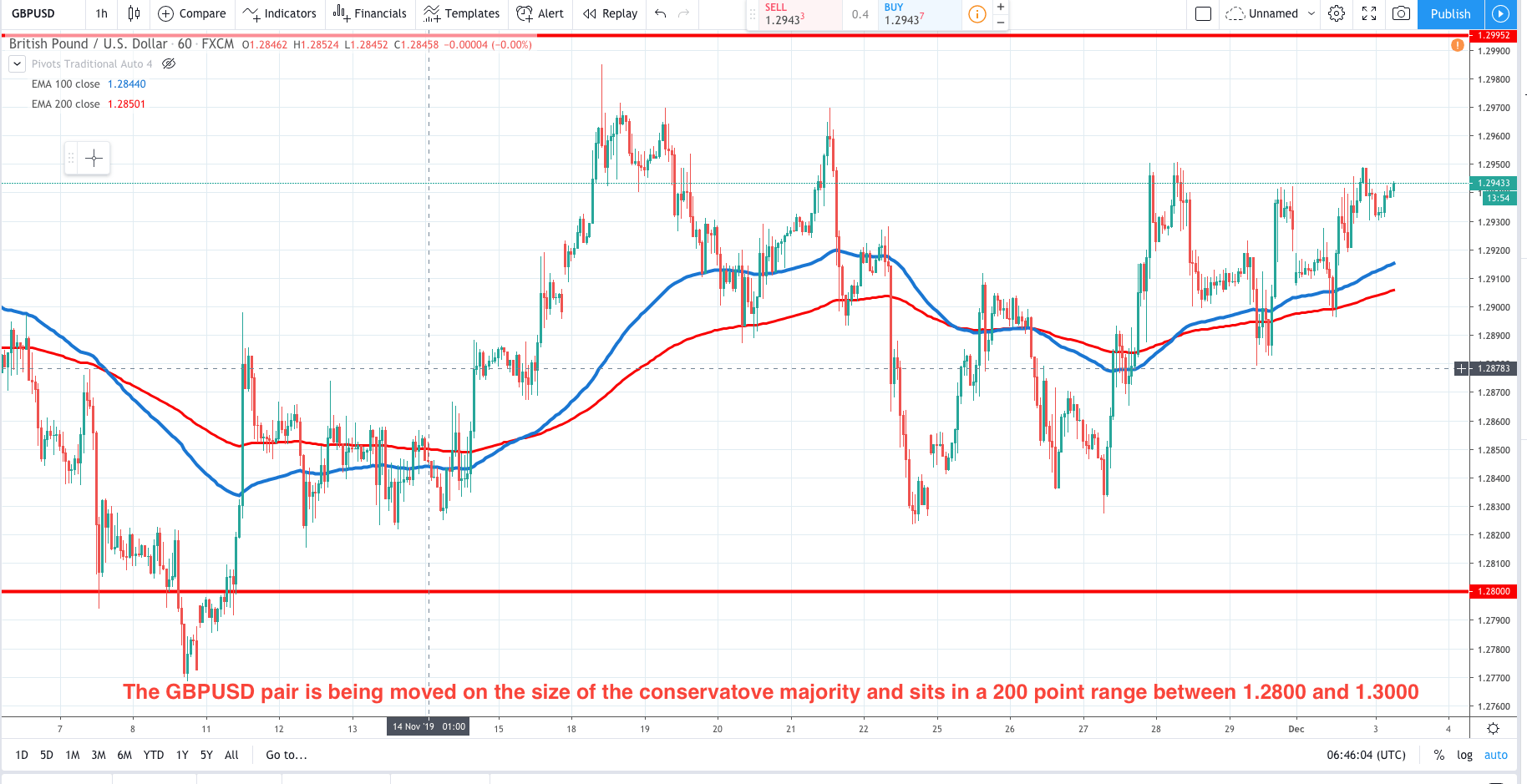

Don’t forget the UK election will drive the GBP for the next 10 days

Remember, the coming UK General election is what’s driving the GBP right now. On December 12 the UK is having an election in December for the first time in nearly 100 years. The direction of the GBP in the lead up to this election date is being driven by the latest polls .

