Swiss Franc strengthens on Tuesday, January 14 2020, after the US Treasury Department added Switzerland to its watch list for countries labelled as “currency manipulator” alongside other countries such as Germany, Ireland, Italy, Japan, Malaysia, Singapore, South Korea and Vietnam. This is not the first time Switzerland has been added to the watch list. In 2016, US added the country to the list after it abandoned its Euro peg. Two years later, in 2018, the US Treasury Department removed it from the list.

Swiss Franc has long been a safe haven for many investors when markets turn nervous. The Swiss economy has a large current account surplus that strengthens its currency. It has a very low debt-to-GDP ratio. In the past, Swiss National Bank (SNB) committed to capping strength in the currency through a combination of euro-buying market interventions and by holding benchmark interest rate at minus 0.75%. The inclusion in the watch list now likely will discourage SNB from intervening to try and limit Swiss Franc’s strength in the forex market.

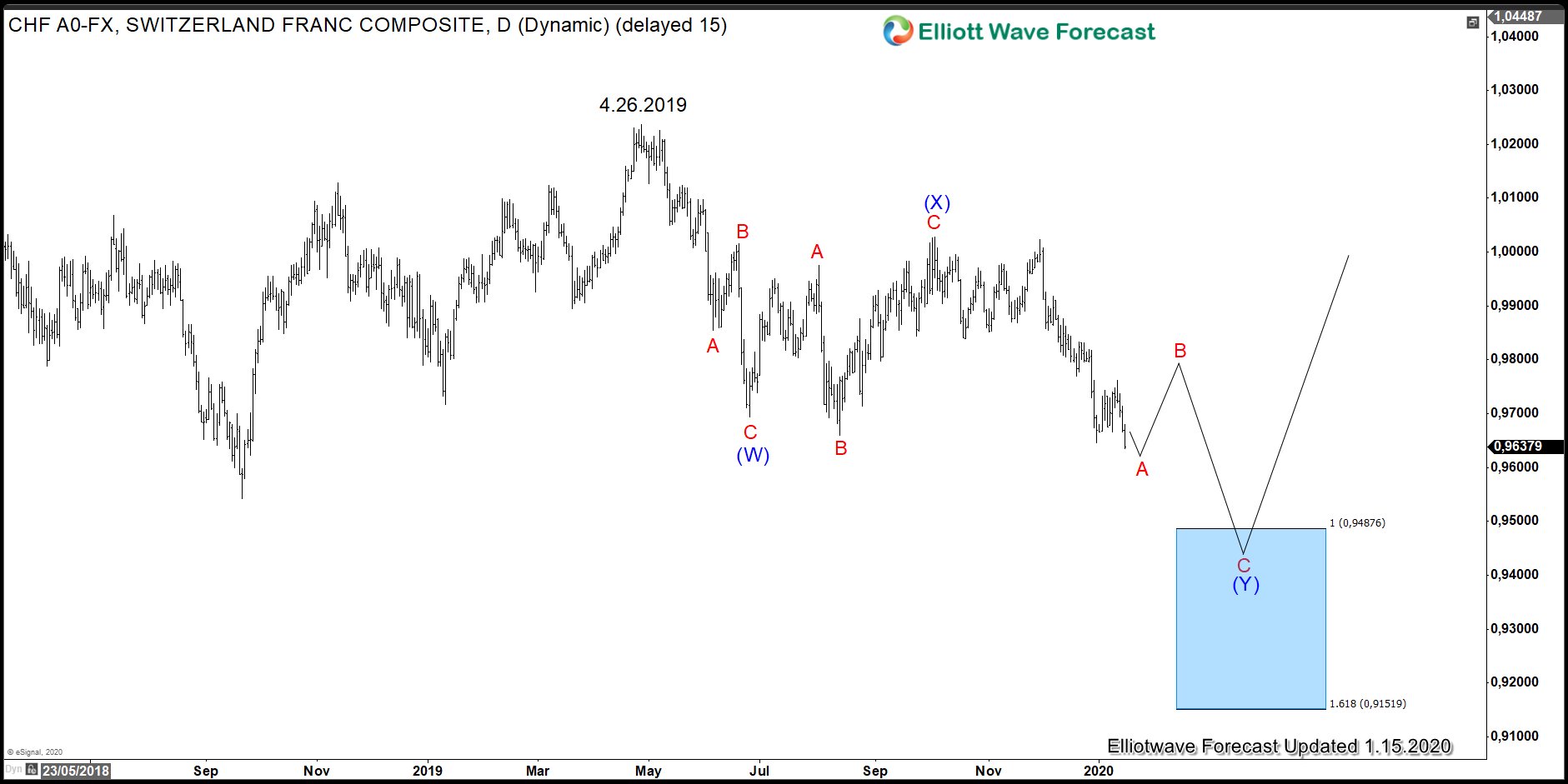

USD/CHF Shows Bearish Sequence from April 2019 High

The Daily Chart of USDCHF above shows the pair has an incomplete bearish sequence from April 26, 2018 high favoring further downside. Wave A of (Y) remains in progress and could end soon. This should be followed by a bounce in wave B before resuming lower in wave C targeting the 100% – 161.8% extension between 0.9152-0.9488 area.

