Stocks were reeling early in NY after Chinese tech giant, Huawei’s CFO was arrested sparking concerns it could derail the trade progress that was made over the weekend. The Dow was down 780 points and turned negative for 2018 but managed to finish the day only lower by 79.4 points. The dollar also recovered some of its losses against the Japanese yen after falling to a fresh monthly low.

The rebound in risk appetite also benefited from the Wall Street Journal report that “Federal Reserve officials are considering whether to signal a new wait-and-see mentality after a likely interest-rate increase at their meeting in December, which could slow down the pace of rate increases next year.”

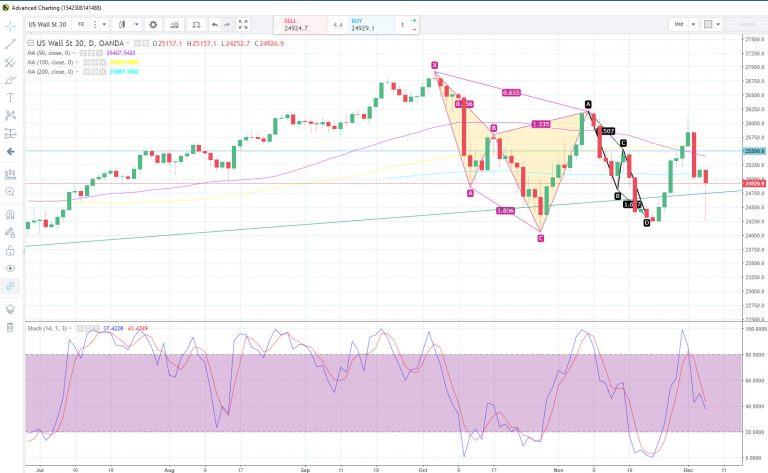

Price action saw the Dow form a triple bottom pattern at around the 24,250 level. Price is now facing key resistance from the 200-day SMA, which currently trades at the 25,113 level. If bearish momentum returns and the triple bottom pattern is invalidated, we could see a run towards the 23,500 region. To the upside, 26,300 remains major resistance.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.