Stocks started the day with losses after reports that China asked the World Trade Organization to impose sanctions on the U.S.

But after the rough start, stocks bounced back. The major indices rallied late morning, then traded sideways into the close.

Today's rally was largely due to Apple and energy stocks.

Here's where the major indices ended the day:

- The S&P finished 0.4% higher. Up 11 points, the S&P ended at 2,888.

- The DOW ended with a 0.4% gain. Adding 114 points, the DOW closed at 25,971.

- The NASDAQ was up 0.6%. Higher by 48 points, the NASDAQ finished at 7,972.

- Bitcoin dropped 1.0%. Losing $60, Bitcoin ended at $6205.

Crude Oil (CL) had a big day with Hurricane Florence expected to hit the U.S. this week. The threat of the hurricane has traders expecting supply issues. And supply problems coupled with higher demand usually means higher oil prices. Snapping a 5-day losing streak, CL was up 2.5%, finishing at $69.23 a barrel.

Apple (AAPL) was a big winner today, ending the day with a 2.5% gain. Apple is expected to unveil its new iPhone tomorrow.

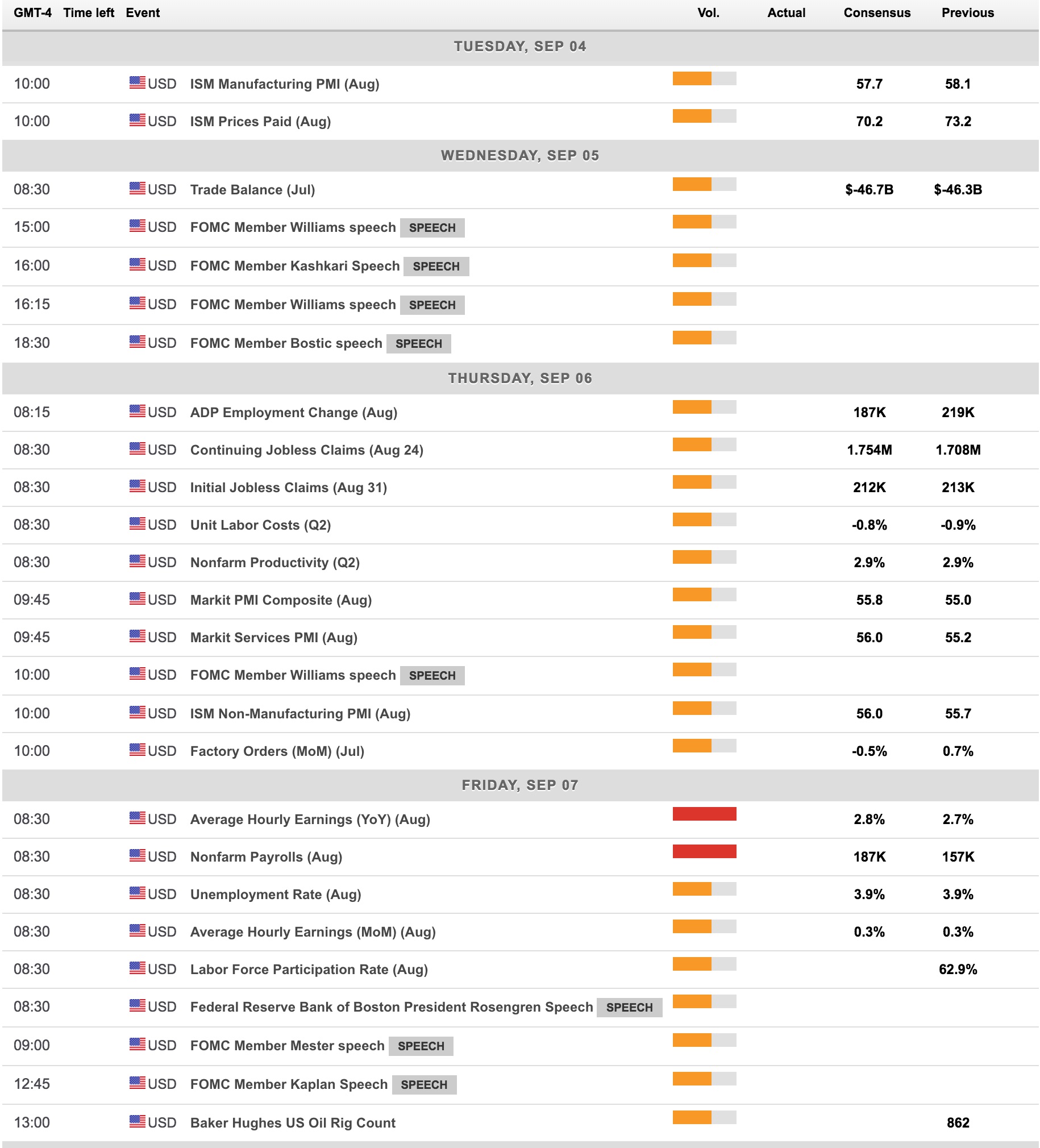

Here is the economic calendar for the week:

Trading Futures, options on futures and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. The lower the day trade margin, the higher the leverage and riskier the trade. Leverage can work for you as well as against you; it magnifies gains as well as losses. Past performance is not necessarily indicative of future results.

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 after US GDP data

EUR/USD came under modest bearish pressure and retreated below 1.0700. Although the US data showed that the economy grew at a softer pace than expected in Q1, strong inflation-related details provided a boost to the USD.

GBP/USD declines below 1.2500 as USD rebounds

GBP/USD declined below 1.2500 and erased the majority of its daily gains with the immediate reaction to the US GDP report. The US economy expanded at a softer pace than expected in Q1 but the price deflator jumped to 3.4% from 1.8%.

Gold drops below $2,320 as US yields shoot higher

Gold lost its traction and turned negative on the day below $2,320 in the American session on Thursday. The benchmark 10-year US Treasury bond yield is up more than 1% on the day above 4.7% after US GDP report, weighing on XAU/USD.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.