Heading into this year, there was a convincing case for a dollar rally. After all, the world’s reserve currency had fallen sharply against most of its major rivals in 2017 as the luster of the pro-dollar “Trump Trade” wore off and the realities of governing set in. As a result, speculative futures traders had flipped to a net short position of 7,000 contracts according to the CFTC’s Commitment of Traders (COT) report at the start of this year, the most bearish positioning since mid-2014. In other words, expectations for any dollar-positive developments were extremely subdued as we flipped our calendars to 2018.

As any pole vaulter will tell you, it’s relatively easy to clear the bar when it’s set too low. In this case, dollar bulls capitalized on the lopsided positioning and continued run of solid economic data in the first half of the year, driving the US dollar index to rally 7.5% off its February lows. The greenback has rallied by even more against currencies that traders were heavily net long such as the Canadian and Australian dollars (+8% and +9% off the February lows, respectively).

Unfortunately for US dollar bulls, the strong positioning tailwind at the start of the year is starting to peter out. According to the COT report, futures traders have now shifted back to a net long position in the dollar index, to the tune of 23,000 contracts. This is the most bullish reading in over a year and closer to the middle of the middle of the three-year range. In other word, dollar

Make no mistake: The Fed is still likely to raise rates at least once more this year, with the potential for another two hikes by the end of the second quarter of 2019, but the outlook beyond that is murky. In fact, as of writing in mid-July, the eurodollar curve has inverted, signaling that traders believe the Fed is more likely to cut its benchmark interest than raise it in 2020!

As CNBC commentators remind us daily, the market is a discounting machine, meaning that the greenback is likely to peak well before the Fed switches to a more dovish outlook, whether that’s in H2 2019 or 2020. Indeed, the market’s skepticism over continued Fed rate hikes is the primary reason for the much-ballyhooed flattening of the US yield curve.

In contrast, the Fed’s biggest rival is likely to shift to a more hawkish posture over the next year. The European Central Bank is planning on winding down its asset purchases by the end of this year, with a new rate hike cycle set to kick off in 2019, assuming everything goes to script (always a big assumption when looking out at future economic developments!). Sooner or later, forward-looking FX traders may start pondering the potential for the US-Eurozone interest rate spread to start tightening after spending the last three years growing wider.

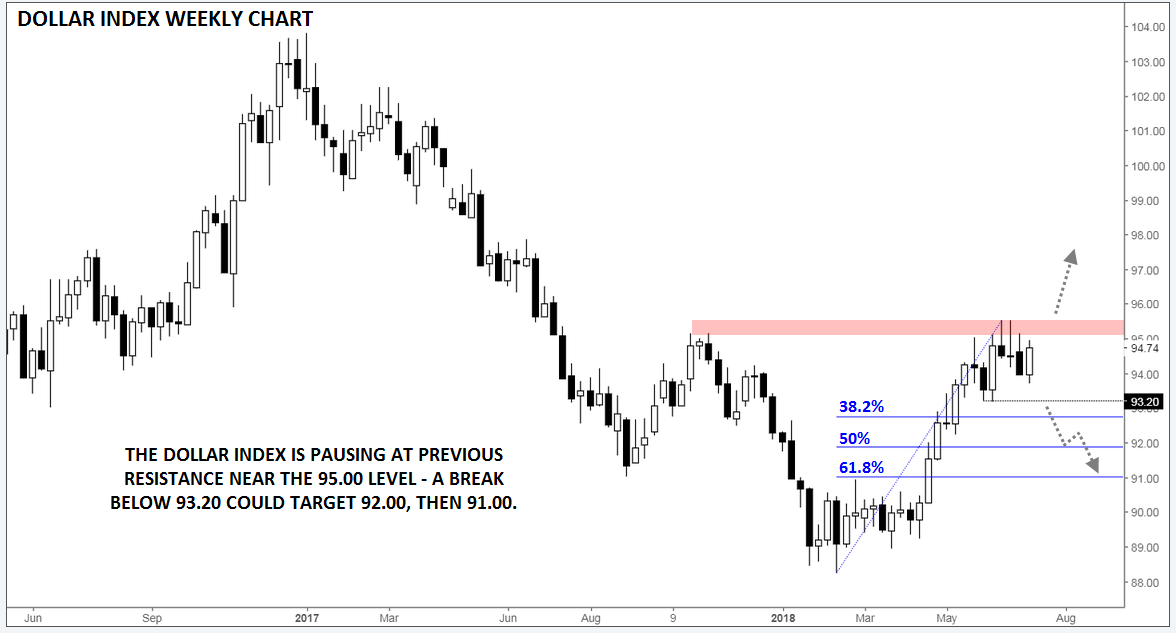

Of course in trading, being right but early on a thesis is the same thing as being wrong. Accordingly, readers may want to wait for a sign that the dollar index is resuming its long-term downtrend before growing too bearish. The first level of potential support to watch will be the 2-month low near 93.20, followed by the 61.8% Fibonacci retracement of this year’s rally near 91.00. Alternatively, a break above the 1-year high in the mid-95.00s would show that strong bullish momentum is trumping any fundamental concerns and could open the door for a continuation higher toward 98.00 in time.

This research is for informational purposes and should not be construed as personal advice. Trading any financial market involves risk. Trading on leverage involves risk of losses greater than deposits.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.