Sterling moved slightly higher as Brexit negotiations went on in Brussels. Yesterday, it was reported that the two sides were close to an agreement. Today, Boris Johnson held several meetings with members of parliament as he tried to measure the support of his deal. The prime minister appeared to struggle to find support from DUP and Tory MPs. This is because the deal under consideration would see a customs border introduced between Northern Ireland and the rest of the UK. In the previous negotiations, Theresa May trashed that offer saying that no British prime minister would be comfortable with such a deal. Meanwhile, data from the UK showed that headline CPI remained unchanged at 1.7%. On a MoM basis, the CPI declined from the previous 0.4% to 0.1%. Core CPI declined from the previous 2.0% to 1.7%.

The euro declined today after the EU released its CPI data for September. Numbers from Eurostat showed that the headline CPI declined from the previous 1.0% to 0.8%. On a MoM basis, CPI rose from the previous 0.1% to 0.2%. CPI ex-tobacco declined from the previous 0.9% to 0.8%. Meanwhile, the trade surplus declined to $14.7 billion after rising to $24.8 billion in August. The weak inflation numbers came a few weeks after the European Central Bank (ECB) slashed interest rates by 10 basis points. The bank will also start a new round of quantitative easing in the coming month. It also came a day after the IMF announced that chances of a recession were increasing.

The US dollar index was little changed today after the US released retail sales numbers for the month of September. According to the Census Bureau, retail and food services sales for the month declined slightly to $525.6 billion. This was a 0.3% decline from the previous month. It was 4.1% higher than the number released in September last year. Retail trade sales were lower by 0.3% from the previous month while non-store retailers rose by 12.9%. Analysts were expecting core retail sales to increase by 0.2% and headline sales to increase by 0.3%. Meanwhile, in Canada, data showed that CPI remained unchanged at 1.9%.

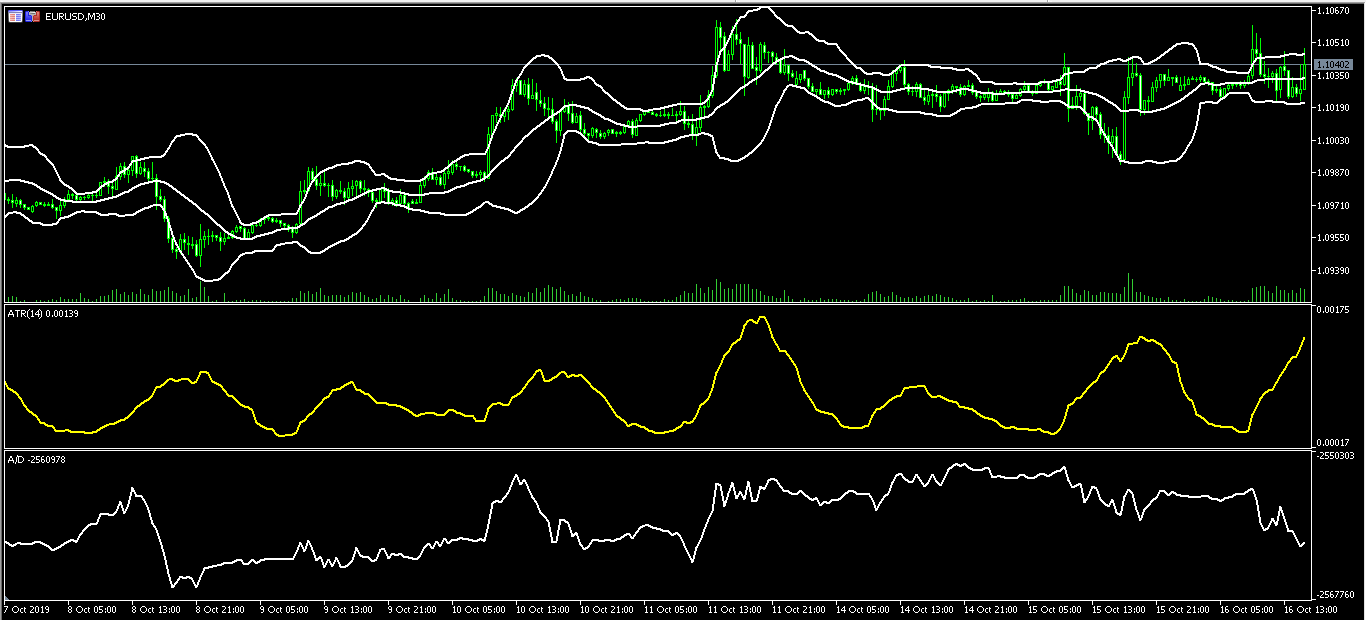

EUR/USD

The EUR/USD pair rose slightly after relatively weak retail sales numbers from the US. The pair is trading at 1.1040, which is higher than the intraday low of 1.1022. On the 30-minute chart below, the pair is slightly below the upper band of Bollinger Bands while the Average True Range (ATR) has shot up. The accumulation/distribution indicator has been moving lower. At this point, the pair may move in either direction as the Fed prepares to release its Beige Book.

