U.K. Prime Minister Theresa May will trigger Article 50, next week on March 29th withdrawing U.K. out of the European Union project. The cable reacted negatively to the announcement and dropped nearly 100pips at 1.2350 while the sterling ended the day lower against all the G10 currencies as well. The complex Brexit negotiations will take two years to complete. In the meanwhile, the government plans to keep stimulus measures eased to ensure, as much as possible, the financial stability in the country. It’s worth mentioning the government has a stock purchased asset program running of £435B. On the other hand, the euro gained some ground as the European Commission spokesman Margaritis Schinas stated that E.U. “is ready to begin negotiations”.

The U.K. CPI report will be released at 9:30 GMT today and will be one of the determinable factors for the stance of BoE in the next policy meetings. The headline inflation surpassed BoE’s 2% inflation target and in the last policy meeting, a member of the Monetary Policy Committee voted for raising rates to 0.5% surprising the market. The headline inflation rate is expected to meet the first estimates of 2.1% in February. The BoE Governor Mark Carney will give a speech after the release of the report and traders will hang on every word of the speech to gauge the stance of the central bank during the Brexit procedure. Most probably Mr. Carney will not refuse the possible risks over U.K.’s way out of the E.U. but he will ensure the investors that BoE will do everything possible to keep a balance in the market. Both the CPI report and the BoE Governor Carney’s speech will have a direct impact on the British pound.

