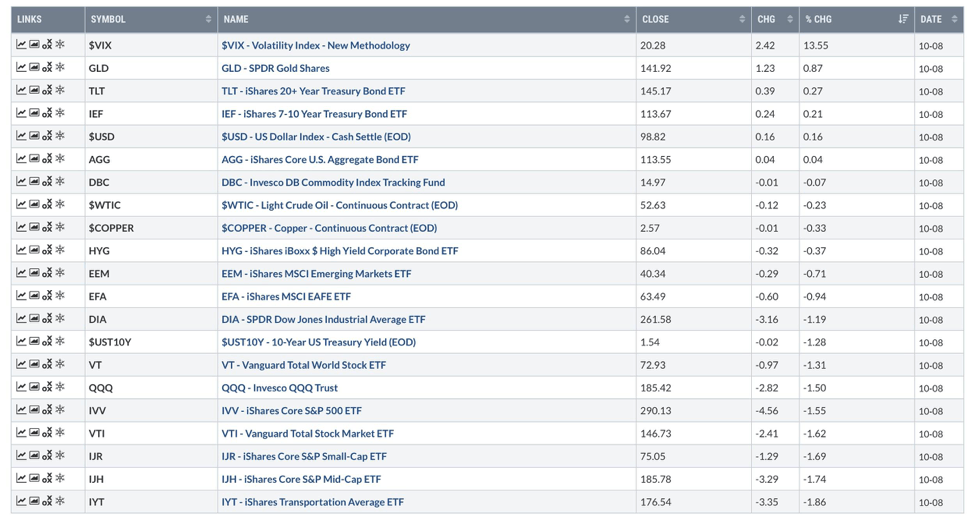

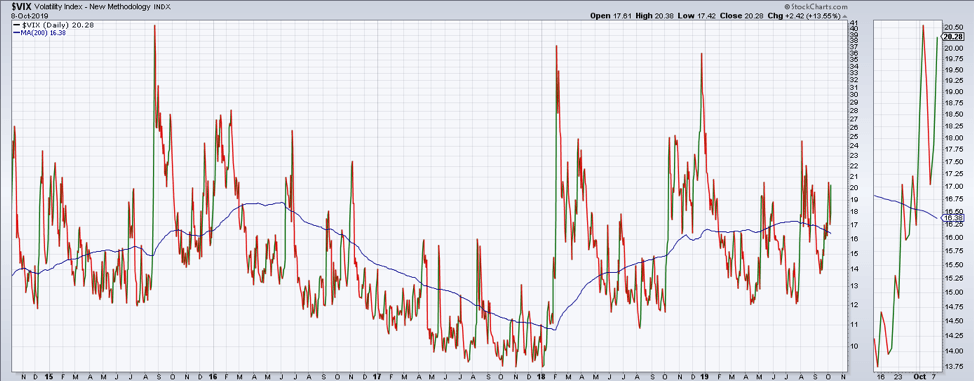

Market Update: The market sold off on intensifying conditions between the U.S. and China. Volatility surged as the VIX moved up over 13% on the day. Gold and Treasuries were also higher on the day as risk-off conditions surfaced. The Vanguard Total World Stock market ETF (VT) finished lower by -1.31%.