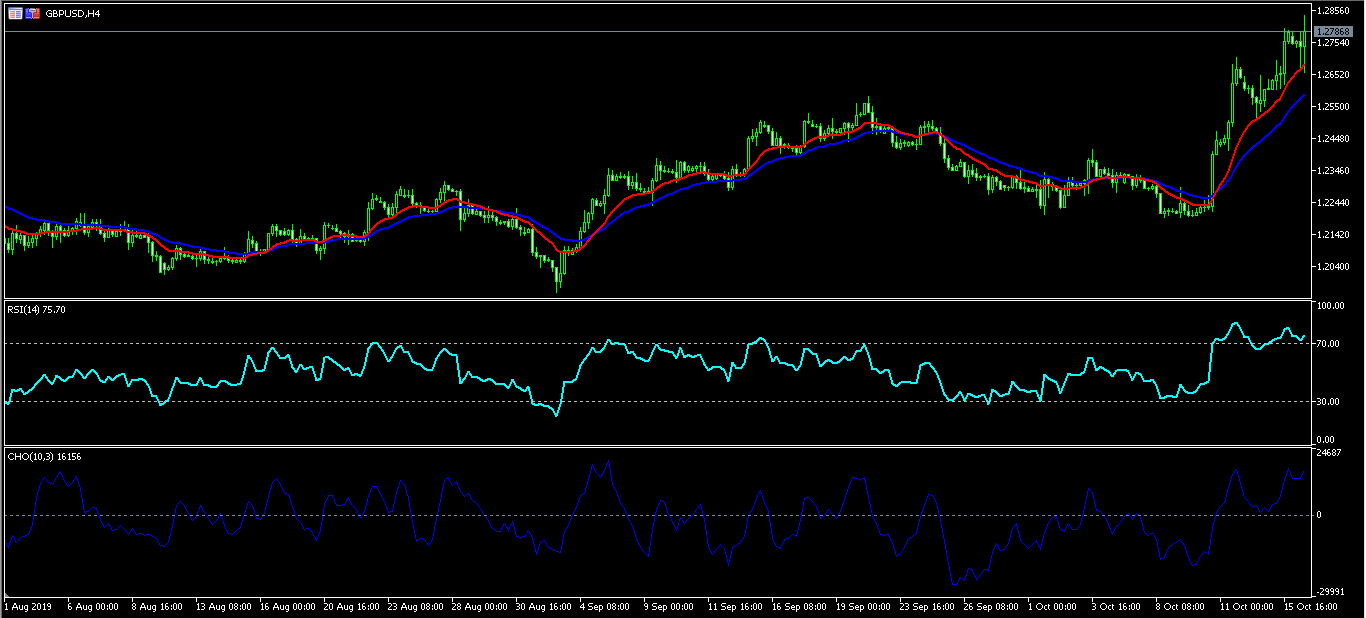

GBP/USD

The GBP/USD pair was struggling for direction as traders waited for definitive news on Brexit. As of this writing, the pair is trading at the 1.2836 level. This is slightly higher than yesterday’s high of 1.2810. On the four-hour chart, the price is above the 14-day and 28-day moving averages while the RSI has remained above 70, which is the overbought level. The Chaikin oscillator has continued to rise as well. The pair may continue to defy technical indicators as the market reacts to the important news on Brexit.

