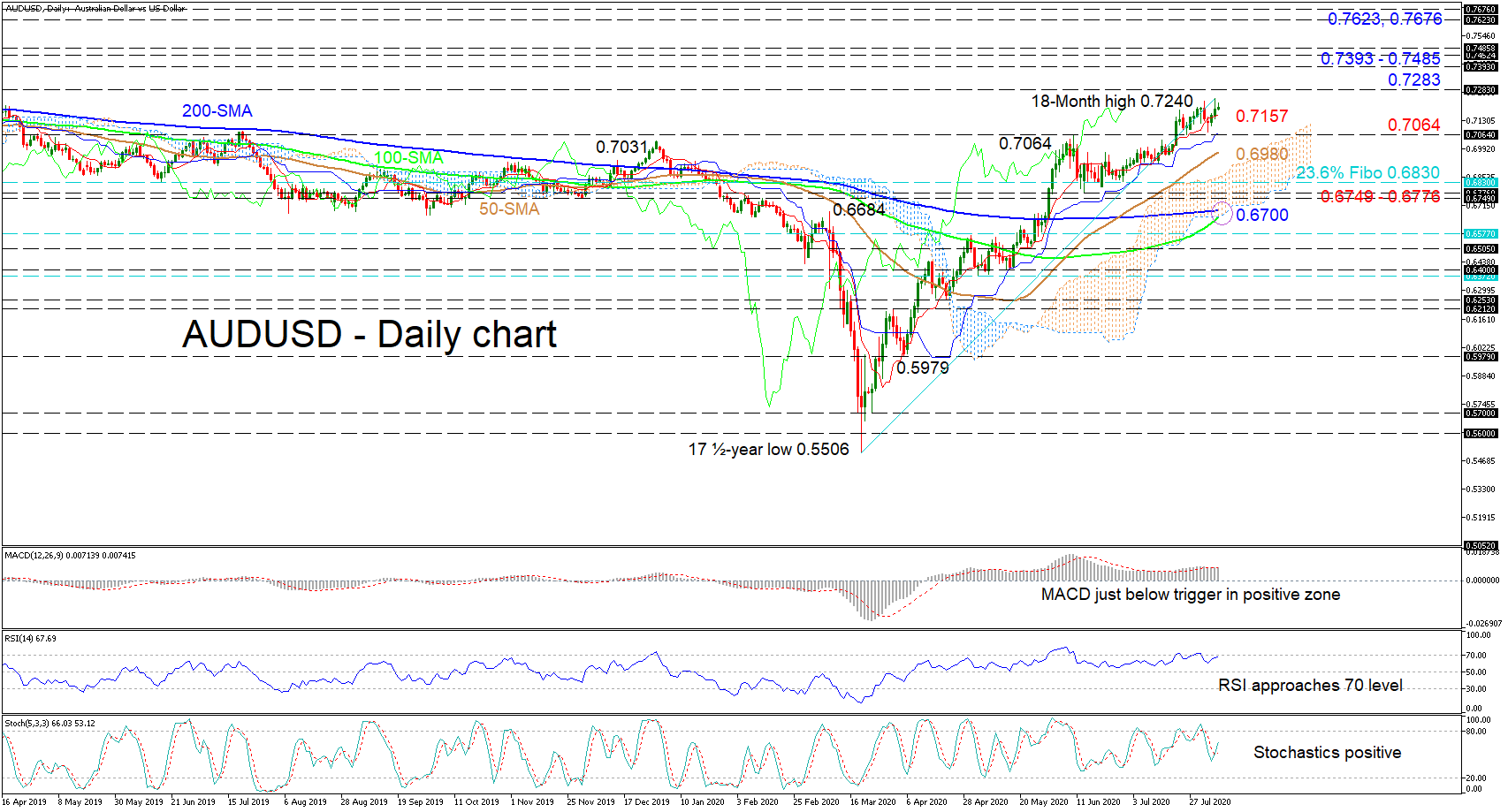

AUDUSD is experiencing a steady appreciation and appears to be barely affected by a recent stumble in the price. This is reflected in the rising Ichimoku lines, which indicate that the pair’s positive momentum is intact. Furthermore, the Ichimoku cloud, the 50- and 100-day simple moving averages (SMAs), and the nearing bullish crossover of the 200-day SMA by the 100-day one may keep confidence in the ascent for a while longer.

Glancing at the oscillators, positive momentum looks paused in the very near-term. The MACD, some distance in the positive region, is floating marginally below its flattened red signal line, while the RSI gradually nears 70. Additionally, the stochastic oscillator has turned positive.

If the climb builds, immediate limitations may come from the fresh 18-month high of 0.7240 and the 0.7283 overhead barrier from January 2019. Overtaking these, buyers may encounter strong resistance from a section of congested highs from 0.7393 to 0.7485. Surpassing this obstacle trench, traders may turn their focus to the 0.7623 and 0.7676 highs from June 2018.

Otherwise, a dip underneath the red Tenkan-sen line at 0.7157 may see initial support commence at the 0.7064 level, where the blue Kijun-sen line currently lies. Further losses could meet the 50-day SMA at 0.6980 and the cloud’s upper boundary ahead of the 0.6830 mark, which is the 23.6% Fibonacci retracement of the up leg from 0.5506 to 07240. Slightly beneath, the 0.6749 to 0.6776 support zone could bring the decline to a halt, as it is reinforced by the floor of the cloud and the bullish cross in the SMAs around 0.6700.

Summarizing, AUDUSD continues to possess a bullish tone above 0.6776 in the short-to-medium-term timeframe. A shift below the 200-day SMA though, may undermine the positive structure.

Forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.

Recommended Content

Editors’ Picks

EUR/USD holds gains near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold price defends gains below $2,400 as geopolitical risks linger

Gold price is trading below $2,400 in European trading on Friday, holding its retreat from a fresh five-day high of $2,418. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row, supported by lingering Middle East geopolitical risks.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.