The British pound rose in overnight trading after European leaders accepted Theresa May’s request for an article 50 extension. The premier was given until May 22 to come up with a solution. This was a shorter period than she was asking. The extension comes at a time when the prime minister has faced a number of defeats in the Tory-controlled parliament. Just last week, the members rejected her deal and this week, the speaker denied her a chance for another vote. European leaders too are frustrated because the uncertainty on Brexit has been cited as one of the leading factors affecting the global economy.

The Japanese yen declined after Japan released weaker inflation numbers. The national CPI rose by a mere 0.2%, which was the same as that of January but lower than the 0.3% that traders were expecting. On a monthly basis, the rate of inflation was unchanged. The national core CPI, which excludes the volatile food and energy products, increased by 0.7%, which was lower than the expected 0.8%. More negative news from the country was that the manufacturing PMI in February was at 48.9, which was lower than the expected 49.2.

Today, traders will focus on key economic numbers from Europe. The French manufacturing PMI is expected to remain at 51.4 while the composite PMI is expected to remain unchanged at 50.7. In Germany, the manufacturing PMI is expected to improve slightly to 48 while the services PMI is expected to drop to 54.8. For the European Union as a whole, the manufacturing PMI is expected to improve slightly by increasing from 49.3 to 49.5. The composite PMI is expected to improve slightly from 51.9 to 52.

Other key data expected today are the interest rates decision by the Russian central bank, which is expected to leave rates unchanged at 7.75%. In Canada, the CPI numbers will be released, with the headline CPI expected to remain unchanged at 1.4%. The core CPI is expected to remain at 1.5%. In the United States, traders will receive the PMI numbers, with the manufacturing PMI expected to increase slightly to 53.5. The existing home sales numbers will also be released.

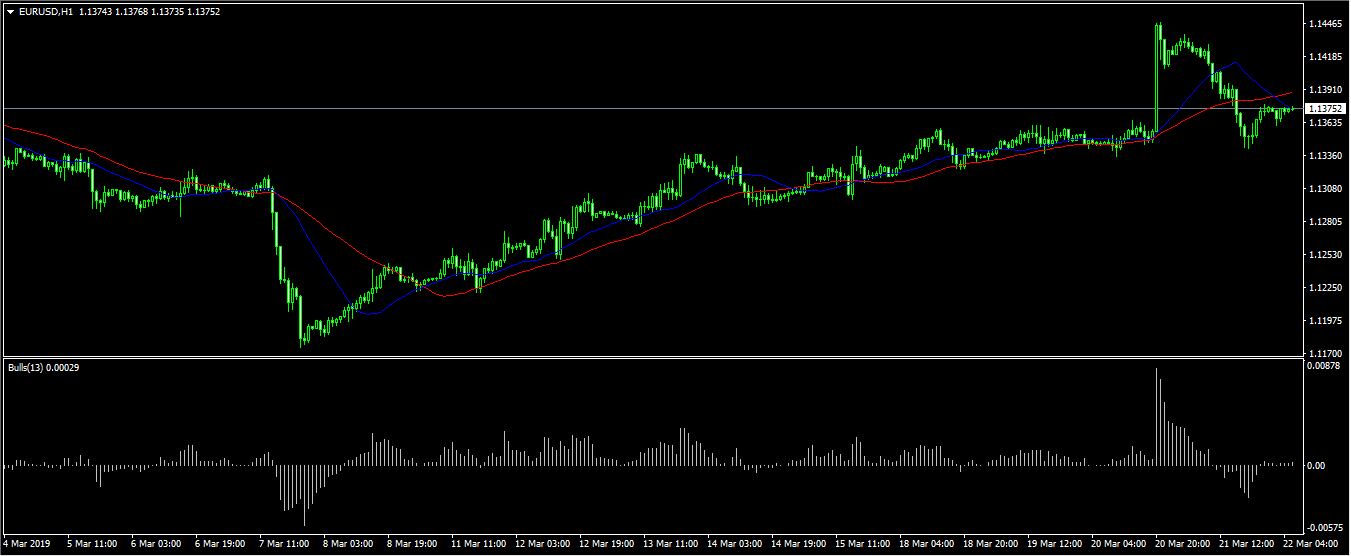

On Wednesday, the EUR/USD pair rose sharply after the FED released its decision. The pair reached a high of 1.1448. Yesterday, the pair pared those gains and dropped to the previous lows. In overnight trading, the pair rose slightly after the EU leaders gave Theresa May a new lifeline on Brexit. The pair is now trading at 1.1375. The price is along the three-week exponential moving average but lower than the 6-week average while the Bulls Power has eased the momentum. Today, the pair could have another breakout depending on the PMI numbers.

