Skill shortages in the UK jobs market have continued to boost pay growth, but with Brexit uncertainty set to persist, we now think it's unlikely to be followed up with a Bank of England rate hike later this year.

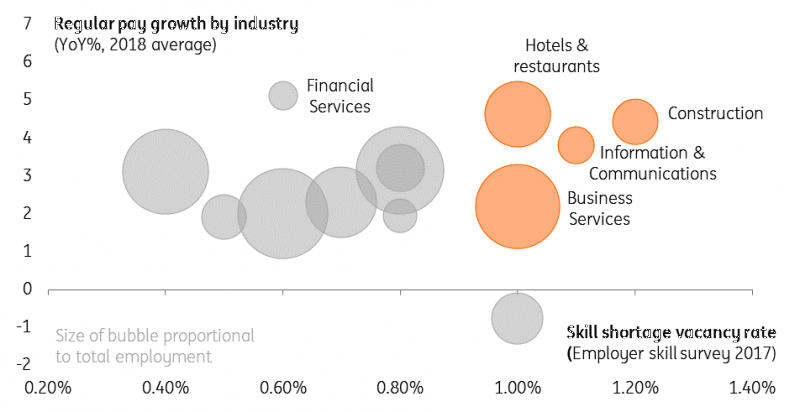

The key takeaway from the latest UK jobs report is the continued strength in wage growth. At 3.4%, regular pay is growing close to its fastest rate since the financial crisis, and this comes as firms in certain sectors are finding it harder to attract/retain staff. Surveys indicate that skill shortages are particularly acute in the construction, IT and hospitality industries, and this has seen rates of pay outpace other sectors.

Skill shortages translating into higher pay growth

In principle, there are few reasons to expect this trend to fade imminently, although amid all of the uncertainty, we'd note the number of people on the unemployed claimant count has begun to exceed the number of job vacancies - perhaps a sign of some weakness ahead.

For the time being though, rising wage growth should offer some extra impetus to consumer spending, particularly the relatively benign consumer price inflation backdrop. The temporary reprieve from Brexit noise may also help sales of bigger-ticket items, although consumer confidence still remains depressed overall. In the short-run, retailers may also get a boost from the forecasts of decent weather for the Easter weekend.

Overall though, we don’t expect a substantial rebound in economic growth over the next few months. The headwinds facing businesses have not faded, and many will need to continue building up their preparations for a possible ‘no deal’ Brexit later in the year. In many cases this will be very costly, and therefore will continue to weigh down overall investment.

For that reason, we think it is now pretty unlikely that the Bank of England will hike rates this year – unless some form of deal is approved earlier than most people expect. However if wage growth continues to perform relatively well (which don’t forget has been at the heart of the BoE’s rate hike rationale in the past), then further gradual tightening cannot be ruled out in the medium term.

A gap is appearing between the claimant count and job vacancies

Read the original analysis: Strong UK wage growth unlikely to prompt BoE rate hike this year

Content disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more here: https://think.ing.com/content-disclaimer/

Recommended Content

Editors’ Picks

AUD/USD remained bid above 0.6500

AUD/USD extended further its bullish performance, advancing for the fourth session in a row on Thursday, although a sustainable breakout of the key 200-day SMA at 0.6526 still remain elusive.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.