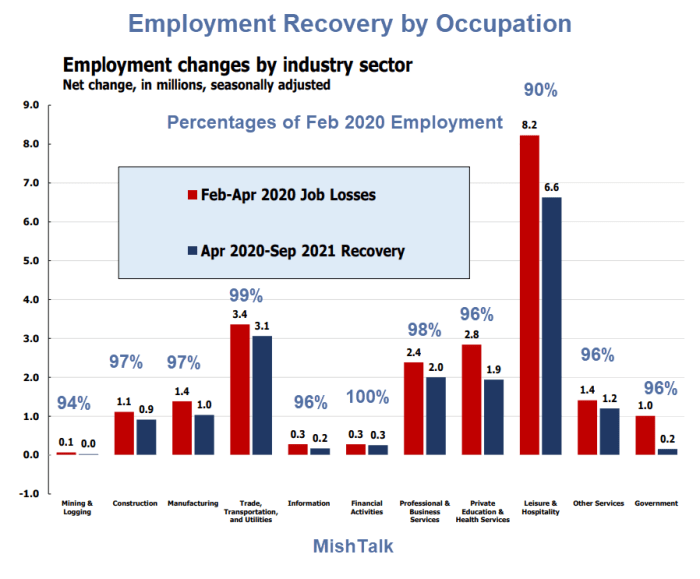

Let's look at 11 sectors in search of job winners and losers.

Recovery by Sector to Nearest Full Percent

- Mining and Logging: 43,000 below the February 2020 total of 689,000. 94% of February 2020 total.

- Construction: 201,000 below the February 2020 total of 7.648 million. 97% of February 2020 total.

- Manufacturing: 400,000 below the February 2020 of 12.799 million. 97% of February 2020 total.

- Trade, Transportation, Utilities: 300,000 below the February 2020 total of 27.876 million. 99% of February 2020 total. Transportation employment is 72,000 above its February 2020 level. Retail Trade is 200,000 below February 2020. Utilities are 10,000 below February 2020.

- Information: 100,000 below the February 2020 total of 2.914 million. 96% of February 2020 total.

- Financial Activities: 25,000 below the February 2020 total of 8.875 million. 100% of February 2020 total.

- Professional and Business Services: 385,000 below the February 2020 total of 21.469 million. 98% of February 2020 total.

- Private Education and Health Services: 900,00 below the February 2020 total of 24.565 million. 96% of February 2020 total.

- Leisure and Hospitality: 1.6 million below the February 2020 total of 16.915 million. 90% of February 2020 total.

- Other Services: 210,00 below the February 2020 total of 5.937 million. 96% of February 2020 total.

- Government: 851,00 below the February 2020 total of 22.835 million. 96% of February 2020 total.

Winners and Losers

Leisure and hospitality lost the most jobs and is the slowest in regaining the pre-pandemic level.

Despite millions of job openings, the number of leisure and hospitality employees is 1.6 million (10% below) the February 2020 total of 16.915 million.

The clear winner is financial activities. Out of 8.875 million workers, the total drawdown was only 279,000. Of that total, only 25,000 remain.

BofA Raises Minimum Wage to $21

In related discussion, please note BofA Raises Minimum Wage to $21, Wage Push Inflation Will Kill Small Businesses

Financial Activities is where to be. After all, "It's God's Work"

This material is based upon information that Sitka Pacific Capital Management considers reliable and endeavors to keep current, Sitka Pacific Capital Management does not assure that this material is accurate, current or complete, and it should not be relied upon as such.

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold climbs above $2,340 following earlier drop

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.