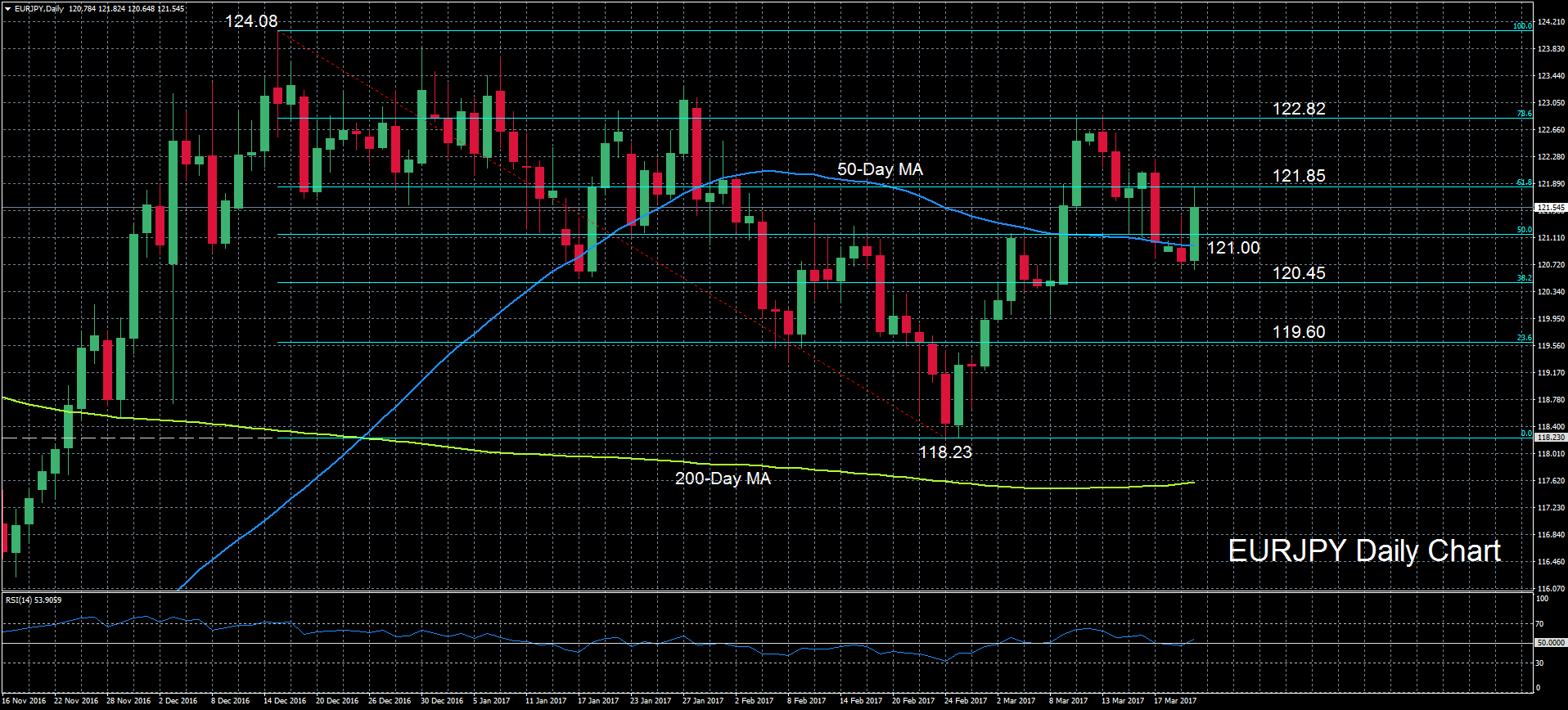

EURJPY is significantly higher today as the pair attempts to regain some positive momentum following a week long slide. Prices rose sharply above the 50-day moving average but met resistance at the 61.8% Fibonacci retracement level of the December-February downleg from 124.08 to 118.23.

Further upside moves in the near term are possible as the RSI rose back into bullish territory above 50, though at around 53, the positive bias is not very strong. Should prices extend today’s gains, a break above the 61.8% Fibonacci level at 121.85 would bring the next Fibonacci level into view. The 78.6% Fibonacci level capped EURJPY’s two-week rally at around 122.82 earlier this month. A successful challenge of this level would set the pair on track to target December’s 6-month high of 124.08.

Such a move would reinforce the bullish medium-term outlook, which is in danger of turning neutral if prices continue to consolidate.

On the downside, immediate support should, come from the 50-day moving average, which is currently flat-lining at 121. A drop below this key level would turn the short-term bias back to bearish. Further declines would open the way towards the 38.2% and 23.6% Fibonacci levels at 120.45 and 119.60 respectively.

Forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.

Recommended Content

Editors’ Picks

EUR/USD consolidates recovery below 1.0700 amid upbeat mood

EUR/USD is consolidating its recovery but remains below 1.0700 in early Europe on Thursday. The US Dollar holds its corrective decline amid a stabilizing market mood, despite looming Middle East geopolitical risks. Speeches from ECB and Fed officials remain on tap.

GBP/USD advances toward 1.2500 on weaker US Dollar

GBP/USD is extending recovery gains toward 1.2500 in the European morning on Thursday. The pair stays supported by a sustained US Dollar weakness alongside the US Treasury bond yields. Risk appetite also underpins the higher-yielding currency pair. ahead of mid-tier US data and Fedspeak.

Gold appears a ‘buy-the-dips’ trade on simmering Israel-Iran tensions

Gold price attempts another run to reclaim $2,400 amid looming geopolitical risks. US Dollar pulls back with Treasury yields despite hawkish Fedspeak, as risk appetite returns.

Manta Network price braces for volatility as $44 million worth of MANTA is due to flood markets

Manta Network price is defending support at $1.80 as multiple technical indicators flash bearish. 21.67 million MANTA tokens worth $44 million are due to flood markets in a cliff unlock on Thursday.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.