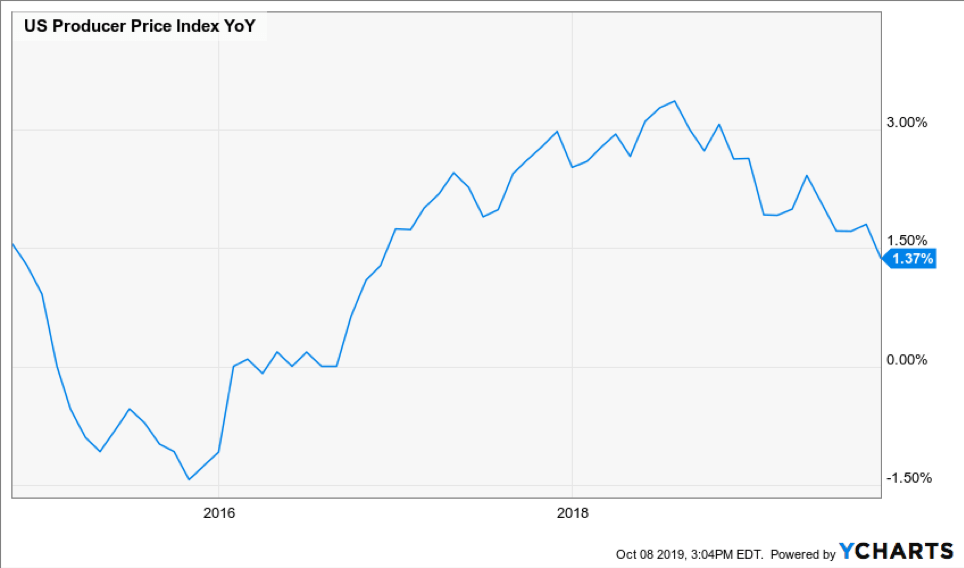

Economic Data: The producer price index was down -0.34% month-over-month. It is up 1.37% year-over-year, down from over 3% at the peak last year. Growth and inflation has been slowing for the better part of the last 12 months.

Volatility: The VIX is close to breaking out to a new short-term high and would imply a breakdown in equity prices. A new 2019 high would occur on a move above 25. Market bulls do not want volatility to break out to the upside. The VIX remains above its 200-day moving average.

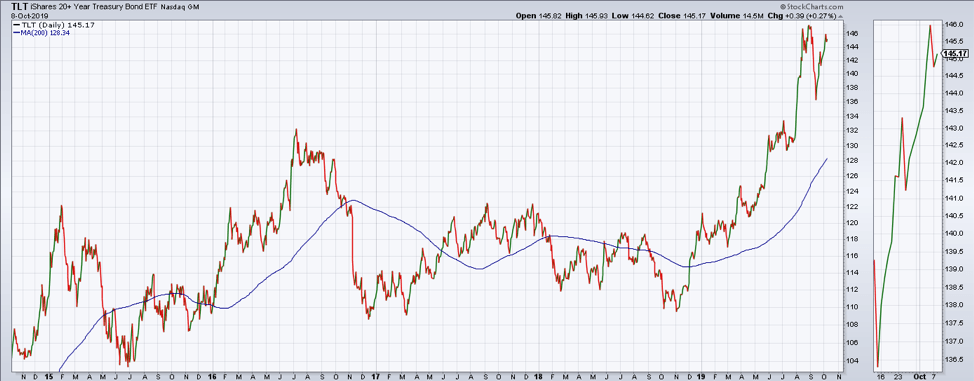

Long-Term Treasuries: The TLT ETF, which tracks the 20-year Treasury market, has yet to break above the high it set this year. A breakout to the upside would most likely be accompanied by a breakdown in interest rates and a rapid deterioration in economic expectations. This could come on the back of failed trade negotiations with China, weak earnings, or weaker than expected consumer data. All of which could come to reality. As my friend Raoul Pal says, "buy bonds and wear diamonds".

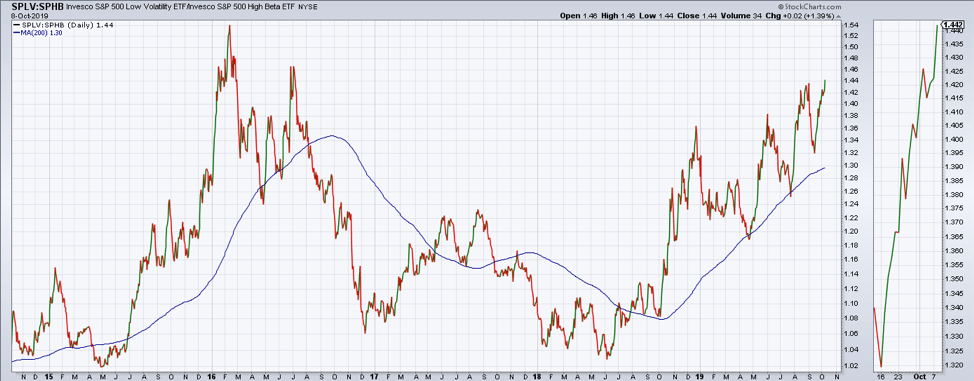

Low Volatility factor: The low volatility factor broke out to new highs against the high beta factor (SPLV/SPHB). This is a bearish development and indicative of accelerating defensive sentiment.

