Highlights:

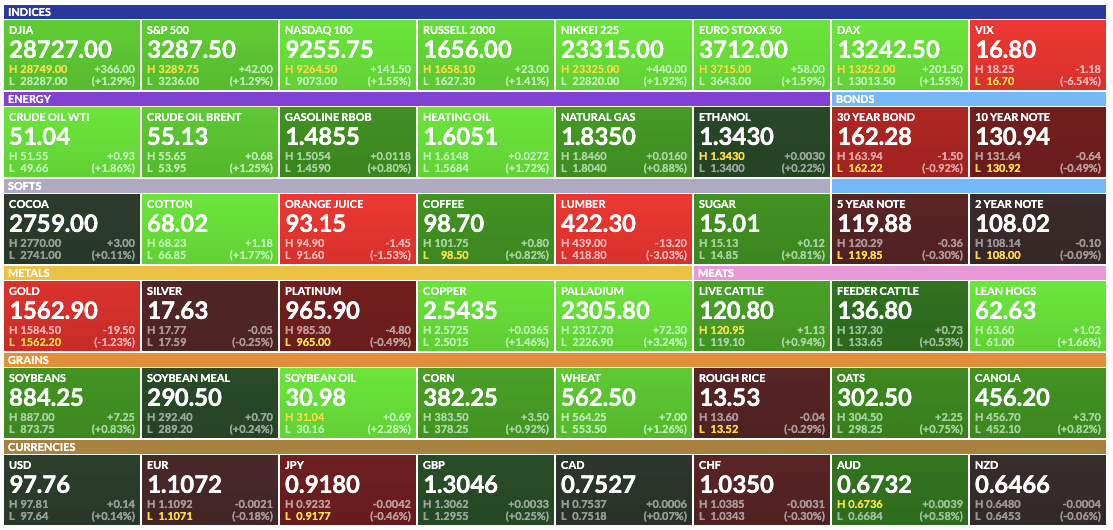

Market Summary: Stocks rebounded despite continued worries over the coronavirus outbreak. The S&P 500 moved higher by 0.73%. 10-year yields were up 3 basis points, hitting bond prices slightly. Gold also fell -0.35% yesterday. Oil and copper could not catch a break, dropping -2.81% (West Texas Crude) and -0.40% respectively.

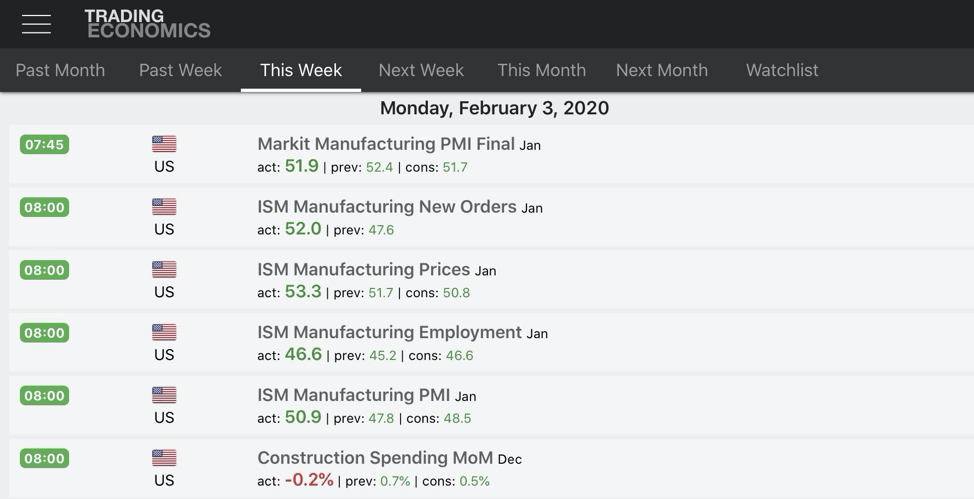

Economic Data: Markit manufacturing PMI came in at 51.9, down from 52.4 previous. The good news is that the ISM manufacturing PMI came in higher than expected at 50.9, up from 47.8. New orders were also up to 52.0 from 47.6. Construction spending dropped -0.2% month-over-month.