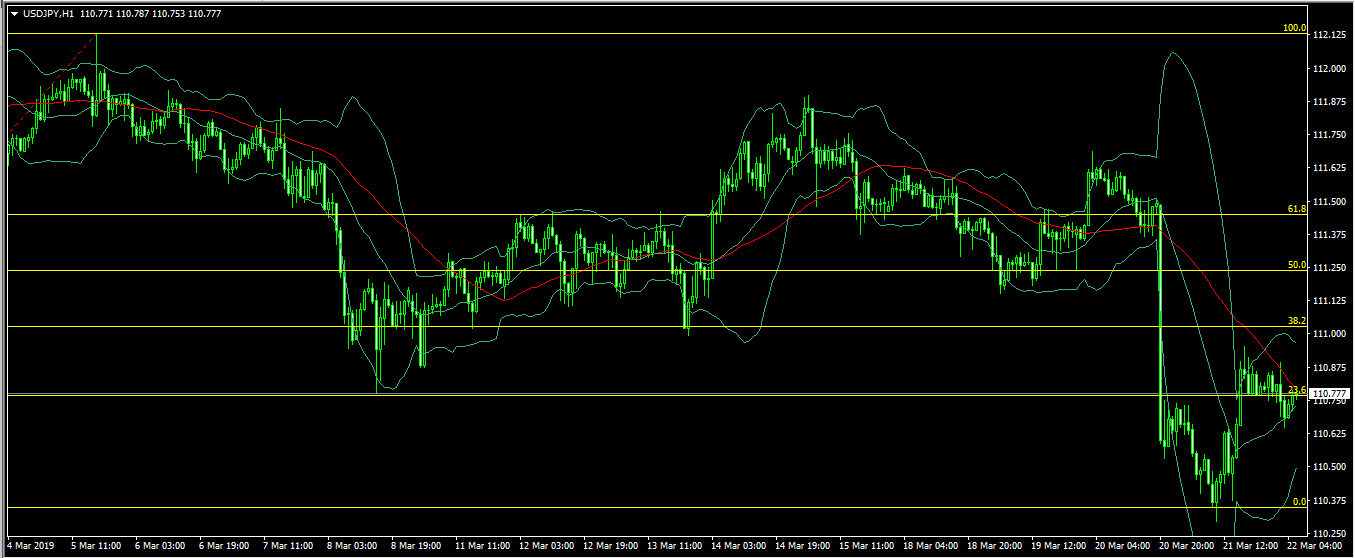

USD/JPY

The USD/JPY pair was little changed today after Japan released its inflation numbers. The pair is now trading at 110.77, which is along the 23.6% Fibonacci Retracement level. It is also along the middle line of the Bollinger Bands indicator and along the 5-week moving average. The pair could move up as traders reflect on the weak inflation numbers from Japan. If it does, it will test the 38.2% Fibonacci Retracement level at 111.0.

