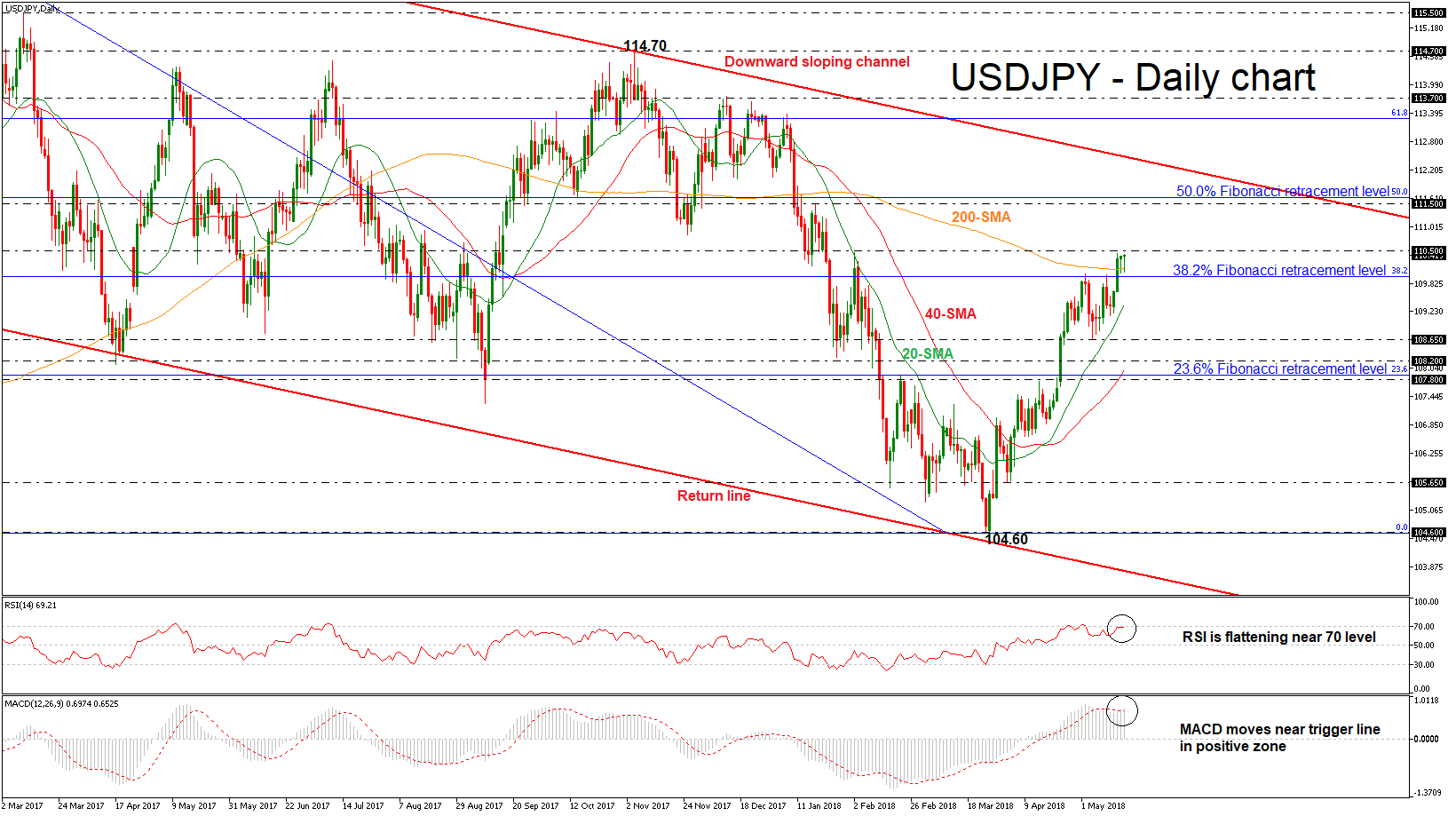

USDJPY is moving near its opening level during today’s early European session following the aggressive buying interest of the previous three days. The pair has challenged a fresh more than three-month high of 110.44 and successfully surpassed the 200-day simple moving average (SMA). The price remains above the aforementioned obstacle however, technical indicators suggest that the market could ease a little bit in the short-term.

From the technical point of view, in the daily timeframe, the RSI indicator is flattening after reaching overbought levels, while the MACD oscillator is holding near its trigger line in the positive territory, both hinting that the next potential move in prices could be weaker than before.

If the price extends its bullish bias and climbs above the 110.50 barrier, immediate resistance could be met at the 111.50 hurdle, which stands near the 50.0% Fibonacci mark. A jump above this significant zone could send prices towards the descending trend line of the downward sloping channel near 112.00.

On the flip side, should the market create a bearish correction of the sharp bullish rally, immediate support could be found near the 38.2% Fibonacci retracement level around the 110.00 handle of the downleg from 118.60 to 104.60. A significant leg below this area could drive prices towards the 20-day SMA which currently fluctuates near 109.35 before the market retests the 108.65 support.

In the bigger picture, the pair has been developing within a channel tilted slightly to the downside since December 2016 and is now turning its focus to the upside, trying to hit the upper boundary.

Forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.

Recommended Content

Editors’ Picks

EUR/USD rebounds to 1.0650 on renewed USD weakness

EUR/USD gained traction and rose to the 1.0650 area in the early American session on Tuesday. Disappointing housing data from the US seem to be weighing on the US Dollar, helping the pair stretch higher.

GBP/USD climbs above 1.2450 after US data

GBP/USD extended its recovery from the multi-month low it touched near 1.2400 and turned positive on the day above 1.2450. The modest selling pressure surrounding the US Dollar after dismal housing data supports the pair's rebound.

Gold retreats to $2,370 as US yields push higher

Gold stages a correction on Tuesday and fluctuates in negative territory near $2,370 following Monday's upsurge. The benchmark 10-year US Treasury bond yield continues to push higher above 4.6% and makes it difficult for XAU/USD to gain traction.

XRP struggles below $0.50 resistance as SEC vs. Ripple lawsuit likely to enter final pretrial conference

XRP is struggling with resistance at $0.50 as Ripple and the US Securities and Exchange Commission (SEC) are gearing up for the final pretrial conference on Tuesday at a New York court.

US outperformance continues

The economic divergence between the US and the rest of the world has become increasingly pronounced. The latest US inflation prints highlight that underlying inflation pressures seemingly remain stickier than in most other parts of the world.