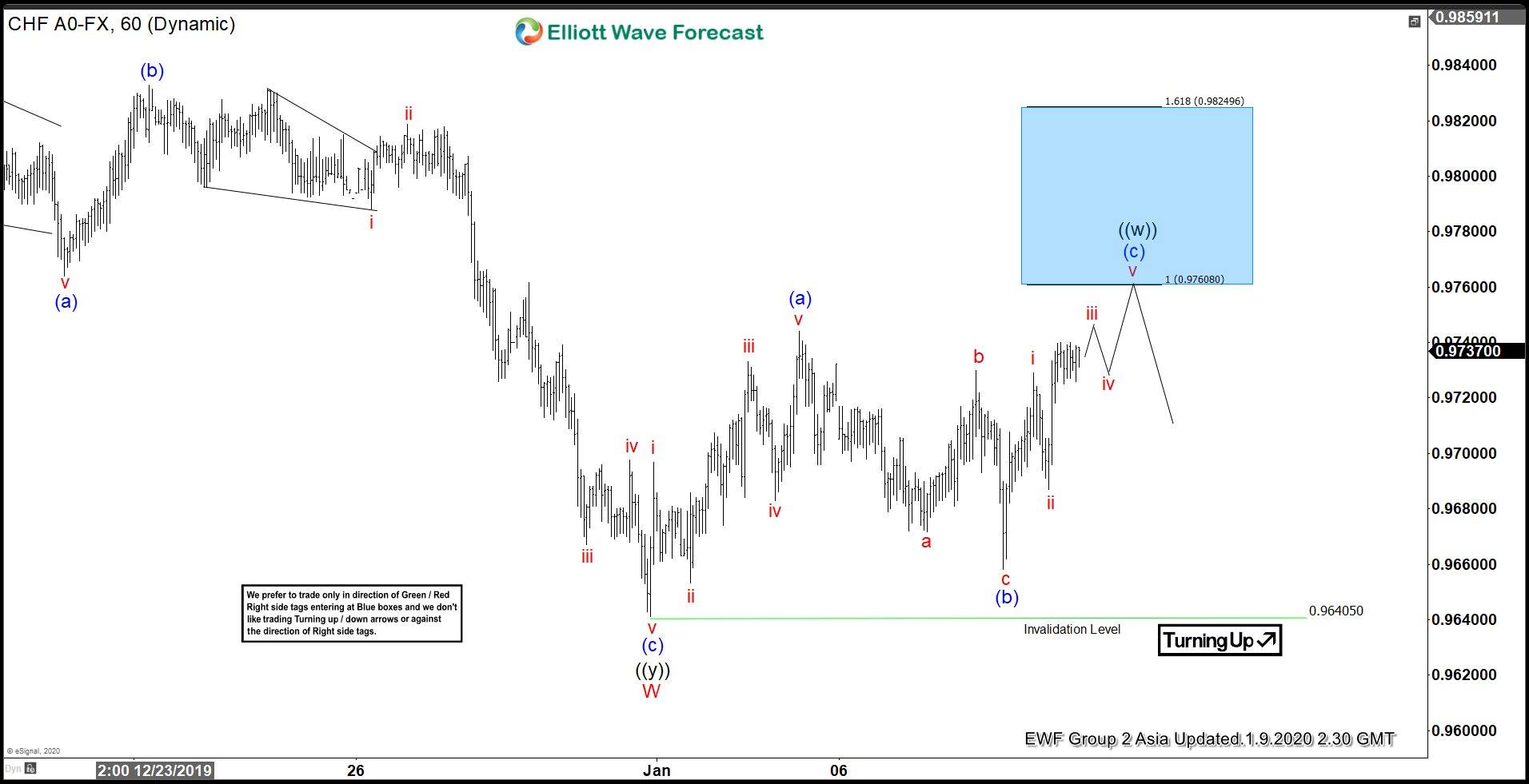

USD/CHF 1.9.2020 1 Hour Asia Elliott Wave Update

The chart from 1.9.2020 Asia update showed that USDCHF has ended the cycle down from October 2019 high. Wave W ended at 0.9640 low. The pair then bounced from that level to correct the cycle down. Wave (a) ended at 0.9744 and wave (b) ended at 0.9658. The 100% – 161.8% extension of wave (a) – (b) is between 0.9760 – 0.9825. This area was highlighted with a blue box. The blue box area is the area where we expect sellers to appear for an extension lower or 3 waves pullback at least.