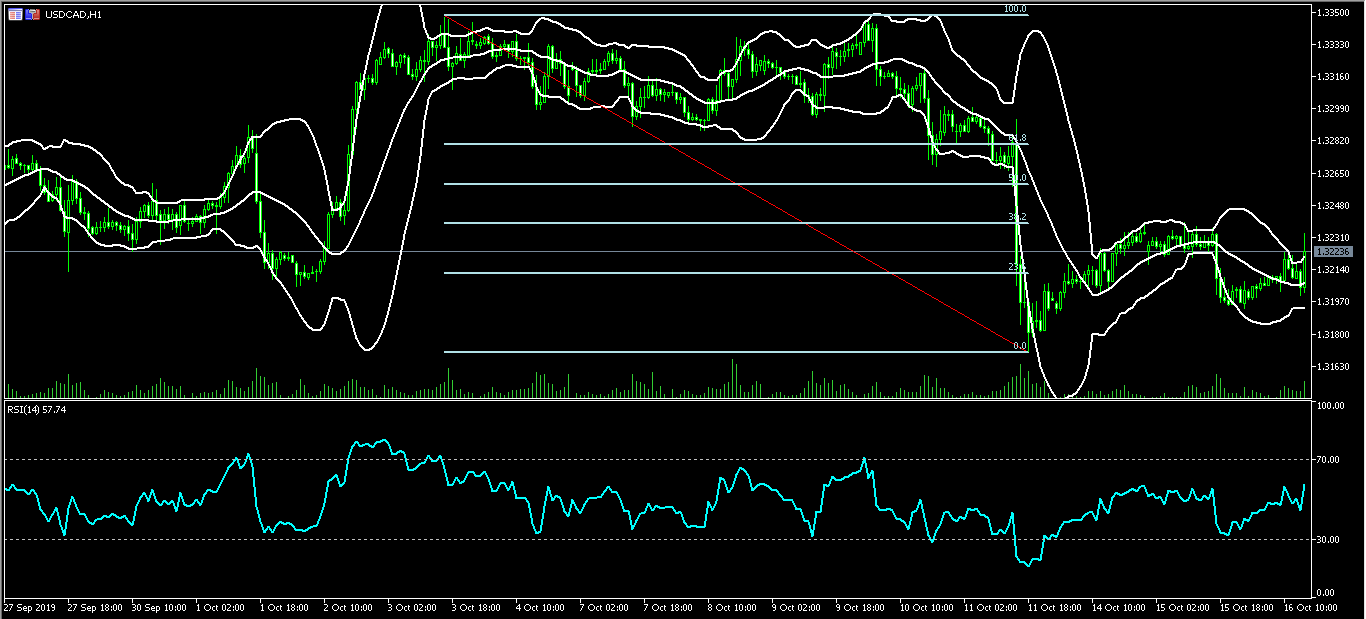

USD/CAD

The USD/CAD pair rose slightly after data from Canada showed softening inflation. On the hourly chart, the pair is trading slightly above the 23.6% Fibonacci Retracement level. The price is trading along the upper line of the Bollinger Bands. The RSI has moved slightly higher while volumes have been slightly lower. The pair may move in either direction ahead of the release of the Fed’s Beige Book.

General Risk Warning for FX & CFD Trading. FX & CFDs are leveraged products. Trading in FX & CFDs related to foreign exchange, commodities, financial indices and other underlying variables, carry a high level of risk and can result in the loss of all of your investment. As such, FX & CFDs may not be appropriate for all investors. You should not invest money that you cannot afford to lose. Before deciding to trade, you should become aware of all the risks associated with FX & CFD trading, and seek advice from an independent and suitably licensed financial advisor. Under no circumstances shall we have any liability to any person or entity for (a) any loss or damage in whole or part caused by, resulting from, or relating to any transactions related to FX or CFDs or (b) any direct, indirect, special, consequential or incidental damages whatsoever.

Recommended Content

Editors’ Picks

EUR/USD consolidates recovery gains above 1.0650

EUR/USD stays in a consolidation phase following Wednesday's rebound and trades in a narrow range above 1.0650. The improving risk mood doesn't allow the US Dollar to gather strength as markets await mid-tier data releases.

GBP/USD clings to moderate gains above 1.2450

GBP/USD is clinging to recovery gains above 1.2450 in European trading on Thursday. The pair stays supported by a sustained US Dollar weakness alongside retreating US Treasury bond yields. Fed policymakers will speak later in the day.

Gold shines amid fears of fresh escalation in Middle East tensions

Gold trades in positive territory near $2,380 on Thursday after posting losses on Wednesday. The precious metal holds gains amid fears over tensions in the Middle East further escalating, with Israel responding to Iran's attack over the weekend.

Ripple faces significant correction as former SEC litigator says lawsuit could make it to Supreme Court

Ripple (XRP) price hovers below the key $0.50 level on Thursday after failing at another attempt to break and close above the resistance for the fourth day in a row.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.