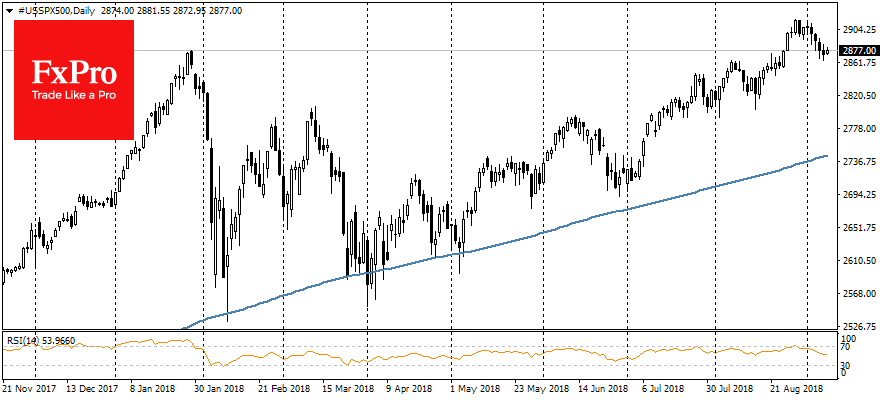

The US dollar is on the rise after strong U.S. labour market data published on Friday. The EURUSD is traded near 1.1540; it returned to this month lows. The U.S. stock markets had been declining the fifth day in a row on Friday, and had increased the losses during week to 1.2% on S&P500.

The dollar index is trading near 94.45, adding almost 0.6% after the release of the statistics for August. MSCI for Asia-Pacific region declined by 3.5% last week and remains under pressure on Monday, losing 0.6% due to fears of trade wars.

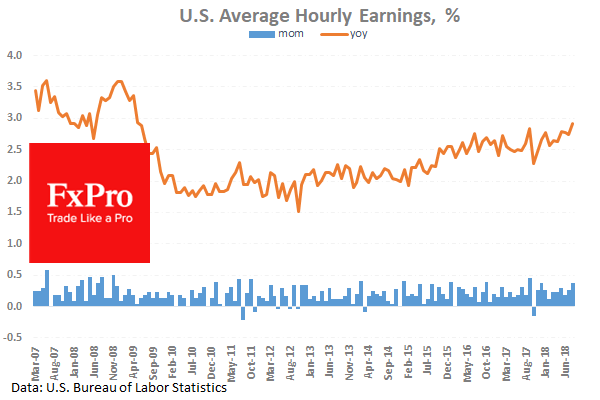

The acceleration of wage growth coupled with the continued high pace of the U.S. employment growth is a strong argument for the Fed to implement a more rigorous monetary policy. Average hourly wages grew by 0.4%, and the annual growth rate rose to 2.9%, the highest level in 9 years. At the same time, the employment rate increased by 201K, recovering to the trend indicators after the weak data of July. According to CME’s FedWatch tool, the markets are 99% convinced that Fed will raise the rate in September, and lay 75% probability of another increase in December, which is 10 points higher than the month before.

Asian markets had experienced the strongest weekly drop in six months on the outcome of last week amid Trump’s threats to impose tariffs on almost all Chinese imports of more than $550 bln. High uncertainty and already introduced tariffs are already causing a slowdown in the world trade, but China’s surplus in the trade with the United States is updating the records, as US companies are in a hurry to increase purchases from China before the introduction of 25% tariffs. The recent threats of expanding tariffs for almost all exports can lead to even bigger trade deficits in the US and China in the next couple of months, but this will almost inevitably be followed by a serious downturn.

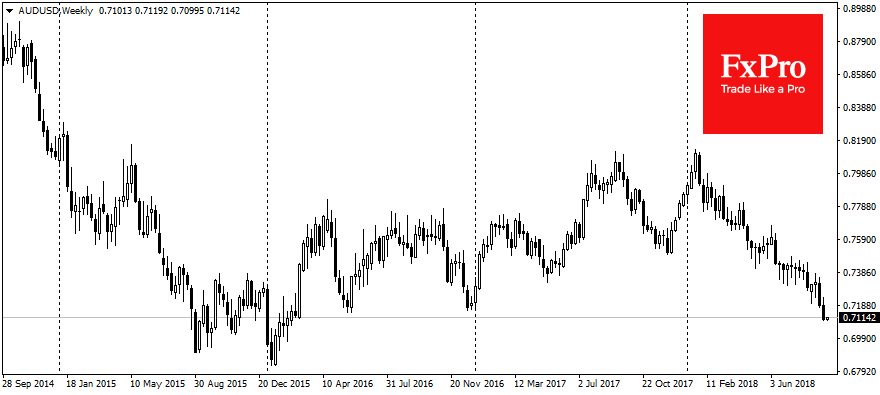

Very often, the Aussie can be considered as a canary in coal mine for the world trade in general and Chinese industry in particular. The fall of the Australian dollar to 31-months lows, despite a strong growth of the country’s GDP, can be seen as an important leading indicator of China’s dynamics, as Australia is a major supplier of raw materials for Asian factories. And now, AUDUSD is traded near 0.71, which is just a couple of steps from 0.68 – the lows to the beginning of 2016, when the fear of a hard landing of China’s economy came over the market.

FxPro UK Limited is authorised and regulated by the Financial Services Authority, registration number 509956. CFDs are leveraged products that incur a high level of risk and it is possible to lose all your capital invested. Please ensure that you understand the risks involved and seek independent advice if necessary.

Disclaimer: This material is considered a marketing communication and does not contain, and should not be construed as containing, investment advice or an investment recommendation or, an offer of or solicitation for any transactions in financial instruments. Past performance is not a guarantee of or prediction of future performance. FxPro does not take into account your personal investment objectives or financial situation. FxPro makes no representation and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplied by any employee of FxPro, a third party or otherwise. This material has not been prepared in accordance with legal requirements promoting the independence of investment research and it is not subject to any prohibition on dealing ahead of the dissemination of investment research. All expressions of opinion are subject to change without notice. Any opinions made may be personal to the author and may not reflect the opinions of FxPro. This communication must not be reproduced or further distributed without the prior permission of FxPro. Risk Warning: CFDs, which are leveraged products, incur a high level of risk and can result in the loss of all your invested capital. Therefore, CFDs may not be suitable for all investors. You should not risk more than you are prepared to lose. Before deciding to trade, please ensure you understand the risks involved and take into account your level of experience. Seek independent advice if necessary. FxPro Financial Services Ltd is authorised and regulated by the CySEC (licence no. 078/07) and FxPro UK Limited is authorised and regulated by the Financial Services Authority, Number 509956.

Recommended Content

Editors’ Picks

EUR/USD holds gains near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold price defends gains below $2,400 as geopolitical risks linger

Gold price is trading below $2,400 in European trading on Friday, holding its retreat from a fresh five-day high of $2,418. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row, supported by lingering Middle East geopolitical risks.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.