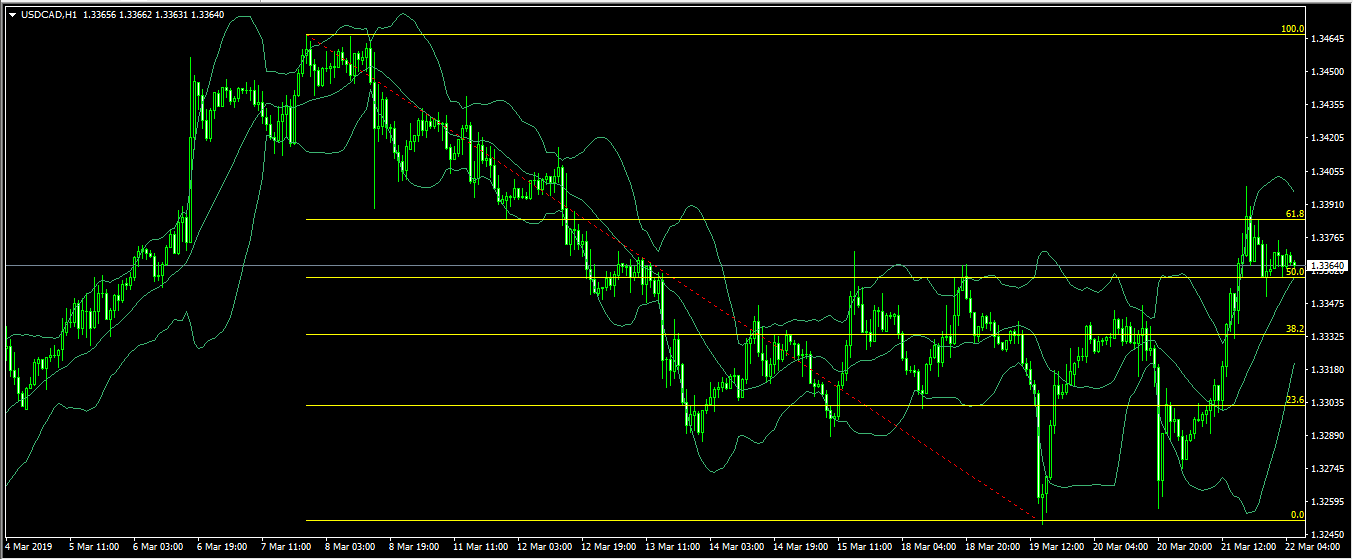

After reaching a high of 1.3400 yesterday, the USD/CAD declined to a low of 1.3365. This price is along the 50% Fibonacci Retracement level and along the middle line of the Bollinger Bands. Since the pair will likely move in either directions, the key points to watch will be the 61.8% and 38.2% Fibonacci Retracement levels at 1.3385 and 1.3330 respectively.

General Risk Warning for FX & CFD Trading. FX & CFDs are leveraged products. Trading in FX & CFDs related to foreign exchange, commodities, financial indices and other underlying variables, carry a high level of risk and can result in the loss of all of your investment. As such, FX & CFDs may not be appropriate for all investors. You should not invest money that you cannot afford to lose. Before deciding to trade, you should become aware of all the risks associated with FX & CFD trading, and seek advice from an independent and suitably licensed financial advisor. Under no circumstances shall we have any liability to any person or entity for (a) any loss or damage in whole or part caused by, resulting from, or relating to any transactions related to FX or CFDs or (b) any direct, indirect, special, consequential or incidental damages whatsoever.

Recommended Content

Editors’ Picks

EUR/USD rises toward 1.0700 after Germany and EU PMI data

EUR/USD gains traction and rises toward 1.0700 in the European session on Monday. HCOB Composite PMI data from Germany and the Eurozone came in better than expected, providing a boost to the Euro. Focus shifts US PMI readings.

GBP/USD regains 1.2350 ahead of UK PMIs

GBP/USD is recovering ground above 1.2350 in the European session, as the US Dollar comes under fresh selling pressure on improving risk sentiment. The further upside in the pair could be capped, as traders await the UK PMI reports for fresh trading impetus.

Gold price flirts with $2,300 amid receding safe-haven demand, reduced Fed rate cut bets

Gold price (XAU/USD) remains under heavy selling pressure for the second straight day on Tuesday and languishes near its lowest level in over two weeks, around the $2,300 mark heading into the European session.

PENDLE price soars 10% after Arthur Hayes’ optimism on Pendle derivative exchange

Pendle is among the top performers in the cryptocurrency market today, posting double-digit gains. Its peers in the altcoin space are not as forthcoming even as the market enjoys bullish sentiment inspired by Bitcoin price.

US S&P Global PMIs Preview: Economic expansion set to keep momentum in April

S&P Global Manufacturing PMI and Services PMI are both expected to come in at 52 in April’s flash estimate, highlighting an ongoing expansion in the private sector’s economic activity.