The GBPUSD has moved closed down to 1.2900 after a flurry of polls out over the weekend which have shown a narrowing lead for the conservative party led by PM Johnson. The widely followed YouGov poll was: Conservatives 43% (unchanged), Labour 34% (+2), Lib Dems (13% unchanged) and Brexit Part 2% (-2), conducted on November 28-29. The basic playbook for the GBPUSD pair is:

-

A growing conservative majority = GBP strength

-

A narrowing conservative majority= GBP weakness

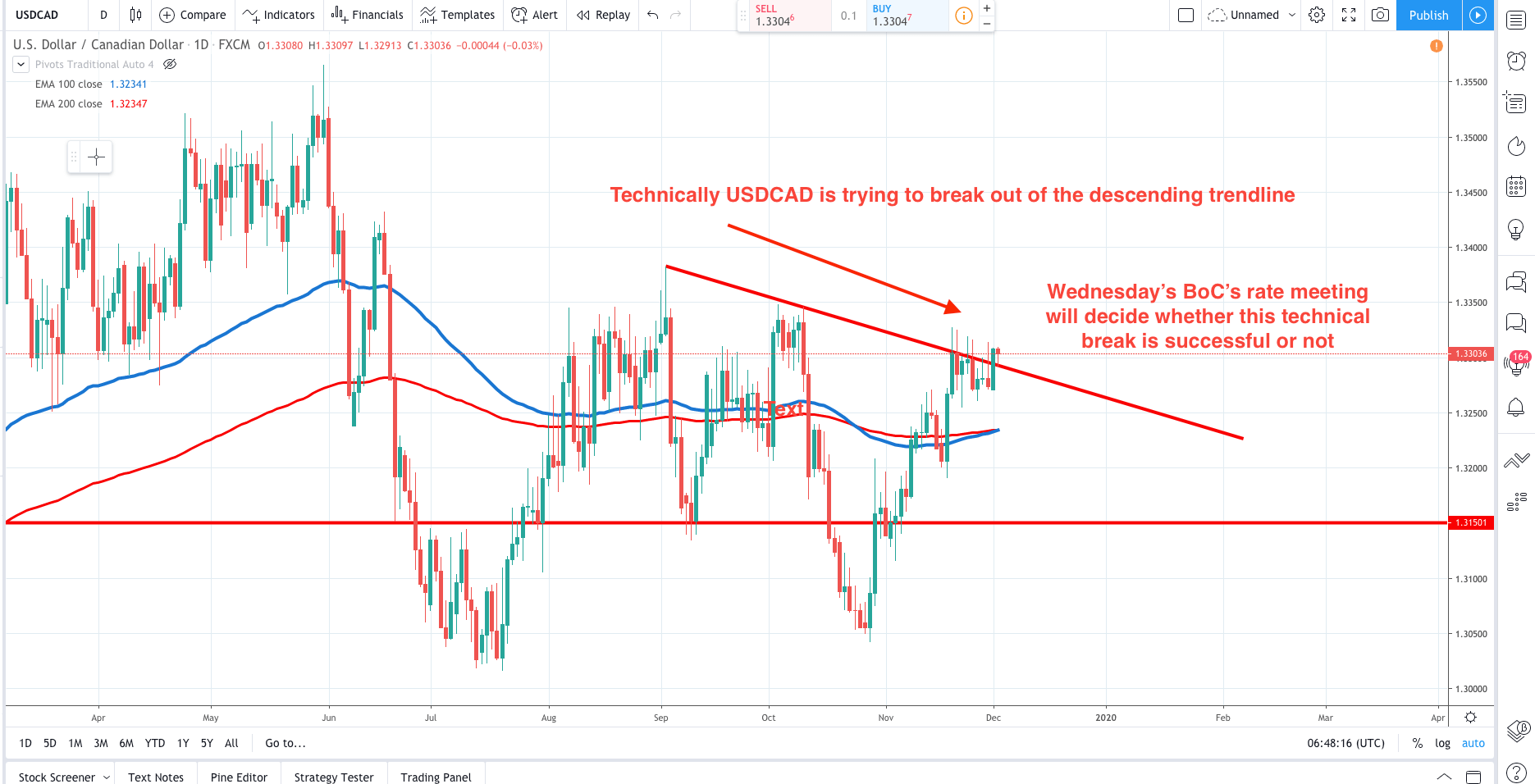

CAD: BoC in focus for tomorrow

Bank of Canada, 1.75%. Neutral/bullish.

The Bank of Canada had been the only major central bank to not turn explicitly dovish. However, at their latest rate meeting the BoC highlighted their concern over the US-China trade deal as a potential drag on the Canadian economy and the BoC's tone was more dovish. However, last week Governor Poloz was more upbeat about the Canadian economy. This week Canada's September non-farm earnings showed the largest rise in wages since 2014. The Q3 GDP on Friday was as expected at +1.3%, so this is enough positive data that the BoC should stay on hold at the moment With the BoC having enough solid data to maintain rates as they are for the immediate future the market will be waiting to see how Poloz steers future expectations on Wednesday’s meeting. A bullish perspective from Governor Poloz and expect further USDCAD downside.

Our products and commentary provides general advice that do not take into account your personal objectives, financial situation or needs. The content of this website must not be construed as personal advice.

Recommended Content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.