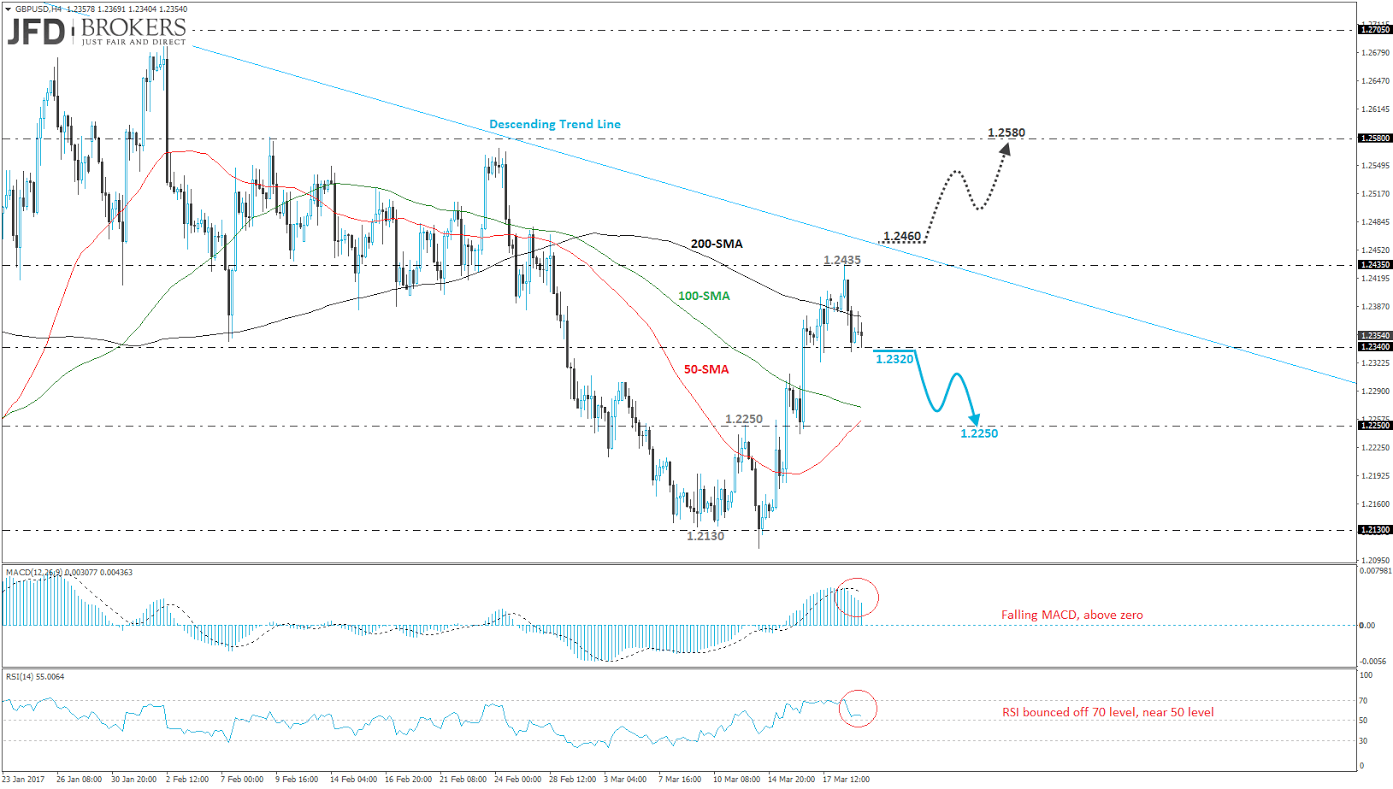

GBP/USD – Technical Outlook

Sterling started a positive day during yesterday’s session against the U.S. dollar, heading up to a new three-week high at 1.2435, before the announcement of triggering Article 50 over next week. However, later, the GBP/USD dropped lower and hit 1.2340 support level. The session ended near 1.2350 and currently, the price is trading lower with no clear directional strength. A drop below 1.2340 will open the way for the price to fall until the next support at 1.2250 which overlaps with the 50-SMA on the 4-hour chart.

An alternative scenario is a further upward run if there is a penetration above the mentioned fresh high and the descending trend line that is holding since September 2016. A successful attempt to break the latter obstacle will expose the pair towards the 1.2580 resistance handle. Technically, on the short-term timeframe, the MACD oscillator is moving lower and slipped below its trigger line. The RSI indicator ebounded on the 70 level and is approaching the 50 level.