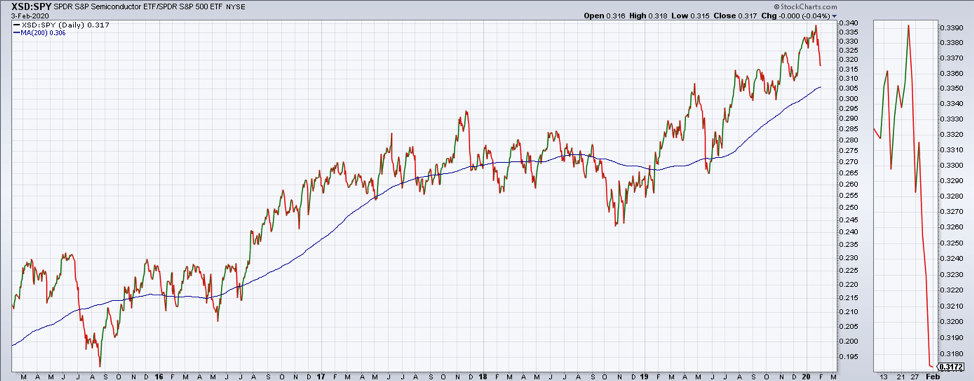

Semiconductors: Despite the coronavirus fears and the pullback in risk markets, the semiconductor sector remains in a positive trend relative to the broad market. In our opinion, this is an important sector to watch as a barometer of economic growth. When semiconductors are demonstrating relative strength versus the broad market, it is indicative of good economic conditions.

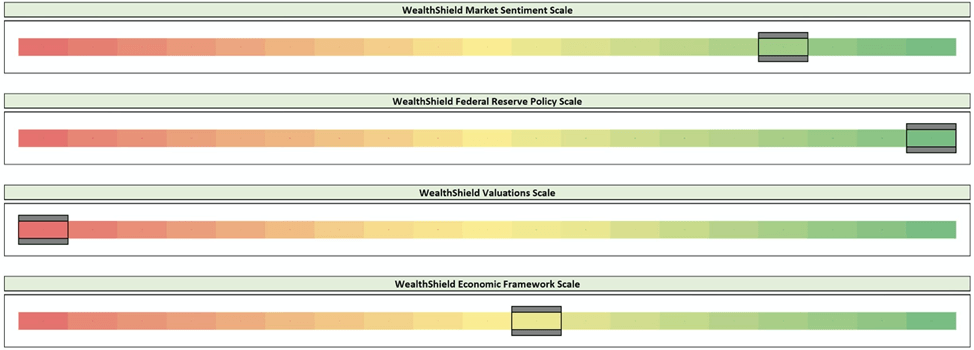

Framework: We had a few changes in our framework as of the close of January. Notably, the economic growth component improved from orange to yellow, indicative of improvement within a continued economic slowdown. Furthermore, market sentiment has dropped a few notches as the risk-free asset started to outpace international stocks in a couple time frames. Despite this, market sentiment is still green. Valuations have deteriorated further as US stocks are registering some of the most overvalued conditions ever witnessed historically.

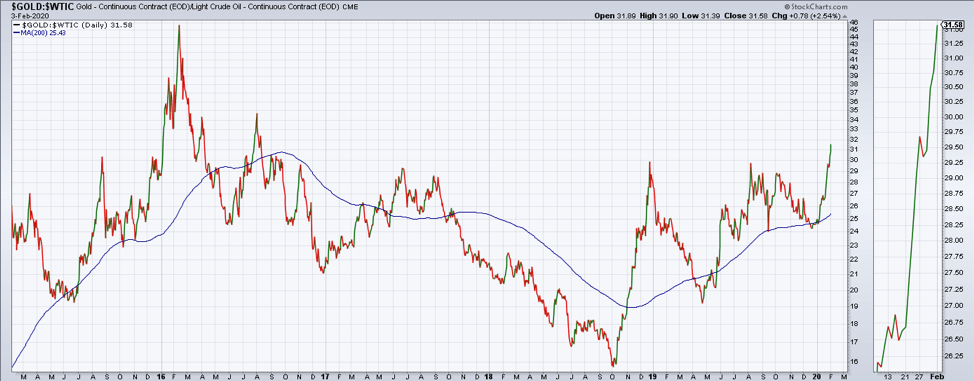

Gold vs Oil: The coronavirus has become a catalyst for a major breakout in gold versus oil. As travel has halted and China oil demand set for a major setback, the conditions were perfect for a rally in precious metals relative to more cyclical segments of the commodity market. Gold is in a positive trend relative to oil and has broken above the 2018 high.