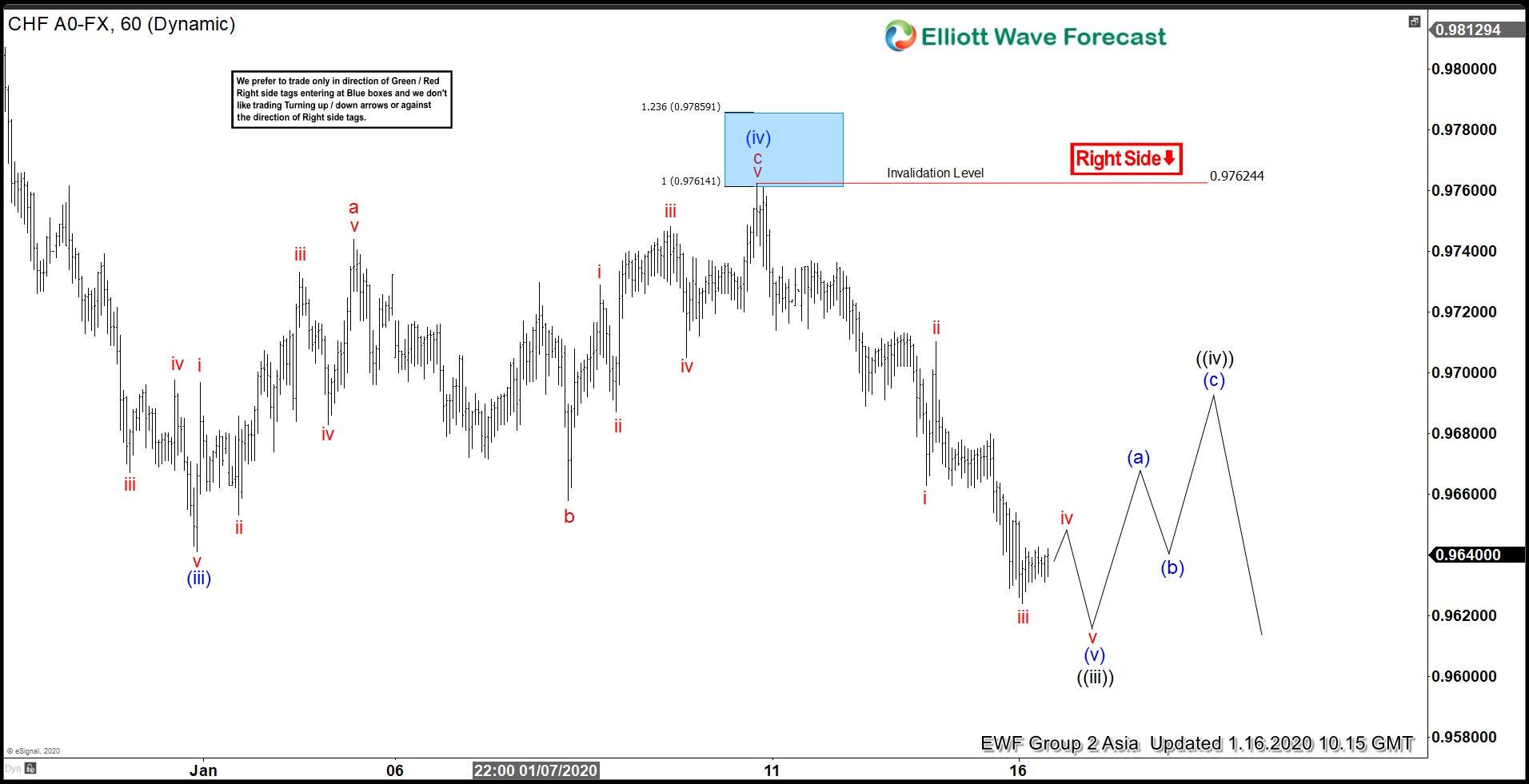

USD/CHF 1.16.2020 1 Hour Asia Elliott Wave Update

In subsequent update from 1.16.2020 above, the pair reached the blue box area, and it not only pullback in 3 waves but extends lower. We adjusted the count and now it ended wave c of (iv) at 0.9763 high. From there, the pair has broken below wave (iii) low and resumed its decline. Members who sold from the blue box area playing the hedging now have a risk free position and in profit. Near term, as far as 0.9763 pivot stays intact, USDCHF can still extend lower targeting the 100% extension in the Daily chart.

FURTHER DISCLOSURES AND DISCLAIMER CONCERNING RISK, RESPONSIBILITY AND LIABILITY Trading in the Foreign Exchange market is a challenging opportunity where above average returns are available for educated and experienced investors who are willing to take above average risk. However, before deciding to participate in Foreign Exchange (FX) trading, you should carefully consider your investment objectives, level of xperience and risk appetite. Do not invest or trade capital you cannot afford to lose. EME PROCESSING AND CONSULTING, LLC, THEIR REPRESENTATIVES, AND ANYONE WORKING FOR OR WITHIN WWW.ELLIOTTWAVE- FORECAST.COM is not responsible for any loss from any form of distributed advice, signal, analysis, or content. Again, we fully DISCLOSE to the Subscriber base that the Service as a whole, the individual Parties, Representatives, or owners shall not be liable to any and all Subscribers for any losses or damages as a result of any action taken by the Subscriber from any trade idea or signal posted on the website(s) distributed through any form of social-media, email, the website, and/or any other electronic, written, verbal, or future form of communication . All analysis, trading signals, trading recommendations, all charts, communicated interpretations of the wave counts, and all content from any media form produced by www.Elliottwave-forecast.com and/or the Representatives are solely the opinions and best efforts of the respective author(s). In general Forex instruments are highly leveraged, and traders can lose some or all of their initial margin funds. All content provided by www.Elliottwave-forecast.com is expressed in good faith and is intended to help Subscribers succeed in the marketplace, but it is never guaranteed. There is no “holy grail” to trading or