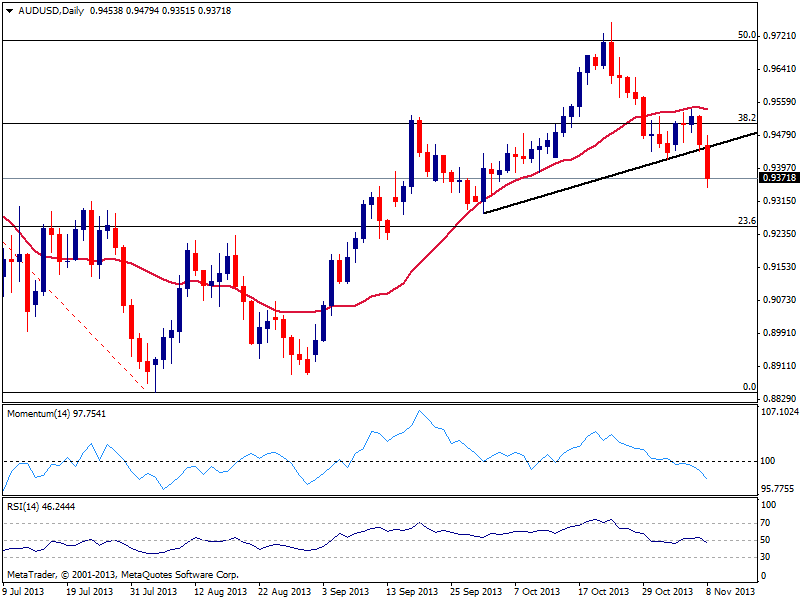

Technically the pair seems to have formed a H&S figure clear in the daily chart, with the shoulders around the 38.2% retracement of the 1.0580/0.8846 year fall at 0.9510 and the head at past October high and 50% retracement of the same rally around 0.9740. Having broke below the neckline and with daily indicators showing a strong bearish tone, the pair has room to extend its slide towards 0.9000, target of the figure.

A price acceleration below the weekly low of 0.9351 should see a downward continuation towards 0.9260 area, strong static support level, while a break below this last will confirm the rest of the key psychological 0.9000 figure. Former low at 0.9420 acts as immediate resistance, and a recovery above may see a pullback towards 0.9510 area, denying the bearish continuation.

View Live Chart for AUD/USD

Recommended Content

Editors’ Picks

GBP/USD stays weak near 1.2400 after UK Retail Sales data

GBP/USD stays vulnerable near 1.2400 early Friday, sitting at five-month troughs. The UK Retail Sales data came in mixed and added to the weakness in the pair. Risk-aversion on the Middle East escalation keeps the pair on the back foot.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold: Middle East war fears spark fresh XAU/USD rally, will it sustain?

Gold price is trading close to $2,400 early Friday, reversing from a fresh five-day high reached at $2,418 earlier in the Asian session. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Israel vs. Iran: Fear of escalation grips risk markets

Recent reports of an Israeli aerial bombardment targeting a key nuclear facility in central Isfahan have sparked a significant shift out of risk assets and into safe-haven investments.