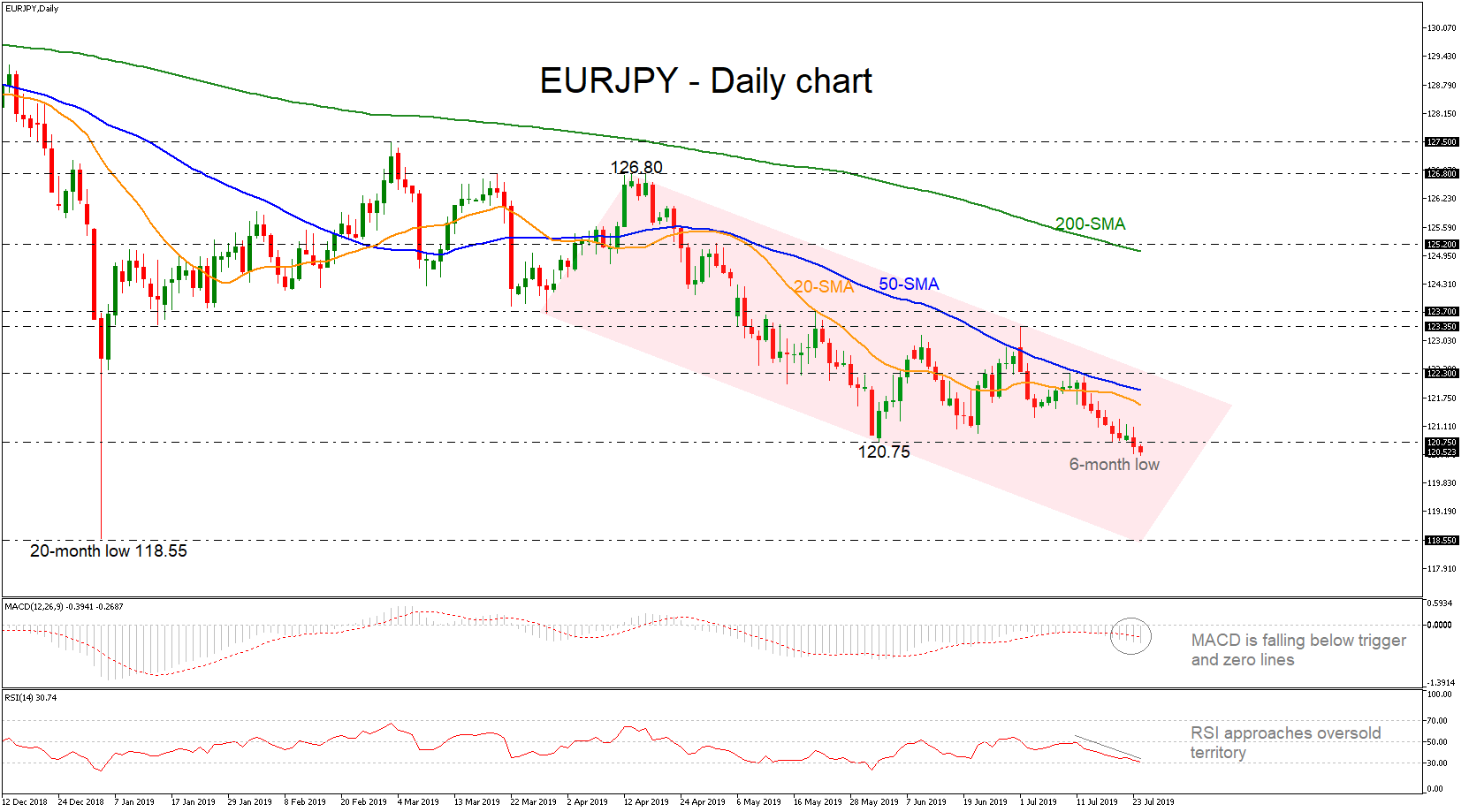

EURJPY is looking strongly bearish in the short-term after plunging towards a new six-month low earlier today, continuing its selling interest from April 15’s peak of 126.80. Prices dropped below the significant 120.75 barrier and the technical indicators are all pointing to further negative momentum. The RSI is heading downwards, approaching the oversold zone, while the MACD extends its bearish momentum below trigger and zero lines.

Should the pair make another run lower, it is likely to meet support at the 20-month low of 118.55, reached on January 3, which stands around the return line of the medium-term descending channel.

If the negative structure fails to hold and prices turn higher for some bullish movement, the 120.75 could act as immediate resistance for the pair. A potentially more important obstacle though, is the 20- and then the 50-simple moving averages (SMAs) at 121.55 and 121.90 respectively. Even higher, the price could challenge the 122.30 hurdle.

In the bigger picture, EURJPY struggles within a three-month downward sloping channel and investors could turn their eyes towards the next strong level of 118.55. For the outlook to become neutral to bullish, the price needs to penetrate the 122.30 resistance.

Forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold climbs above $2,340 following earlier drop

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.