forecasting the market and we are wrong sometimes like everyone else. Please understand and accept the risk involved when making any trading and/or investment decision. UNDERSTAND that all the content we provide is protected through copyright of EME PROCESSING AND CONSULTING, LLC. It is illegal to disseminate in any form of communication any part or all of our proprietary information without specific authorization. UNDERSTAND that you also agree to not allow persons that are not PAID SUBSCRIBERS to view any of the content not released publicly. IF YOU ARE FOUND TO BE IN VIOLATION OF THESE RESTRICTIONS you or your firm (as the Subscriber) will be charged fully with no discount for one year subscription to our Premium Plus Plan at $1,799.88 for EACH person or firm who received any of our content illegally through the respected intermediary’s (Subscriber in violation of terms) channel(s) of communication.

Recommended Content

Editors’ Picks

EUR/USD fluctuates in daily range above 1.0600

EUR/USD struggles to gather directional momentum and continues to fluctuate above 1.0600 on Tuesday. The modest improvement seen in risk mood limits the US Dollar's gains as investors await Fed Chairman Jerome Powell's speech.

GBP/USD stabilizes near 1.2450 ahead of Powell speech

GBP/USD holds steady at around 1.2450 after recovering from the multi-month low it touched near 1.2400 in the European morning. The USD struggles to gather strength after disappointing housing data. Market focus shifts to Fed Chairman Powell's appearance.

Gold aiming to re-conquer the $2,400 level

Gold stages a correction on Tuesday and fluctuates in negative territory near $2,370 following Monday's upsurge. The benchmark 10-year US Treasury bond yield continues to push higher above 4.6% and makes it difficult for XAU/USD to gain traction.

XRP struggles below $0.50 resistance as SEC vs. Ripple lawsuit likely to enter final pretrial conference

XRP is struggling with resistance at $0.50 as Ripple and the US Securities and Exchange Commission (SEC) are gearing up for the final pretrial conference on Tuesday at a New York court.

US outperformance continues

The economic divergence between the US and the rest of the world has become increasingly pronounced. The latest US inflation prints highlight that underlying inflation pressures seemingly remain stickier than in most other parts of the world.