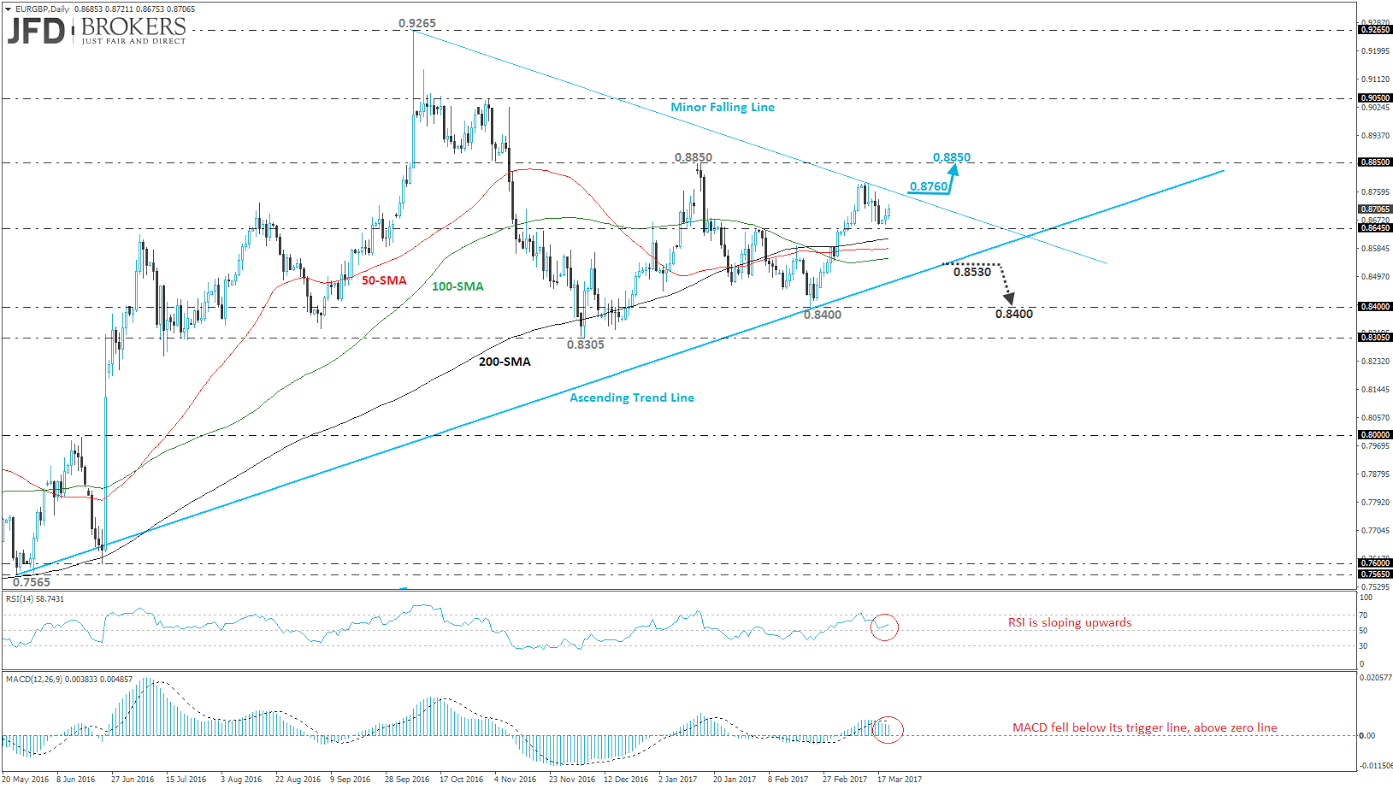

EUR/GBP – Technical Outlook

The EUR/GBP pair added 2% at its value so far this month, following the rebound on the ascending trend line that pushes the price further up. The significant diagonal line is holding since May of 2016 however, a minor downtrend line created from October of 2016. Euro is trading slightly above the three daily SMAs on the chart (50, 100 and 200 – SMAs) versus the sterling, indicating further upside movement.

The first scenario is a bullish movement if there is a break above the falling line that will drive the price towards the 0.8850 resistance barrier. The second scenario is a retest of the upward line and if the bears manage to push the pair below it, we would expect to see a retest of the 0.8400 strong psychological level. On the daily chart, the RSI indicator is pointing upwards with a solid move whilst the MACD oscillator fell below its trigger line.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

AUD/USD keeps the red below 0.6400 as Middle East war fears mount

AUD/USD is keeping heavy losses below 0.6400, as risk-aversion persists following the news that Israel retaliated with missile strikes on a site in Iran. Fears of the Israel-Iran strife translating into a wider regional conflict are weighing on the higher-yielding Aussie Dollar.

USD/JPY recovers above 154.00 despite Israel-Iran escalation

USD/JPY is recovering ground above 154.00 after falling hard on confirmation of reports of an Israeli missile strike on Iran, implying that an open conflict is underway and could only spread into a wider Middle East war. Safe-haven Japanese Yen jumped, helped by BoJ Governor Ueda's comments.

Gold price pares gains below $2,400, geopolitical risks lend support

Gold price is paring gains to trade back below $2,400 early Friday, Iran's downplaying of Israel's attack has paused the Gold price rally but the upside remains supported amid mounting fears over a potential wider Middle East regional conflict.

WTI surges to $85.00 amid Israel-Iran tensions

Western Texas Intermediate, the US crude oil benchmark, is trading around $85.00 on Friday. The black gold gains traction on the day amid the escalating tension between Israel and Iran after a US official confirmed that Israeli missiles had hit a site in Iran.

Dogwifhat price pumps 5% ahead of possible Coinbase effect

Dogwifhat price recorded an uptick on Thursday, going as far as to outperform its peers in the meme coins space. Second only to Bonk Inu, WIF token’s show of strength was not just influenced by Bitcoin price reclaiming above $63,000.