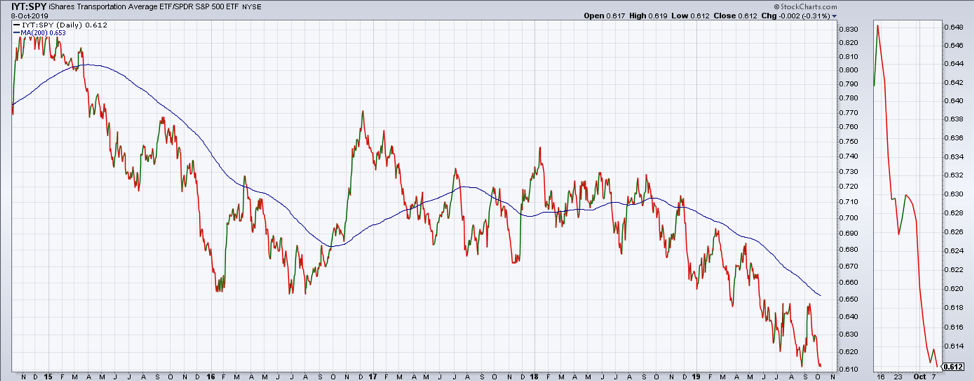

Transportation: Transportation stocks continue to deteriorate and are suggestive of continued negative economic data. The IYT ETF, which tracks transportation shares, is close to breaking to new lows against the broad market (SPY). The ratio remains below a falling 200-day moving average and suggests weak relative strength.

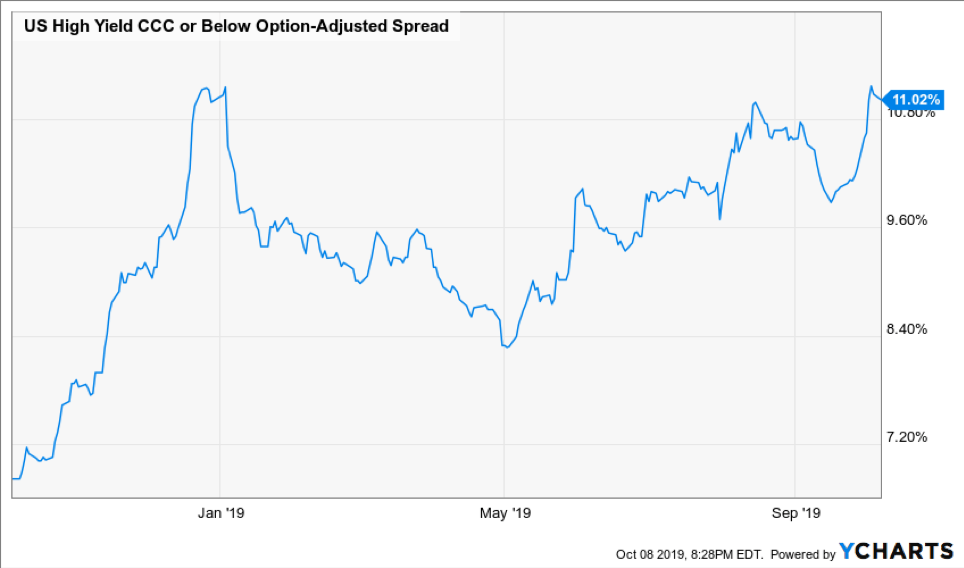

Credit Spreads: It is now time for us to question whether something is happening in credit that we should be concerned about. Spreads on the riskiest of junk bonds (CCC) broke to new 1-year highs recently and are suggestive of tightening credit conditions. If credit deteriorates rapidly, we would expect equity markets to follow. Credit spreads are in a positive trend (widening) and are flashing warning signals to risk markets.