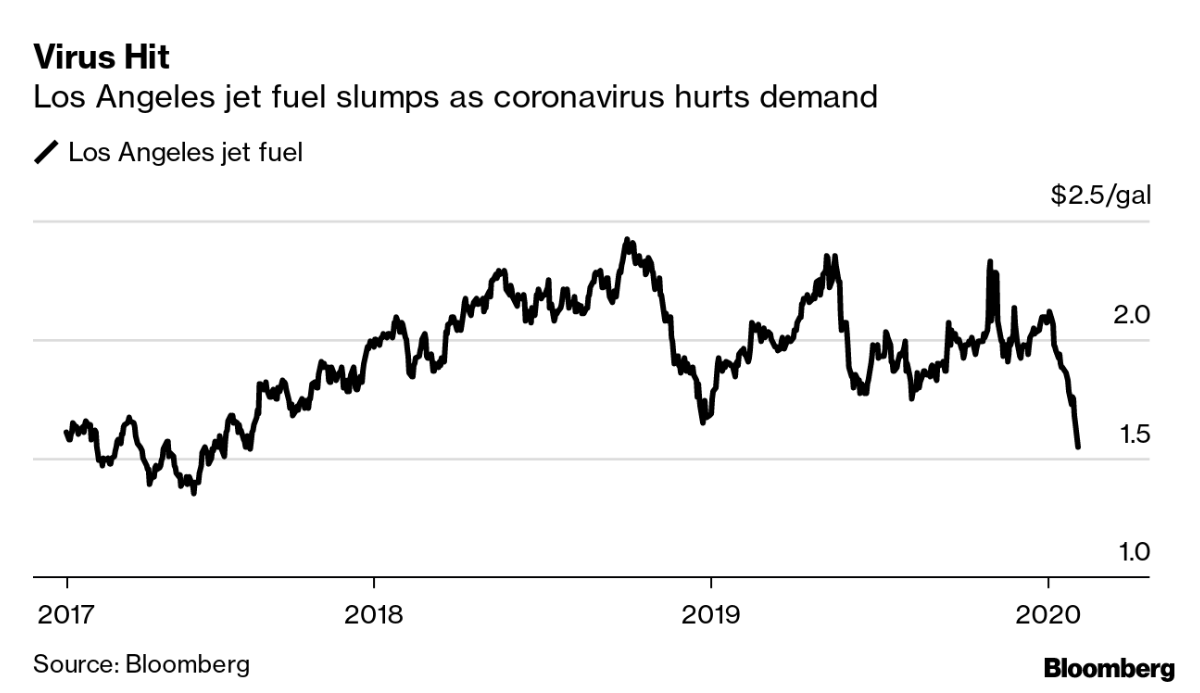

Chart of the Day: The coronavirus may leave California with a jet fuel glut. The price in the Los Angeles wholesale market was the cheapest yesterday since August 2017 due to waning demand in China after flights were canceled. Speculation is increasing that an influx of fuel from Asia may swamp West Coast refiners.

Futures Summary:

News from Bloomberg:

The Iowa caucuses devolved into political embarrassment for the Democratic party and left candidates and voters hanging. Results won't be released until at least this morning. "Inconsistencies" were found from some precincts after new technology and more complex rules were introduced. Several campaigns declared victory using their own internal numbers. Follow our live blog for all the updates and here's our QuickTake on the complexity of caucuses.

Today's State of the Union address may see Trump take credit for a strong economy, new trade deals and an immigration crackdown as he seeks to divert attention from his impeachment. On that, a Senate acquittal will come tomorrow and the only question left is whether any Democrats, especially those in Trump-leaning states, will vote with the GOP.

Stocks rose globally, with shares in China gaining after yesterday's big sell-off. Treasuries and gold sank, oil was up and the dollar was steady. The Aussie moved higher after the RBA held rates and suggested it wasn't in a hurry to ease further.

Coronavirus latest: A death was reported in Hong Kong in what would be the second fatality outside mainland China, where the number of cases has topped 20,000. The death toll rose to 427. Casinos in Macau are being asked to temporarily close. Here's our Virus Update and everything you need to know about the virus.

OPEC+ technical experts meet today to assess how the virus may hurt oil demand. Their appraisal will help decide if an emergency ministerial meeting is held this month to consider new production cuts. Saudi Arabia is pushing for a gathering and Russia said it's ready to participate after Vladimir Putin and King Salman bin Abdulaziz spoke by phone yesterday.

WealthShield is a division of Emerald Investment Partners, an SEC Registered Investment Advisor. Advisory services are only offered to clients or prospective clients where WealthShield and it’s representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by WealthShield unless a client service agreement is in place. Before investing, consider your investment objectives and WealthShield’s charges and expenses.

Recommended Content

Editors’ Picks

AUD/USD pressures as Fed officials hold firm on rate policy

The Australian Dollar is on the defensive against the US Dollar, as Friday’s Asian session commences. On Thursday, the antipodean clocked losses of 0.21% against its counterpart, driven by Fed officials emphasizing they’re in no rush to ease policy. The AUD/USD trades around 0.6419.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday during the early Asian session. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold price edges higher on risk-off mood hawkish Fed signals

Gold prices advanced late in the North American session on Thursday, underpinned by heightened geopolitical risks involving Iran and Israel. Federal Reserve officials delivered hawkish messages, triggering a jump in US Treasury yields, which boosted the Greenback.

Runes likely to have massive support after BRC-20 and Ordinals frenzy

With all eyes peeled on the halving, Bitcoin is the center of attention in the market. The pioneer cryptocurrency has had three narratives this year already, starting with the spot BTC exchange-traded funds, the recent all-time high of $73,777, and now the halving.

Billowing clouds of apprehension

Thursday marked the fifth consecutive session of decline for US stocks as optimism regarding multiple interest rate cuts by the Federal Reserve waned. The downturn in sentiment can be attributed to robust economic data releases, prompting traders to adjust their expectations for multiple rate cuts this year.