Outlook:

We get PPI today, not usually a driver but expected to show a similar outcome as CPI—headline the same 1.6% but core PPI up 2.1%.

The rise in CPI and yields is giving the dollar some respite from a sell-off, but by the end of the day or by the open Sunday evening, we expect the consensus to shift back to dollar-negative. We have no good cause to erase the analysis that the Fed is not only going to cut on July 31, but again later in the year. This opinion is backed up by Powell’s own strong signals in Congressional testimony.

Besides, Congress is falling all over itself to show support for Powell and respect for the Fed’s independence. Granted, Powell earned it with 116 trips to Capital Hill to educate lawmakers. The WSJ reports “That outreach appears to be paying off. Democrats were warm to Mr. Powell, encouraging him to stand firm against President Trump’s sustained criticism. And Republicans didn’t join Mr. Trump in pressing any critique.” In other words, the traditional Republican/Libertarian opposition to QE is what is muted these days when only a few months ago they were agitating for the Fed to shrink its balance sheet.

A fly in the ointment remains the Japan model, i.e., that the Fed cuts rates to the bone and then has no ammunition to address a real recession. While Powell admits the Fed keeps a close and careful eye on Japan, he hasn’t mentioned any new or innovative policies to avoid Japan’s fate. Another criticism of Powell is that rate cuts throw gasoline on asset bubbles. But the overall stance, and one that is being accepted, is that doing too much now is better than having to fix it later.

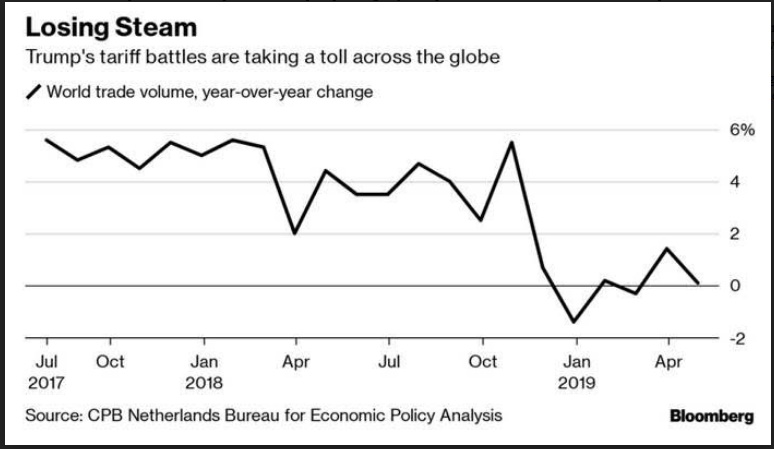

And we keep coming back, inevitably, to the barely disguised Real Reason for rate cuts—the Fed is trying to counteract the damage Trump is inflicting on the US and global economy with trade wars. A nice industrial output read from the eurozone and other seemingly favorable data are temporary. Analysts fear the worst is yet to come. See the chart.

When trade volumes fall, businesses pare back capital spending plans. Powell noted in his testimony that capital spending plans are the thing to worry about, not labor market conditions or unemployment, since it’s capital spending that leads to those very employment data points the Fed is supposed to be monitoring. This is the Fed introducing a new mandate to its Congressional mandate of “price stability and full employment.” Because capital spending has a big confidence factor embedded in it, Powell is venturing into new and murky waters.

We have been calling for this recognition for a long time—with a tortured effort periodically to get a handle on capital spending (it ain’t easy). If you are feeling wonky, check out Mr. Yardeni. There’s investment in structures, equipment, intellectual property—too much data. In a nutshell, capital spending will likely be 5% this year, down from 6% in 2018 and feeble compared to double digit growth in earlier expansions.

This is due entirely to the Trump-generated headwind of trade wars. And it’s not going to recover until Nafta 2.0 and the China deal are behind us. It’s in Trump’s self-interest to keep those issues in turmoil for as long as he can so that he can say, again, he’s “the only one who can fix it.” So the Fed is right to cut rates at least once to offset this problem, but it’s not going to be all that helpful to other economics suffering from the same effects, especially in Europe. It remains to be seen whether the Fed and/or other central banks adopt a new mandate of promoting capital investment. The logical way to do it with fiscal policy, which si beyond the scope of central banks.

At a guess, the dollar will resume a downward slide on the expectation that the job of offsetting Trump is bigger than anyone knows and a second and third cut are likely. We like an oddball proxy—the gain in emerging market currencies that reflects long-term investor readings of relative differentials. See the dollar/peso chart. The dollar has retraced over 62% of the politically-inspired upmove and is bouncing upward, as usual, but likely to resume the downmove. If the peso can gain despite Mexico’s very real issues, the dollar has a powerful headwind.

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a free trial, please write to [email protected] and you will be added to the mailing list..

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 after US GDP data

EUR/USD came under modest bearish pressure and retreated below 1.0700. Although the US data showed that the economy grew at a softer pace than expected in Q1, strong inflation-related details provided a boost to the USD.

GBP/USD declines below 1.2500 as USD rebounds

GBP/USD declined below 1.2500 and erased the majority of its daily gains with the immediate reaction to the US GDP report. The US economy expanded at a softer pace than expected in Q1 but the price deflator jumped to 3.4% from 1.8%.

Gold drops below $2,320 as US yields shoot higher

Gold lost its traction and turned negative on the day below $2,320 in the American session on Thursday. The benchmark 10-year US Treasury bond yield is up more than 1% on the day above 4.7% after US GDP report, weighing on XAU/USD.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.