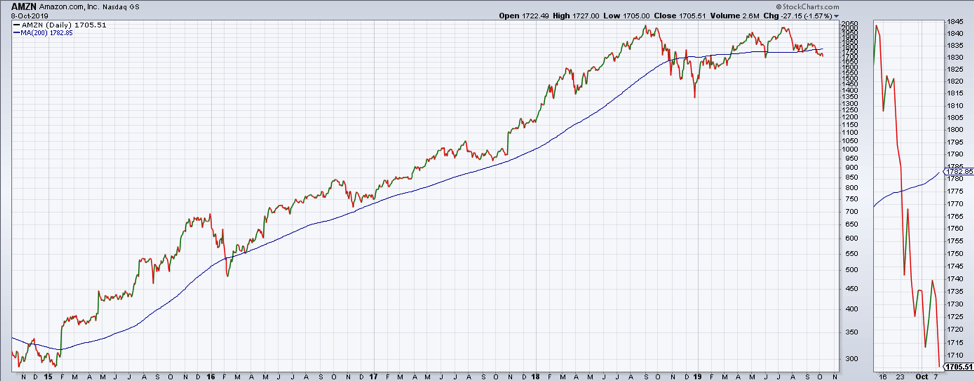

Chart of the Day: Has Amazon peaked? Amazon recently broke below its 200-day moving average after making a double top pattern. If Amazon breaks down from here, it could suggest trouble for the broad market. Amazon has been the hero of the bull market since the global contraction of 2015-2016.

Futures Summary:

News from Bloomberg:

China is still open to a partial trade deal with the U.S. as long as no more tariffs are imposed, an official said, signaling that Beijing is focused on limiting the damage to its economy. Negotiators heading to Washington for talks tomorrow aren't optimistic about securing a broad agreement.

Turkish troops began crossing into northeastern Syria to force back Kurdish militants controlling the border area, a Turkish official said, days after President Trump said the U.S. wouldn't stand in the way. A small forward group of Turkish forces entered Syria at two points along the frontier in preparation for a broader offensive. Kurdish-led forces vowed earlier to defend themselves. Here's a look at what the YPG is.

California is bracing for a blackout. PG&E began cutting power to 800,000 homes and businesses to avert wildfires as high winds are forecast to whip through the state. The outages will hit 34 counties in Northern California. The shutoff, affecting roughly 2.4 million people, is aimed at preventing power lines from sparking another deadly—and costly—conflagration.

Trump's counter-attack against House Democrats is taking shape as the White House moved to consolidate Republican support on Capitol Hill and vowed to block any cooperation with the spreading impeachment inquiry. The White House told Nancy Pelosi the impeachment inquiry is unconstitutional and invalid and Trump and his administration won't participate. So, what happens next?

U.S. stock futures rose with shares in Europe as investors clung to optimism about the latest round of trade talks this week. The dollar tumbled and Treasuries slid. Gold fell and oil gained. The lira slipped.

WealthShield is a division of Emerald Investment Partners, an SEC Registered Investment Advisor. Advisory services are only offered to clients or prospective clients where WealthShield and it’s representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by WealthShield unless a client service agreement is in place. Before investing, consider your investment objectives and WealthShield’s charges and expenses.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0650 after US data

EUR/USD retreats from session highs but manages to hold above 1.0650 in the early American session. Upbeat macroeconomic data releases from the US helps the US Dollar find a foothold and limits the pair's upside.

GBP/USD retreats toward 1.2450 on modest USD rebound

GBP/USD edges lower in the second half of the day and trades at around 1.2450. Better-than-expected Jobless Claims and Philadelphia Fed Manufacturing Index data from the US provides a support to the USD and forces the pair to stay on the back foot.

Gold is closely monitoring geopolitics

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Ripple faces significant correction as former SEC litigator says lawsuit could make it to Supreme Court

Ripple (XRP) price hovers below the key $0.50 level on Thursday after failing at another attempt to break and close above the resistance for the fourth day in a row.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.